In an announcement ahead of CES 2024, Roku announced the launch of Roku Pro digital streaming televisions. It expands the line of Roku-manufactured television sets into a higher end – and higher priced – category of televisions after launching the Roku Select and Roku Plus HD and 4K smart televisions last spring. Roku also plans to expand the retail availability of its Roku Select and Roku Plus televisions, which were previously available exclusively at Best Buy stores and BestBuy.com.

Streaming, however, is where most of Roku’s revenues come from – not from the sale of smart televisions or streaming sticks themselves, but from people using their platform to stream television. Roku has positioned itself as one of the leading platforms for streaming television—including the most popular Streaming TV OS in the US and Mexico. Over 75 million Roku users globally (either Roku-enabled Smart TVs or Roku streaming devices) stream television for an average of about 3.9 hours per day. That’s a lot of hours with eyeballs on the screen, which makes Roku an attractive destination for advertisers.

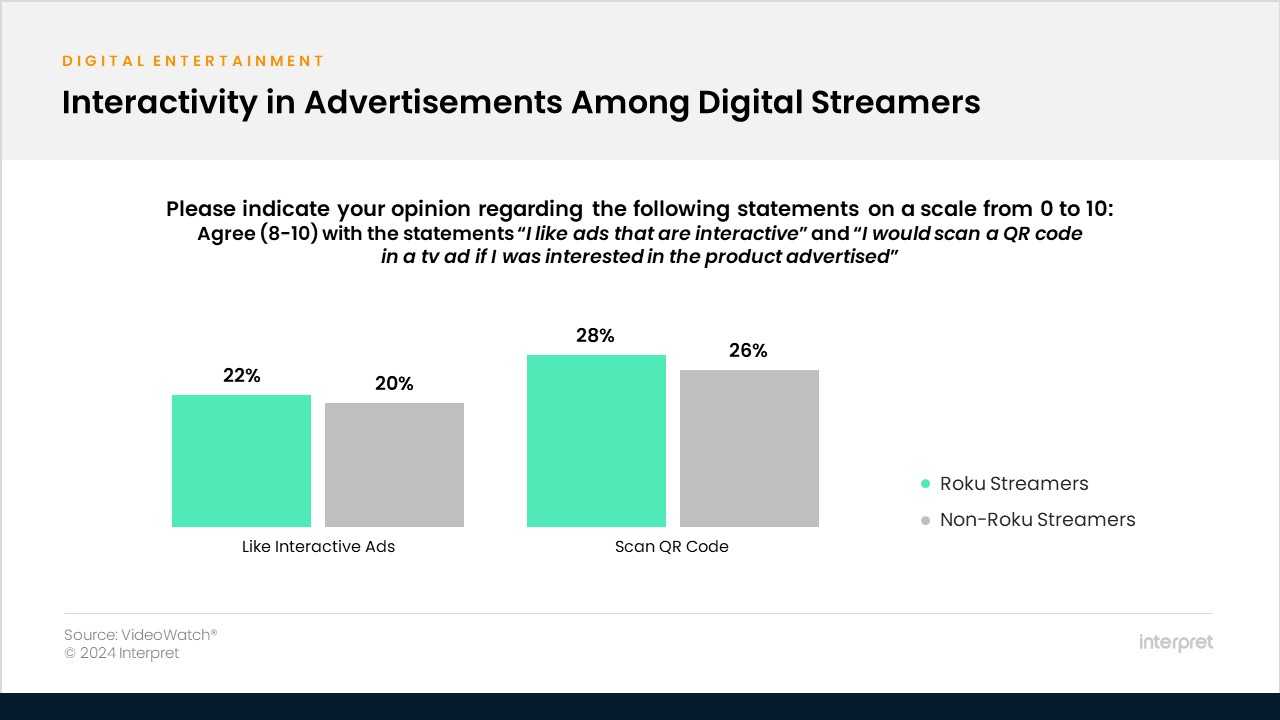

Roku’s revenue-driving advertising business has been touting its strength with younger viewers, a highly desired demographic for brand marketers. Interpret VideoWatch data also shows that viewers that stream digital content with Roku are slightly more likely to interact with ads – including scanning QR codes – than non-Roku digital streamers.

The higher-end television sets may bring in new digital streaming consumers. Roku is hoping to lure a more affluent and tech-savvy audience (one coveted by advertisers) than its current value-focused user base to its ecosystem with high-end features like a 4K QLED display, Mini-LED backlighting system, a Quantum Dot color system, and an AI/machine learning enabled “Smart Picture” system that detects content type and optimizes picture quality—all for under $1,500, a sizable discount compared to competitors in the higher end smart television space like Samsung and LG.

Another benefit of having their own Roku-branded televisions is first-party access to data about how viewers interact with advertising (without having to go through third-party licensing partners). Roku has been among the most innovative with ad technology, introducing shoppable ads with partners like Walmart, highly visible placements on the platform’s “Roku City” screensaver (such as in this recent campaign from Disney Cruise Lines), and branded take-overs of the Roku home screen.

Direct measurement of viewers’ interactions with its ad content gives Roku valuable data to assist in maximizing revenue from ad sales as it aims to become the dominant streaming OS. Roku hopes the new line of televisions can help maintain the momentum experienced during Q3, where Roku TV sales “grew significantly faster than the industry,” according to a letter to shareholders.