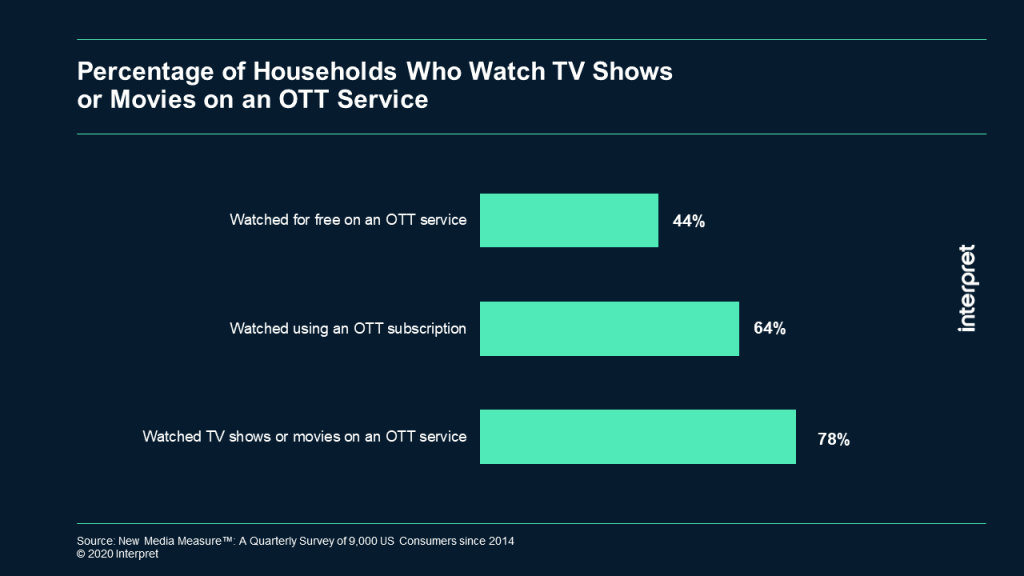

Over-the-top (OTT) video viewing has been on the rise for the past several years. By the end of 2019, 78% of US broadband households claimed to watch TV shows or movies through an OTT video service. Almost two-thirds subscribed to one or more services. Less than half used a free streaming option. Across these households the average number of TV shows watched in the previous 90 days jumped from 4.4 in late 2018 to 5.2 in late 2019. The number of movies viewed experienced a similar increase during that period.

Industry sources are reporting significant increases in video viewing over the past few weeks. With people staying indoors, in-home video has taken on increased importance as consumers try to cope with the new normal. In fact, the European Union called on Netflix and other streaming services to lower their data rates in order to preserve broadband quality within its member nations. (Netflix and other services recently complied.)

Importantly, not all of these increases are leading to greater revenues. While subscription services are attractive, providers only realize greater revenues with new subscriptions or upgrades to premium options. So, a big boost in viewing increases costs but not necessarily revenues.

In theory, ad-supported revenues should scale with increased viewing. Yet, that only works if there are enough buyers of ad inventory. Given current uncertainties around consumer spending, advertisers may be reluctant to spend big, even if viewers are flocking to streaming services.