The COVID-19 outbreak appears to be accelerating society’s transition to a cashless society. More and more retailers in recent years began to accept mobile payments such as Apple Pay or Google Pay, but with people looking to stay virus-free, avoiding cash has never been more popular. Cash withdrawals at ATMs nosedived 25% across the US as the pandemic began, per bank industry figures, while 27% of business owners reported an increase in contactless payments in late March, according to payment technology trade group Electronic Transactions Association (ETA).

“It’s clear that the ‘new normal’ for businesses of all sizes is defined in part by a shift in consumer preference for e-commerce and contactless payments, which can help limit consumer exposure and promote social distancing during the pandemic,” said ETA chief executive Jodie Kelley.

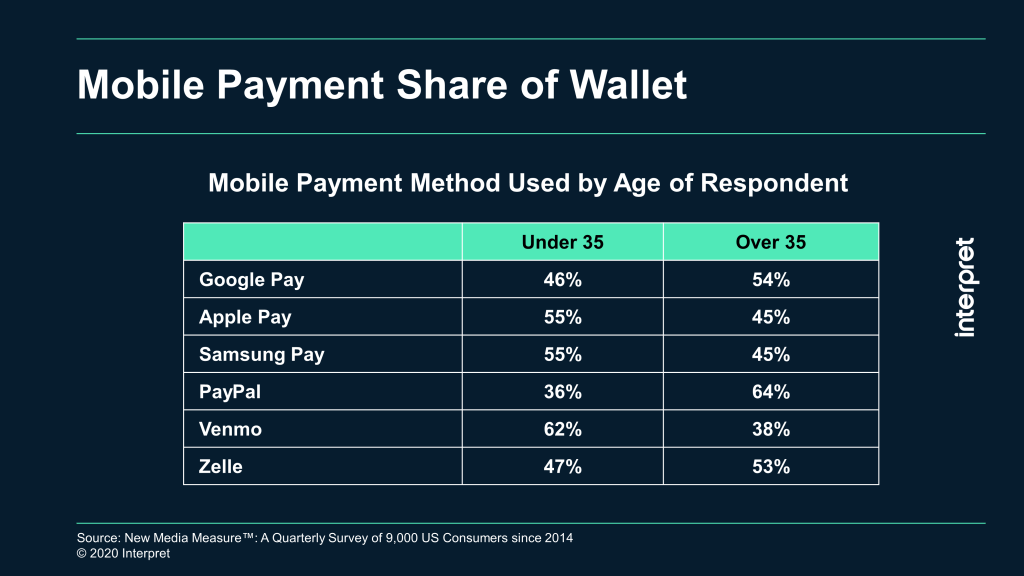

So who’s leading the world of mobile wallets? According to Interpret’s New Media Measure®, PayPal has an adoption rate of 75% of all respondents, and its usage skews a bit older as 64% of PayPal users in our survey were over age 35, whereas Venmo, Apple Pay and Samsung Pay user all skew younger (under 35). In terms of gender preferences, the split was largely equal across mobile payment apps except for Samsung Pay, which was mostly (65%) male; this speaks to the widespread adoption of Samsung phones (Galaxy, Note, etc.) among men. Although the gap was not as large, Google Pay (58%) was also favored by men, suggesting that men may slightly prefer Android devices. It’s worth noting that Google Pay can also be linked to PayPal accounts – an advantage for PayPal since the PayPal mobile wallet is not as widespread across retailers yet.