Consumers who want to avoid exchanging cash or touching credit card readers and checkout displays are relying on mobile payment apps to complete contactless transactions. And while these apps are generally secure, they are not foolproof. According to Kathy Stokes, director of fraud prevention programs for AARP, half of American adults incorrectly believe that they can reverse a payment with a peer-to-peer app such as Venmo or Zelle.

“The only thing I can do is plead for that person to be ethical and send the money back to me,” Stokes commented to the St. Louis Post-Dispatch. “If you use (a peer-to-peer app) to buy those great-priced tickets off of Craigslist, and you never get those tickets, you’re out the money.”

Mainstream payment apps such as PayPal can protect consumers against unauthorized transactions, but not against all kinds of fraud. As James E. Lee, chief operating officer for the non-profit Identity Theft Resource Center, stressed, it’s critical that consumers check a mobile payment app’s security, fraud, and privacy protections before using it for any transaction. PayPal, for example, offers dispute resolution and purchase protection.

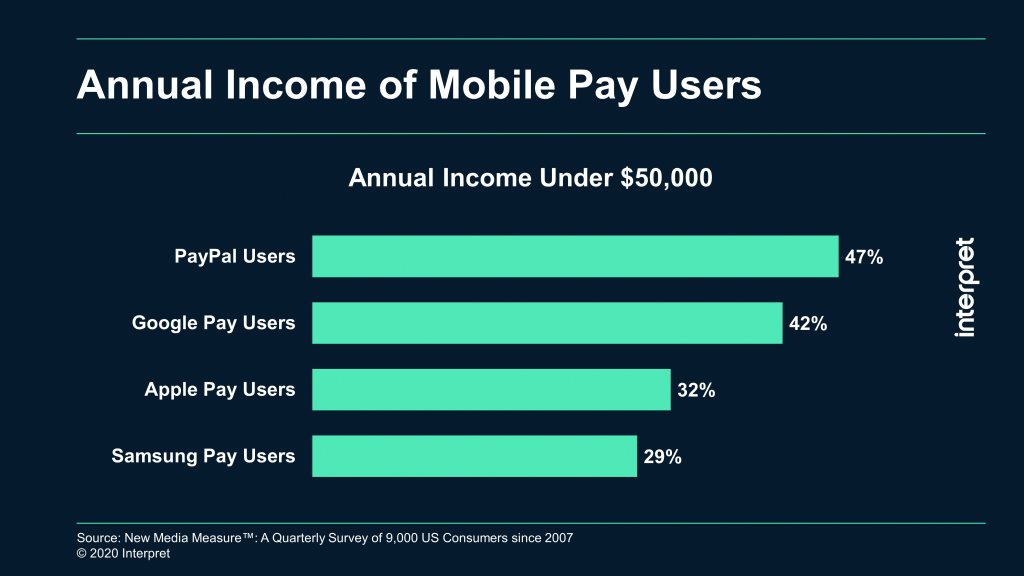

Having financial safeguards in place is particularly important for lower income households. Interpret’s New Media Measure® shows that PayPal is a popular choice among lower earners, as 46% of PayPal users come from households with incomes under $50,000. Google Pay is a close second with 42% of its users coming from homes making less than $50,000. Conversely, Apple Pay and Samsung Pay users tend to earn more, with nearly a third of both userbases coming from households earning over $100,000.