Starting in 2024, Amazon will make Prime Video the latest streaming platform to adopt advertising, but unlike streaming services that have embraced ads to offer consumers a lower-priced tier, the behemoth e-tailer is taking a different approach. Subscribers to Amazon Prime will still receive Prime Video as a perk of membership, but it will no longer be ad-free and instead will incorporate “limited advertisements.”

Prime members in the US can pay an additional $2.99 monthly to retain an ad-free experience. It’s unclear at the moment what happens with ads and pricing for non-Prime members who subscribe to Prime Video separately for $9 per month (although that group is presumably a far smaller segment within the larger 200 million global subscriber base).

While Amazon has been looking to cut costs across its vast business, when it comes to Prime Video, the company has been investing heavily in recent years. Between its Thursday Night Football deal, and original content like The Rings of Power and The Wheel of Time, spending on content jumped up to nearly $17 billion in 2022 – so it’s not a shock to see Prime Video seek new ways to increase monetization.

Moreover, the dynamics of streaming businesses in general have become increasingly challenging, which is why more platforms are either adopting ads, raising prices, or choosing to do both. Growing subscription figures is seemingly much less important than maximizing returns on each consumer and ensuring profitability.

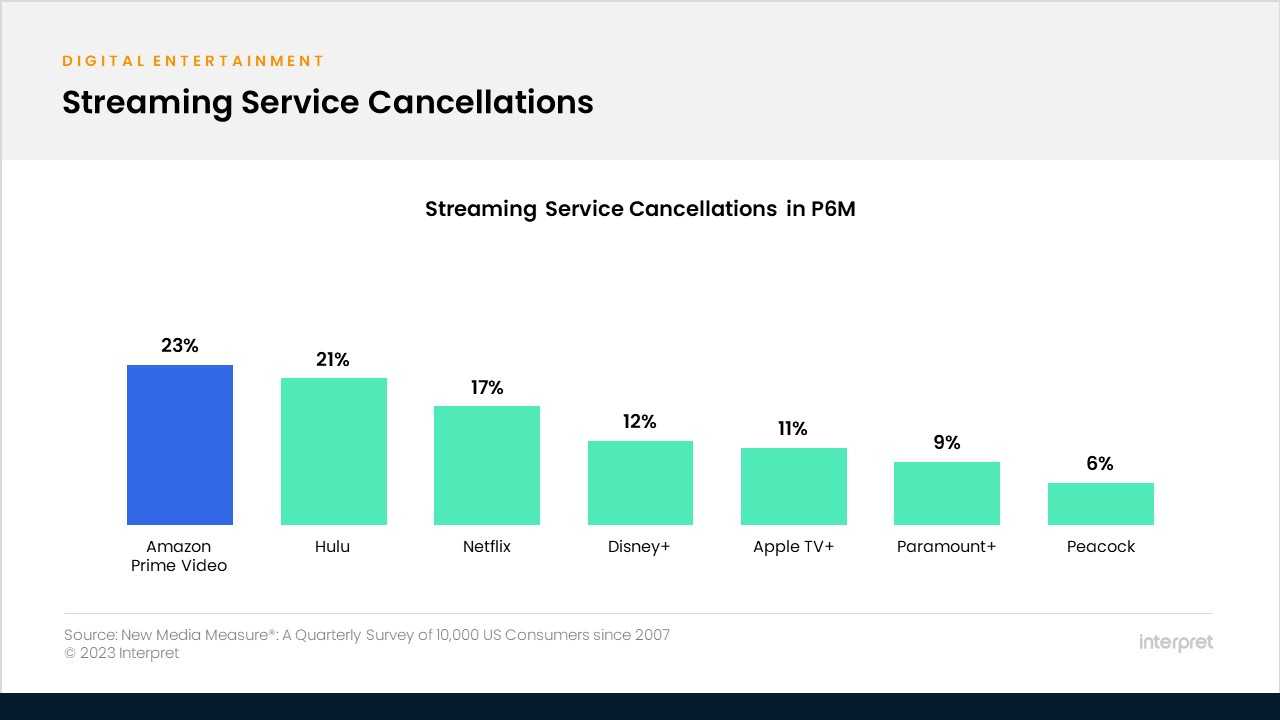

Amazon promises that it will “aim to have meaningfully fewer ads than linear TV and other streaming TV providers,” but it’s hard to gauge what the ultimate impact will be on Prime Video subscriptions. Interpret’s VideoWatch data shows that Prime Video already has more churn than many other streaming platforms, with 23% of consumers in the US stating that they’ve canceled the service in the past six months (Hulu isn’t far behind at 21% cancellations). It’s possible that the introduction of ads could affect this, but as noted above, Amazon is likely more concerned with revenue per user and any churn could potentially be offset by the segment that does opt to pay the additional fee for ad-free streaming.

Additionally, Interpret data reveals Prime Video viewers to be somewhat ad-tolerant, with 56% of subscribers stating that they “seek ad-free content whenever possible,” on par with subscribers to Netflix or Disney+, but not as ad-tolerant as subscribers to Hulu (53%), Paramount+ (52%), or Peacock (50%).