For consumers that fled to vMVPDs (Virtual Multichannel Video Programming Distributors) to avoid ever increasing cable bills, we have some bad news. The online space is far from immune. Last month, YouTube TV and Fubo TV each announced new price increases: $5 per month for Fubo TV and $15 for YouTube TV.

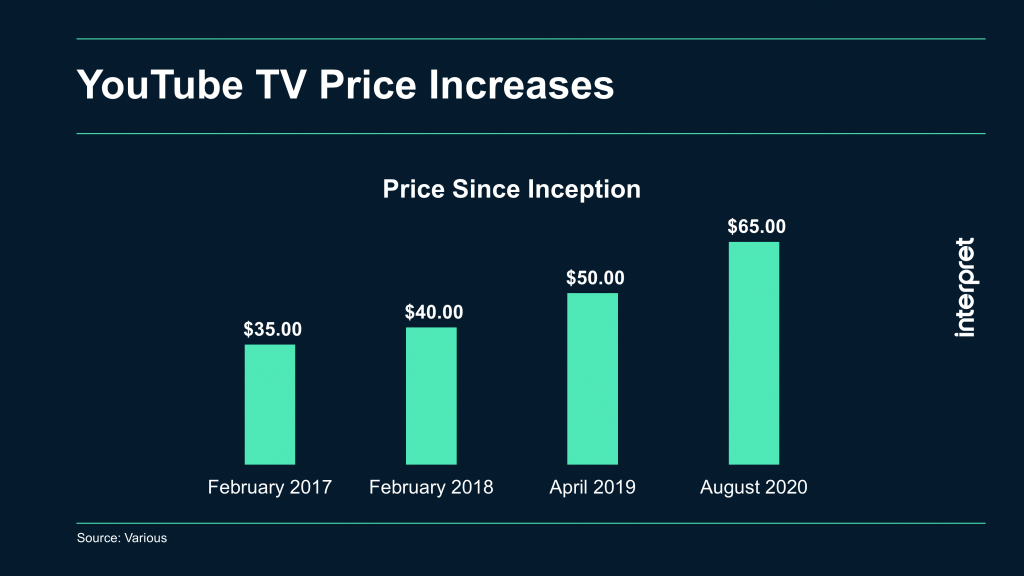

In 2017, Google launched YouTube TV, throwing its hat into the emerging vMVPD ring. At just $35 per month at launch, YouTube TV was viewed at the time as a strong value proposition for people seeking alternatives to traditional cable or satellite TV, though many in the industry questioned its profitability at that price. Not long after its debut, however, Google introduced price increases, first to $40 in February 2018, and then to $50 by April 2019.

YouTube TV’s subscriber numbers continued to increase after its 2019 price hike. However, almost all vMVPDs increased prices for new or existing customers between January and April 2019, which minimized the impact on any single provider. The current increase by YouTube TV could signal to others that the time is ripe to revise pricing. According to Interpret’s New Media Measure® survey data, 30% of consumers who have left traditional cable/satellite mention an OTT subscription as the main reason.

Sling TV, which raised prices on some of its channel packages in December 2019, is now promoting a price guarantee for the next year, hoping to take advantage of YouTube TV’s move. Sling TV has around 2.3 million subscribers. As of Q4 2019, Google CEO Sundar Pichai indicated that YouTube TV had 2 million subscribers.

With the latest price increase, YouTube TV added new ViacomCBS branded channels, bringing BET, CMT, Comedy Central, MTV, Nickelodeon, Paramount Network, TV Land and VH1 to the streaming platform. With a $65 price tag and more than 85 channels in its single channel package, the YouTube offering and price is approaching the lower end pricing of traditional pay-TV services. “While content is likely driving the move, a 30% [price] increase seems really big,” Interpret Vice President Brett Sappington commented to Forbes. “Content producers, like everyone else, are feeling the financial crunch, which always translates into increased content fees.”

Fubo TV’s increase occurs at a time when the service is turning over much of the content in its channel package. Fubo will be adding ESPN, FX, and other Disney-owned channels while also dropping WarnerMedia channels including TNT, TBS, and CNN.