When Disney+ launched a year ago, parents were tantalized by the prospect of having a streaming service with a wide variety of family-friendly classics and animated films from the last few decades. As the coronavirus outbreak began forcing people indoors, Disney+ became a valuable source of entertainment for parents looking for ways to keep their children occupied. In more recent months, however, it’s become clear that Disney+ is seeing the most growth from consumers in the US without any children under age 18.

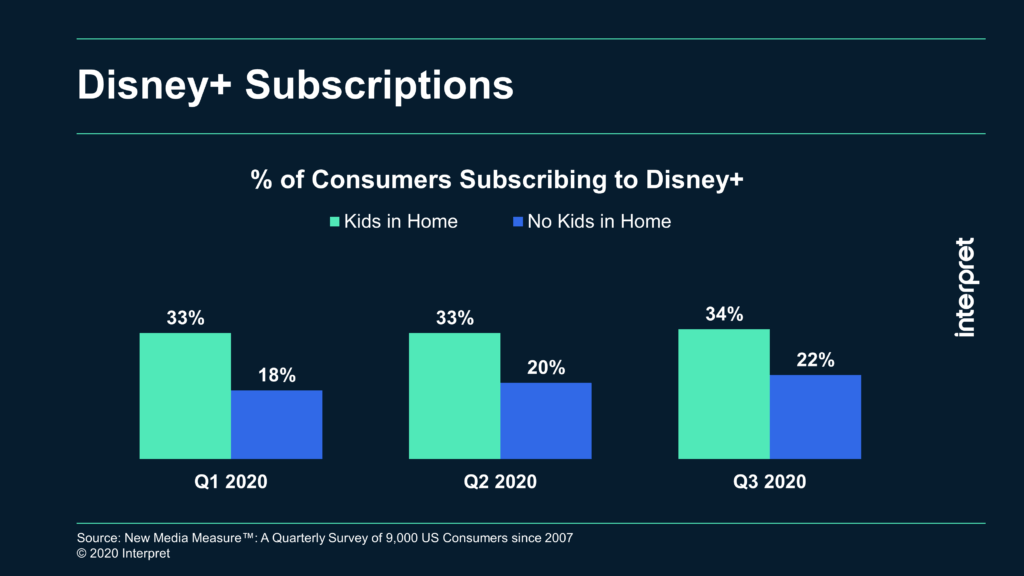

From Q1 2020 to Q3 2020, Interpret’s New Media Measure® data shows the percentage of consumers without kids subscribing to Disney+ rising from 18% to 22%. During the same time frame, Disney+ adoption has remained at a steady one-third among consumers with children. Worldwide subscriber totals for Disney+ hit almost 74 million for the service’s first year on the market, which blew past Disney’s original goal of 60-90 million subscribers by 2024.

“The continued growth of Disney+ speaks to the broad appeal of its portfolio of brands,” said Brett Sappington, Vice President at Interpret. “The Disney parent brand, along with Pixar’s films, resonated immediately with families, allowing the service to enjoy a quick start. However, the Star Wars, Marvel, and National Geographic brands that may have greater appeal among older consumers are now providing an additional boost. Maintaining broad appeal beyond the children’s market will be critical if Disney+ hopes to maintain and build upon its hot start.”

Disney+ trails Netflix’s 195 million global customers but already has reached 38% of the leading platform’s total. 52% of consumers with children under 18 currently subscribe to Netflix. This lead is in spite of Netflix’s higher price and recent US price increase.

With the second season of The Mandalorian airing right now, Pixar’s Soul coming in time for Christmas, and the service expanding internationally to Latin America (with original productions), Disney is in a good position to continue its streaming service success. The company recently reorganized to prioritize its streaming business, which also includes ESPN+, Hulu, and Hoststar.