Roku, the entertainment streaming platform that can be accessed through streaming sticks, connected boxes, and Roku-powered Smart TVs, has become one of the leading players in connected television. Roku has built up a billion-dollar ad business and is now guaranteeing better reach than cable in primetime with its targeted advertising.

It is the latest in ad tech innovation from Roku, which last year introduced shoppable ads with partners like Walmart and DoorDash—an innovation they look to expand upon going forward, including with their latest partner, Instacart. Roku now has the scale, with over 70 million active users (per the company’s official January 2023 metrics) streaming content on its platform, to effectively target and reach desired consumers with personalized interactive ad content.

Roku holds a prime position in connected television due to its role as an aggregator. It has its own Roku Channel, and produces some original content, but more importantly, it provides an ecosystem that enables viewers to browse and find engaging content that they want to watch. This platform also enables some unique advertising opportunities to reach viewers not only as they are watching the selected content, but also before the content is started as the viewer is browsing and making its viewing decision (or even when the device is sitting idle with no apps selected). This is a distinct advantage for device makers like Roku, which traditional streaming services can’t offer advertisers – although some are now serving ads when video is paused and others serve side ads as users look for something to watch.

Roku recently announced a series of new advertising initiatives, including ad placement on their “Roku City” screen saver, sponsored content areas on the Roku Home Screen, and AI-assisted ad placement that identifies scenes to match up with ad campaigns.

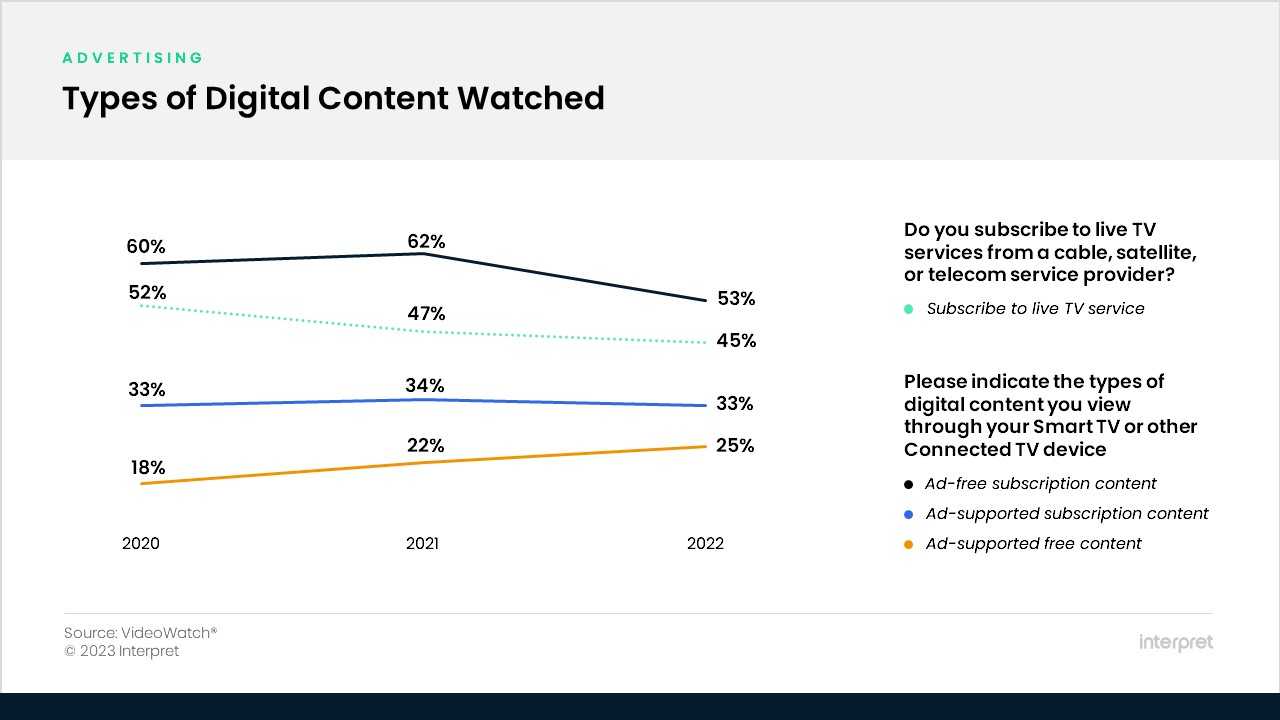

The initiative comes as streaming TV becomes increasingly reliant upon advertising, whether through free ad-supported television (FAST) or ad-based tiers for leading services like Netflix, Disney+, and Max. Interpret VideoWatch data also shows that the number of viewers watching content on live television services (cable, satellite) and ad-free subscriptions has gone down while the number of viewers using free ad-supported television (FAST) is on the rise. Content creators have taken notice as well. Warner Bros. Discovery has started licensing its original content to FAST providers Roku and Tubi to bring those shows to new audiences – and new advertisers.

Other providers are rushing to get into free ad-supported television (FAST) aggregation. Google has also added hundreds of FAST channels to its “Live” offerings on its Google TVOS, including on Chromecast with Google TV devices and Google TV powered smart TVs. A recent report has shown that Google TV is chipping away at Roku’s market share domestically in the United States for connected televisions. Amazon also recently introduced Fire TV Channels – a collection of exclusive channels providing free ad-supported content from brands like NHL, TMZ, and Xbox – and updated the user interface to make it easier to browse and find FAST content. Sling TV, a cloud-based live TV streaming provider, launched its own FAST service in February and has added over 100 new FAST channels – including 12 exclusive channels – to its platform since launch.

As more viewers cut the cord and flock to FAST connected services, content aggregation and the ability to find content spread across an increasing number of channels and providers will become even more important. Roku is positioned strongly, but can it withstand the incursions from mega corporations like Google and Amazon?