Disney is looking to pivot strategy with its struggling sports brand, ESPN, as the economics of live sports distribution becomes increasingly problematic. As the cord-cutting trend has deepened, ESPN has seen declining revenues as more people shift away from cable. ESPN’s cable channels are some of the most expensive in the industry, and the company receives revenue from every cable or satellite subscriber that carries ESPN, even if they don’t want it or watch it. ESPN+, the network’s streaming service, continues to grow, exceeding 25 million subscribers, but only holds a fraction of ESPN’s live sports programming.

Disney CEO Bob Iger still believes in the strength of sports programming overall and is looking to transition the self-proclaimed “worldwide leader in sports” away from linear television to become a direct-to-consumer streaming hub for all things sports. The studio is looking for strategic partners to help make this vision happen, and is casting a wide net in its search – including tech and telecom giants like Apple, Amazon, Google, Microsoft, Verizon and T-Mobile – and more recently, the network has even considered allowing the major sports leagues themselves to have a stake in ownership.

Iger has called in two former Disney executives to help spearhead the search for a strategic partner. With a tech or telecom partner, Disney hopes to boost its distribution and reach, while partnering with a sports league would help boost its content and perhaps keep its licensing fees down, leading to better profitability for its sports broadcasts.

The list of potential suitors is intriguing. Apple has increasingly added live sports for its Apple TV+ streaming service. In the past couple of years, it introduced Friday Night Baseball in partnership with Major League Baseball and launched a 10-year licensing partnership with Major League Soccer for its full slate of games and content. Most recently, it reportedly submitted a bid for the Pac-12’s distribution rights. A partnership with or even partial ownership of ESPN would push Apple to the forefront of sports programming. Google recently won the bidding war for the domestic NFL Sunday Ticket package on its YouTube TV platform as the NFL targeted moving to a streaming partner; partnering with ESPN would further establish its position in sports.

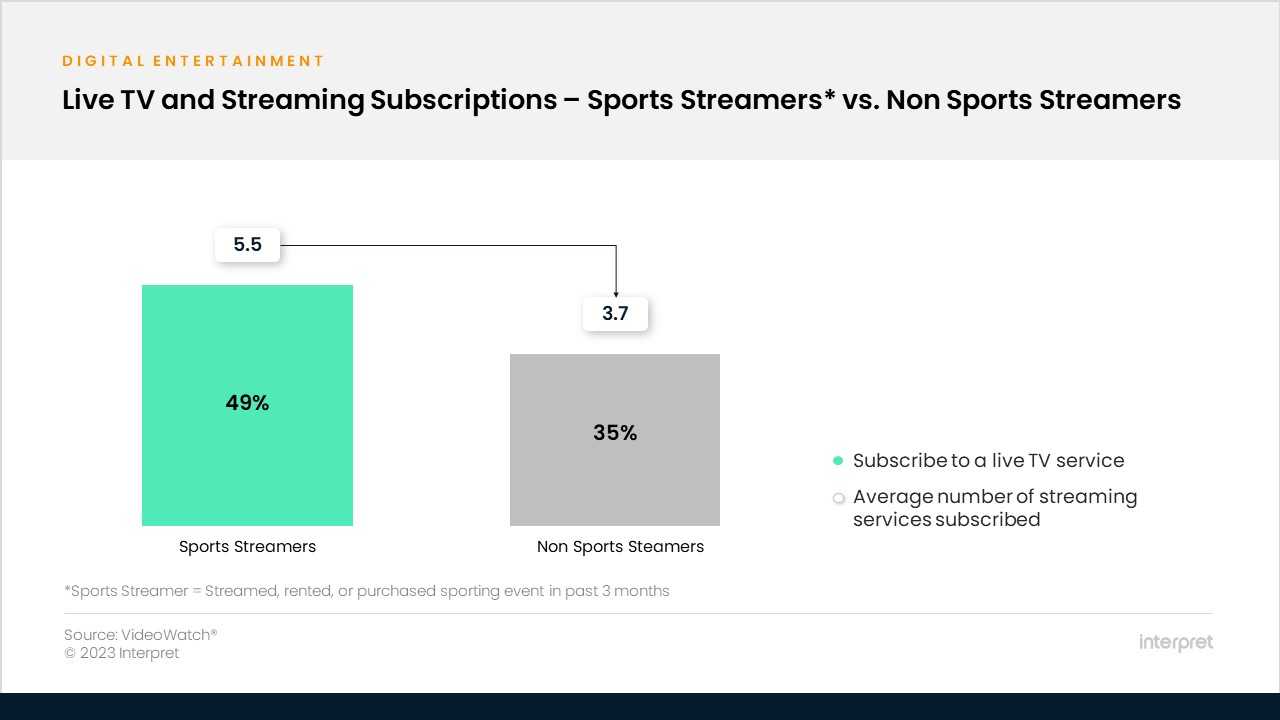

Disney’s approach to making ESPN+ the hub for live sports may be a welcome addition for sports fans that have seen viewing options become more decentralized. Even those who follow a single sport often must subscribe to multiple services in order to watch all the available content. For example, the NFL has Sunday Night Football on Peacock, Monday Night Football on ESPN, and Thursday Night Football (and a Black Friday matchup) exclusively on Amazon Prime Video, in addition to weekly games on three over-the-air broadcast networks. Interpret’s VideoWatch data shows that sports viewers are more likely to subscribe to a live television service and on average subscribe to 33% more streaming services than non-sports viewers.

Disney is facing real challenges to bring ESPN back to profitability—something it hopes to fix with a strategic partnership and transitioning to a direct-to-consumer streaming platform. At the right price, sports fans may come flocking. As they say in Field of Dreams, “If you build it, they will come.”