As we’ve discussed on Interpret Insights previously, esports teams and leagues are dealing with the harsh reality of a market gone soft, or what some have been calling an “esports winter.” Many teams, even with a pivot to lifestyle branding (e.g., FaZe Clan) and a focus on content creation beyond competitive gaming, are struggling for financial viability while leagues, including the most successful one in the industry, LoL Esports, are not profitable. Meanwhile, top publishers like Activision Blizzard don’t appear to be getting enough return on investment from esports. In July, Activision Blizzard confirmed that “less than 50” employees were cut from its esports business and the company disclosed in its financial statements that Overwatch League (OWL) as a whole represents “less than 1%” of the publisher’s net revenues. If OWL is to continue, it won’t be without some changes.

Activision Blizzard has said that OWL teams will vote on a new operating agreement at the end of the current season (October 1st). Any of the teams that decide to opt out of the league will be granted a $6 million termination fee – which would amount to a bill of $114 million for Activision Blizzard if all 19 franchises withdrew. Moreover, according to esports reporter Jacob Wolf, Activision Blizzard is still owed $400 million in franchise fees collectively across both OWL and Call of Duty League.

Considering how costly it was to earn franchise status (between $20 million and $35 million), there’s a distinct possibility that a number of teams may wish to recoup some losses by taking the $6 million termination fee. And if enough of these teams take the money and disband, OWL in its current form may be over. That said, if that happens it doesn’t mean that Overwatch esports in general is dead. Sean Miller, Head of the Overwatch League, told Dexerto in May that Overwatch esports “are not going away anytime soon,” and in July he stressed to The Verge that Activision Blizzard is “building toward a revitalized global scene that prioritizes players and fans.”

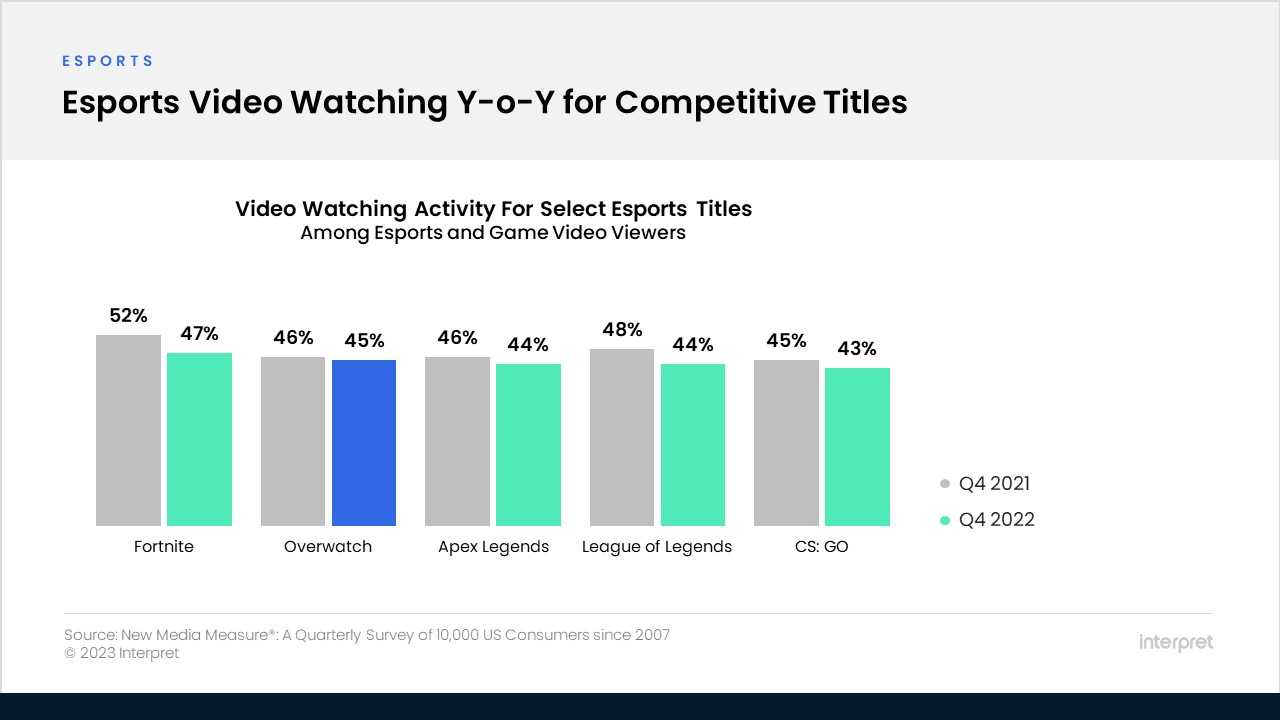

Exactly what that revitalized scene looks like is difficult to predict, but the days of teams paying $20 million or more to become a franchise may very well be over. Interest in Overwatch, however, remains strong, which should be encouraging for players, fans, and Activision Blizzard. According to Interpret’s New Media Measure®, among esports and game-related video viewers, those watching any Overwatch content (tournaments, non-tournament matches, or videos about the game in the past three months) held steady year-over-year, whereas other esports titles exhibited small declines in video interest.