The Walt Disney Company recently agreed to purchase Comcast’s share of Hulu for a minimum of $8.6 billion, pending an appraisal of Hulu’s value. The acquisition gives Disney full control of the streaming platform and seems to be a key component of their plan to make its direct-to-consumer streaming business profitable by Q4 2024.

The purchase comes after Hulu reported modest subscriber gains in the previous quarter, picking up 300K subscribers to bring it to 48.5 million. Core Disney+ (not including the Disney+ Hotstar platform in some Asian markets) also saw gains of 7 million subscribers in the previous quarter. The period reported on for the quarterly report ends September 30, however – before a price increase for their ad-free tier in October.

With the agreement in place, Disney is wasting no time in merging the two streamers into a single streaming app. Disney offered beta access to some US customers in early December. The beta is partially set to test parental control before distributing it to a wider audience in 2024. It is still unknown if the new “unified” app will use the Disney+ or Hulu name, or something new entirely. Hulu is a US-only brand, so global expansion of that brand name may require a higher marketing budget. Moreover, given the family-friendly Disney image, to protect the brand, they might not want to keep the Disney name on the unified platform given the new adult-oriented programming coming from Hulu.

The combined app will bring together the streaming content from Disney+ and Hulu, meaning consumers will be able to find critically acclaimed content such as The Mandalorian, Loki, and Bluey from Disney+ with Only Murders in the Building and The Handmaid’s Tale from Hulu on the same streaming platform. “We expect that Hulu and Disney Plus will result in increased engagement, greater advertising opportunities, lower churn, and reduce customer acquisition costs,” remarked Disney CEO Bob Iger during the company’s earnings call.

The platform combination is the latest in a consolidation trend impacting the streaming world, following DiscoveryWarner’s merger of HBO Max and Discovery+ to Max and Paramount+ including Showtime in its premium offering.

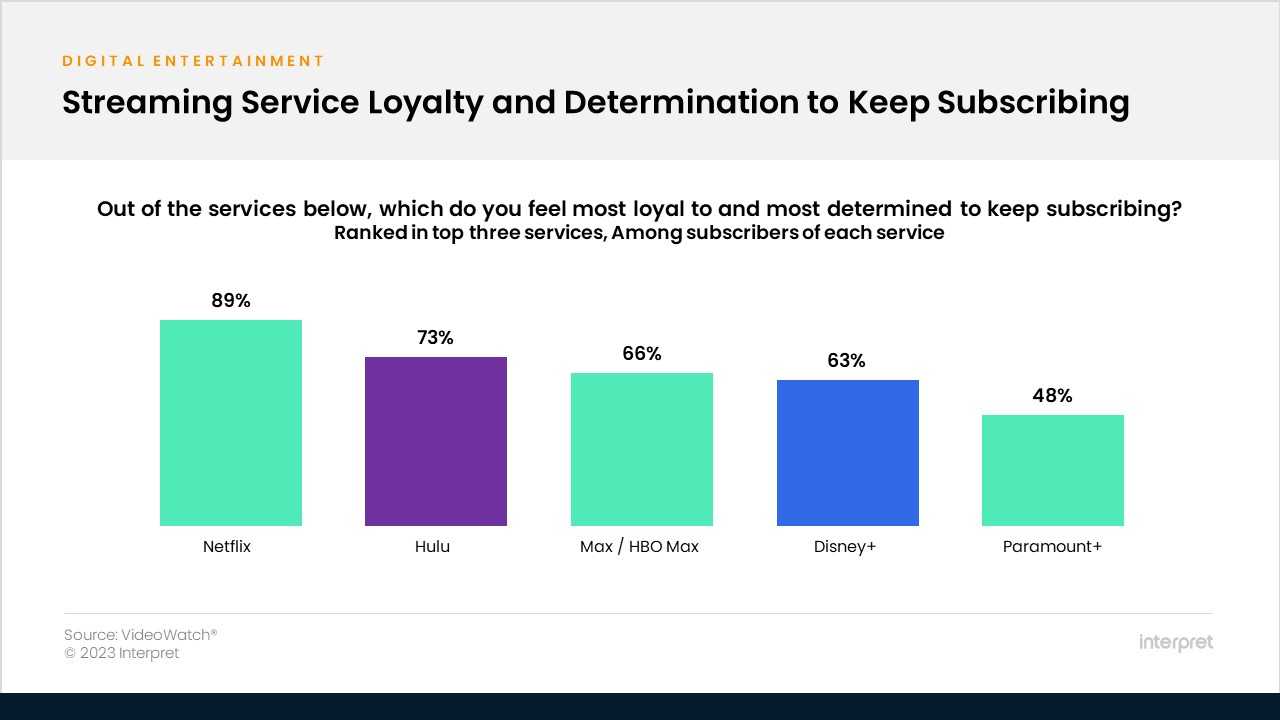

Interpret’s VideoWatch data shows that Hulu subscribers have a longer average subscription tenure (17 months for Hulu versus 15 months for Disney+) and higher loyalty towards keeping the service (73% to 63%) than Disney+ subscribers. Hulu also has a higher percentage of subscribers enrolled in the ad-supported tier (58%) than Disney+ (23%). The hope is that merging the two into one platform will reduce churn and entice advertisers with a larger reachable audience enrolled in the ad-supported levels.

With the combined strength of the Disney+ and Hulu platforms to appeal to families and adults, with a wider content catalog with greater variety than the individual platforms, Disney aims for profitability and to challenge Netflix as the global streaming leader.