Amid weak box office receipts, movie theaters are increasingly looking for creative ways to boost revenue. In their latest ticket price experiment, AMC has announced plans to rollout Sightline – the mammoth theater chain’s version of tiered pricing that takes inspiration from Broadway and live sports and concert venues to vary the cost of admission based on seat location. With Sightline, premium seats in the center of the theater cost more while less desirable seats, such as those in the front row, cost less. AMC is rolling out the initiative first in New York City, Chicago, and Kansas City, and plans to expand the program across the country by the end of the year.

Sightline is also constructed in such a way as to encourage joining the theater chain’s Stubs loyalty program and A-List subscription plan. To reserve the lower-price seats, movie goers must be signed up for any level of their Stubs loyalty program, while subscribers to A-List are not charged extra for premium seats.

There has been significant vocal backlash from movie goers and celebrities alike over the controversial plan. Among the more notable dissenters, Elijah Wood called it out for penalizing people with lower income. But Sightline is just one of many experiments in dynamic ticketing (varying ticket prices based on day of the week, time, seat location, or movie shown) as AMC and other theater chains look for ways to increase revenue under decreased attendance. They have already experimented with premium prices charged for tentpole blockbuster movies on opening weekends and, in partnership with Paramount, reduced matinee pricing for all showings of the comedy 80 for Brady in an effort to increase overall ticket sales and attendance. Adding upscale menu items to the standard theater concessions fare has been another strategy some theater chains have used to capture more revenue from those who are going to the movies.

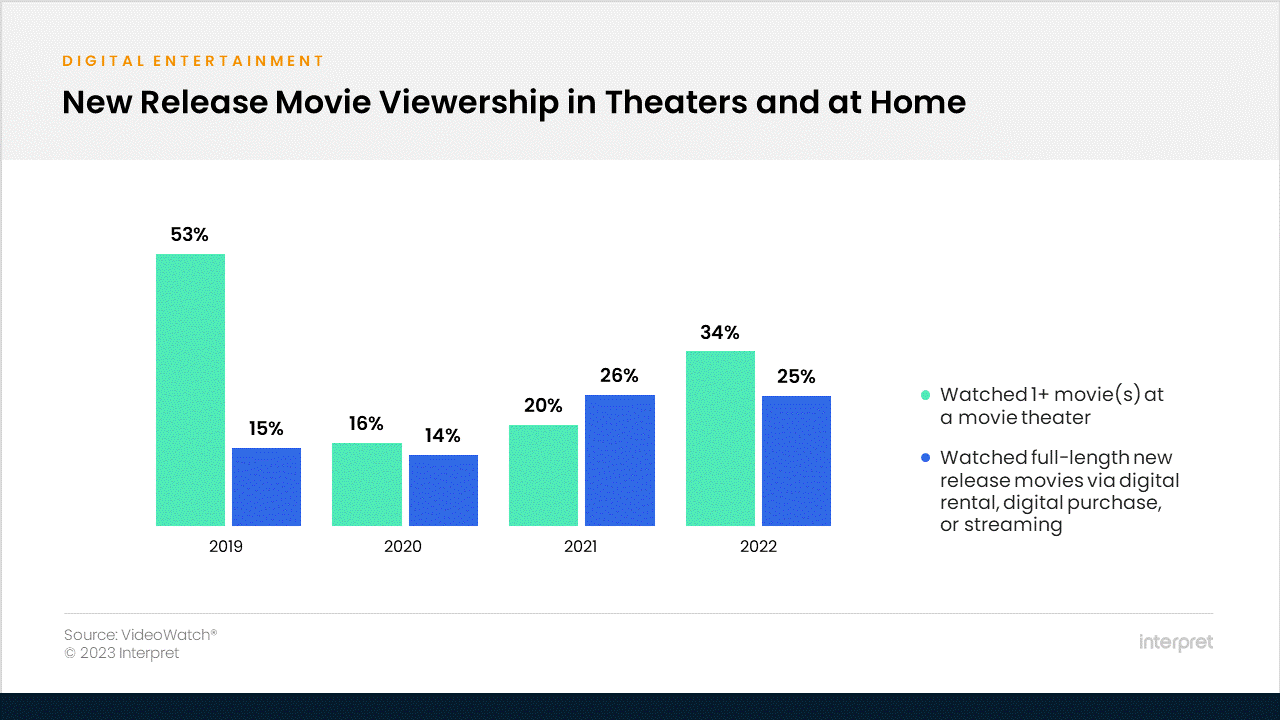

Interpret’s VideoWatch data shows that while people have started to resume watching movies at the theater, attendance in the US is still only at about 64% of pre-pandemic visiting rates. At the same time, the bump of people watching new releases at home – either through steaming services or digital rentals or purchases – that started during the pandemic has held steady and is not showing signs of any decline.

Despite 12 consecutive quarterly losses, AMC CEO Adam Aron is confident that 2023 will see the start of a path to recovery spearheaded by a 35% increase in the number of theatrical releases over 2022. All businesses depend on inventory, and theaters are relying on a steady supply of new films to bring in customers. With the experiments in dynamic ticketing, theater owners are both attempting to lure more people back to the theaters and increase their revenue from each ticket sold, but there is certainly a danger that this experiment from AMC could backfire. AMC’s competitors are showing the same movies, so if AMC gains a reputation for being too pricey, it may lose ticket sales to its rivals.