While no formal announcements have been made, Apple is signaling possible plans for a lower priced ad-supported tier of its digital streaming service, Apple TV+. After it raised the price of its premium streaming service to $6.99 in October – its first price increase since it launched in November 2019—Apple introduced the hiring of ad executive Lauren Fry to help build a video advertising business.

In the short term, the move may have been driven by Apple’s recent forays into live sports. With its built-in ad breaks and high licensing fees, advertising revenue is necessary when broadcasting live sports. In February, the platform launched the MLS Season Pass, a partnership with the professional soccer federation. While MLS Season Pass provides access to all MLS games with no blackout restrictions, select games are also available for free on Apple TV or as part of an Apple TV+ subscription. Last year, Apple also debuted Friday Night Baseball in partnership with Major League Baseball, which is set to return on April 7. Apple is looking at further options to expand its sports coverage on Apple TV+, including ongoing negotiations with the National Basketball Association (NBA) and Pac-12 collegiate football conference.

But sports programming may just be the beginning of video advertising on Apple streaming services. Offering a lower-priced ad tier may help with subscriber retention or to attract new subscribers interested in its original content. Rival streamers Netflix, Disney+, and HBO Max all introduced ad-supported tiers last year in an effort to increase revenues as the digital streaming industry increasingly turns its attention more towards revenue and profitability instead of the traditional streaming metrics of subscriber growth and engagement.

Moreover, industry trends point to changing viewer habits, as the meteoric rise of free, ad-supported television (FAST) channels has shown a willingness by consumers to watch ads in exchange for streaming entertainment. Netflix even remarked earlier this year that it may be open to offering its own FAST channels to further grow its own ad business.

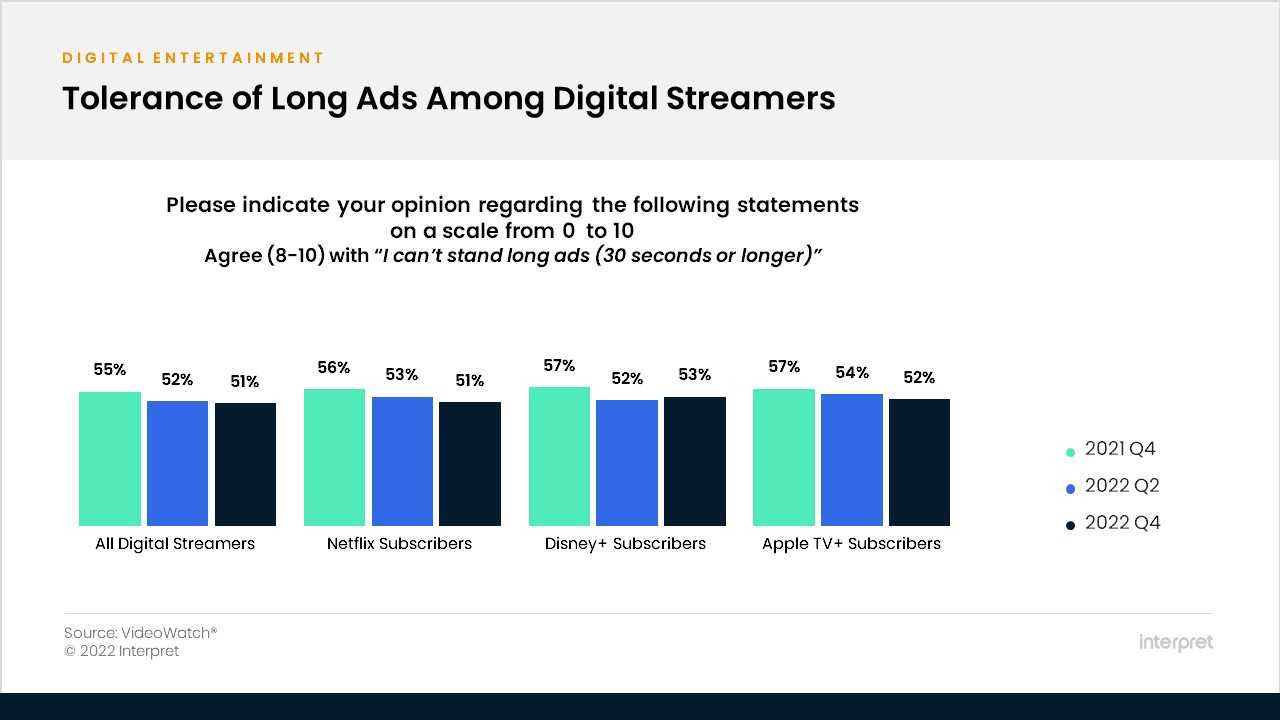

Interpret’s VideoWatch data also shows that as streaming services have increasingly introduced ads, viewers’ attitudes towards advertisements have shifted. Streaming viewers have grown less tolerant of short ads and more accepting of longer ads—the latter perhaps a sign that viewers have become more accustomed to ads being part of their viewing experience even from premium streaming platforms. Apple will no doubt be keeping an eye on these trends and the performance of its rivals’ ad tiers as it weighs its options for Apple TV+.