The long-anticipated “password sharing crackdown” from Netflix is upon us as the streaming wars intensify. Netflix estimates that over 100 million households are sharing credentials, and Netflix has set a goal to convert as many of those sharers as possible into paying customers. To that end, Netflix tested a pilot program to crack down on password sharing in select Latin American countries last year, and started officially rolling out their new password sharing initiatives in February in four test markets: Canada, New Zealand, Portugal, and Spain. The streaming service recently expanded the program, rolling it out to an additional 100+ markets in May, including the US.

Netflix’s plan to combat password sharing includes restricting accounts to a single household and introducing paid sub-accounts for up to two “extra member slots” for additional users outside the household. The fee for each extra member varies per market and costs $7.99 in the US. Household members can use the account outside of the primary location, such as when traveling.

Netflix hopes to either encourage subscribers who are sharing passwords to agree to the extra fee or sign-up for their own household account. In some markets, including the US, the extra household fee is higher than the lowest-cost ad-supported tier ($6.99) – perhaps an incentive to encourage signups on that plan. In their most recent quarterly earnings report, Netflix indicated that their average revenue per subscriber is higher for those on the ad-supported tier than it is from those on the standard ad-free plan. Logins determined not to be a part of the household account will be kicked off and asked to sign up for an “extra member slot” or set up a new account.

The crackdown has resulted in some backlash from customers upset with an apparent change in the company’s attitudes towards password sharing. Spain saw an exodus of about 1 million subscribers after the password sharing crackdown was rolled out there in February. Canada initially saw cancellations rise, but in their quarterly earnings report, Netflix reported that subscriber numbers in the country are now larger than before paid sharing was launched and revenues in the country are growing faster than in the US.

These preliminary results were enough to encourage Netflix to push forward with a more global rollout. With paid password sharing, Netflix hopes to convert non-paying viewers into new subscribers or increase revenue from existing subscribers. Short-term subscriber losses are expected, but long-term prospects for increased acquisitions and revenue are promising. In fact, investment firm JPMorgan recently raised its price target on the stock, highlighting the impact of the password crackdown on revenue growth.

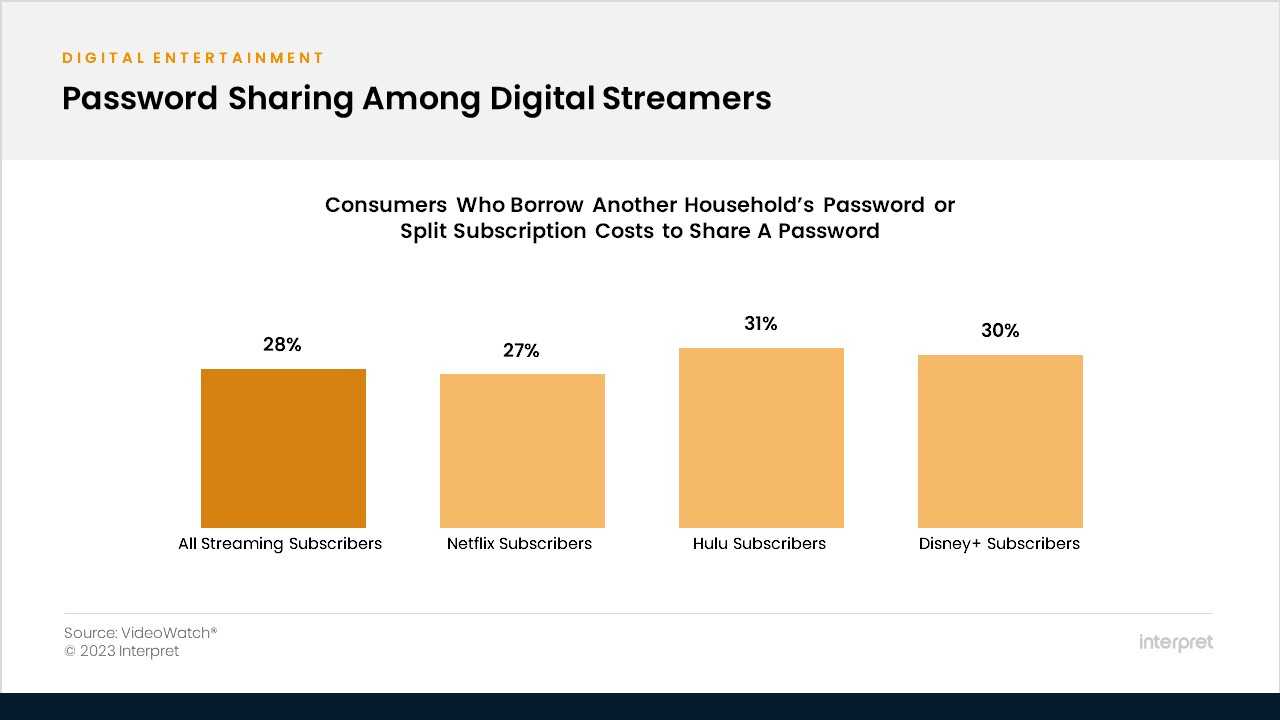

Password sharing is commonplace for video streaming. Interpret VideoWatch data shows that about 28% of all streaming video subscribers (and 27% of Netflix subscribers) either use the password of someone outside the household or split the costs and share a password with another household for at least one streaming service. Other services, such as Hulu and Disney+, have a larger share of subscribers using shared passwords than Netflix. If Netflix is able to convert more than they turn away with their password sharing plans, could the House of Mouse follow suit and look to clean house on its streaming platforms as well?