Are we now witnessing an “esports winter?” Major esports organizations are struggling to survive, let alone thrive. FaZe Clan, which rose to prominence through its lifestyle branding and content creation, went public last July in a $1 billion SPAC deal, attracting hip-hop legend Snoop Dogg to its board. Now, after laying off around 20% of its staff in February, the org’s contending with a penny stock and runs the risk of being delisted by September of this year if it can’t right the ship. Snoop Dogg also officially left FaZe Clan in April of this year.

FaZe might be considered “exhibit A,” but esports attrition is running rampant. 100 Thieves has been laying off staff and senior executives, Evil Geniuses has cut ties with its expensive League of Legends pro players, TSM is selling its costly League Championship Series slot, and Madison Square Garden Co. has been trying to divest itself of esports org Counter Logic Gaming, which it purchased a majority stake in for $10 million.

Arnold Hur, CEO of Korean esports team Gen.G, outright admitted on Twitter that his business has “never turned a profit,” despite the org’s success in landing big sponsorships. “We have continued to invest into the esports scene but macro conditions continue to worsen,” he said. “A new business model is needed.”

This may very well be the biggest hurdle facing the esports sector. Owners of major teams are paying handsome salaries to their biggest players while failing to make a profit, which is clearly not sustainable. Matters were made even worse when Riot required that teams participate in a developmental League of Legends league, the NACL, which it has since backed off of at the request of team owners. However, when that happened, seven of 10 LCS teams dropped their NACL squads, prompting a player walkout and a delay to the LCS’s Summer Split. In short, the entire ecosystem is in disarray.

“A big part of what we’re selling is the dream, it’s the long-term future of esports. And when we lose a team and they can’t generate investment based on that dream, then we view that as a failure,” John Needham, Riot’s president of esports, told the New York Times, as part of a piece titled “The esports world is starting to teeter.”

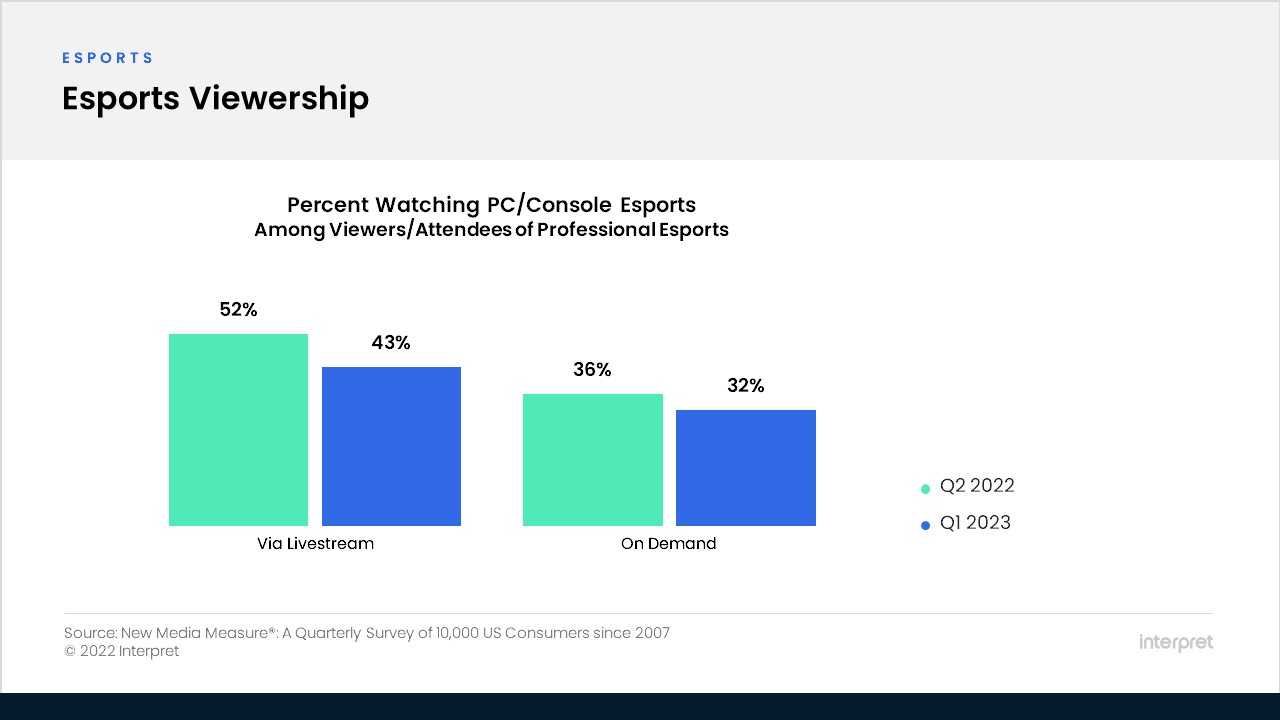

Complicating financial viability for teams is that general viewership is also encountering declines. Estimates from Esports Charts state that viewers watched 14.8 million hours of the 2023 spring season of the LCS, which was down 13% from a year ago and a 32% fall from 2021 levels. Interpret’s New Media Measure® backs up the notion that interest is waning. From the second quarter of 2022 to the first quarter of this year, esports viewers reported watching fewer professional tournaments (PC/console), whether via livestream or on demand.

The esports industry can turn things around. As the saying goes, crisis brings opportunity. But time is of the essence. Publishers, teams, and players must come together to forge a new, more sustainable path forward.