The ongoing global pandemic hit the movie theater business hard in 2020 and 2021, with about 630 theater locations still closed across North America, according to Bloomberg, which notes that domestic theaters generated an estimated $4 billion domestically in 2021 compared to $19 billion pre-pandemic in 2019. However, even as the highly contagious Omicron variant spreads, there’s reason for optimism in 2022.

If the content is appealing enough, consumers are willing to take the risk of entering a theater. Sony Pictures’ Spider-Man: No Way Home jumped up the charts to become Sony’s top release of all time and the 10th biggest film in US movie history, earning about $610 million as of January 2nd. As Hollywood Reporter notes, Spider-Man is the first film to generate pre-pandemic box office numbers. The fact that children as young as five can now be vaccinated means that more families are coming back to the theaters as well. Universal’s animated picture Sing 2, for example, was in the No.2 spot over New Year’s weekend and has grossed around $145 million worldwide. Similarly, Disney’s Encanto, which debuted back at Thanksgiving and is available on Disney+ as well, remains in the top 10 and has grossed $205.7 million worldwide.

On the other hand, Warner Bros’ Matrix Resurrections has struggled commercially, reaching $100 million at the worldwide box office on a reported budget of $190 million. There’s a good chance that Warner’s 2021 release strategy of debuting its films day-and-date on HBO Max hurt its box office haul. For 2022, the studio is returning to a staggered release, but the window is still far shorter than in the past, as big titles like The Batman will hit HBO Max just 45 days after theaters.

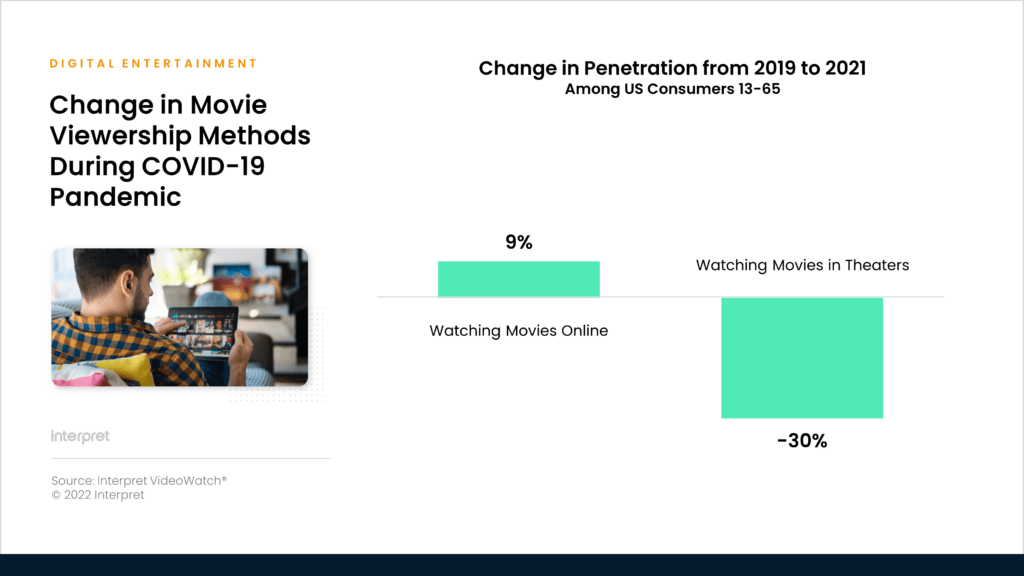

There’s no doubt that digital’s increasing presence has made it hard on movie theater operators. Interpret’s VideoWatch reveals that movie theater attendance during the past three-months fell from 50% of consumers pre-pandemic to only 20% of consumers by mid-2021 when theaters began to reopen. Yet, incidence of watching movies online climbed by 9 percentage points in that same time frame.

“Both studios and theater operators are experimenting heavily, trying to determine the best way forward, and both are learning valuable lessons,” said Brett Sappington, vice president at Interpret. “Studios have wanted to revise movie distribution windows for many years and are now doing so out of necessity. Their learnings will define the new rules of maximizing film revenues in the age of streaming. Theater operators are finding new ways to prove the value of their venues and to engage consumers. Their learnings will define how they will maximize exhibition revenues moving forward.”

Whether 2022 can continue the box office momentum enjoyed by Spider-Man remains to be seen. AMC lost almost $4.6 billion in 2020 and was in the red through the first nine months of 2021. Rival chain Cinemark lost $78 million in its third quarter of 2021. CEO Mark Zoradi just retired from Cinemark but will remain on the board. Even with major headwinds, Zoradi is optimistic, especially if studios can work out windows rather than going straight to streaming. He emphasized to Business Insider that windows are in the best interests of filmmakers because it “eventizes the movie and makes it more valuable in the marketplace.”