As more and more consumers migrate from cable and satellite TV to streaming platforms, we’ve seen a flood of networks launch their own streaming services to ensure that they retain viewers and advertisers. Discovery Channel is the latest example, as Discovery Plus launched on January 4th in the US for $5 per month – a commercial-free version costs $7 per month.

The platform not only offers shows from Discovery Channel, boasting over 55,000 episodes at launch, but because Discovery owns HGTV, TLC, Food Network, Animal Planet, OWN, and more, viewers will have a bevy of entertainment from which to choose. Discovery also has partnerships with BBC, A&E, Group Nine, and others to provide additional content.

Discovery Plus is already available in the UK and Ireland and intends to roll out to 25 international markets this year. The platform should be available on the usual array of streaming devices and smart TVs. Importantly, Discovery should get a boost right out of the gate thanks to a special promotion from Verizon, which is providing as much as one year free of Discovery Plus to its wireless customers. The telecom giant did something similar for Disney Plus when the Mouse House launched its streaming platform over a year ago.

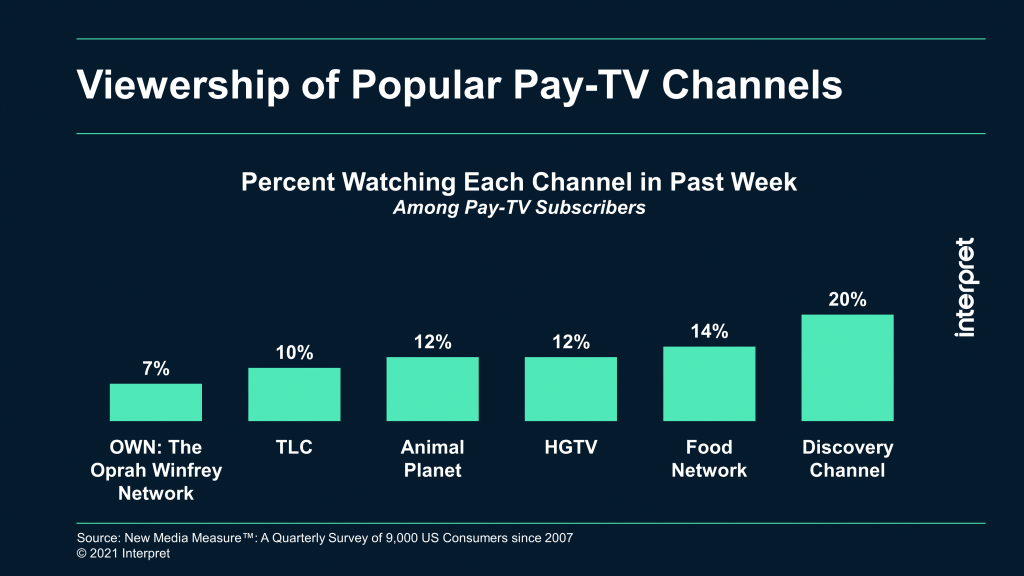

Discovery’s portfolio of channels offers an array of science, reality, and non-fiction programming, providing it with a unique niche of content that is differentiated from Disney+, HBO Max, Peacock, or other broadcast and cable TV network-oriented streaming services. According to Interpret’s New Media Measure®, this type of content is popular, with viewership of Discovery’s portfolio of channels ranging from 7% to 20% of pay-TV subscribers. Discovery is betting that those same people will happily pay $5 per month, particularly if they leave traditional pay-TV.

In addition to incremental revenues, Discovery’s new service provides protection in future carriage agreements. With content budgets tightening among pay-TV distributors, including both MVPDs and vMVPDs, Discovery Plus provides a strong backup plan. So, if a pay-TV provider threatens to drop Discovery’s channels, the network has a way to still get content (and ads) to consumers.