As streaming video increasingly becomes a focal point for many consumers, companies in the pay-TV sector are shifting gears to meet their needs. Comcast recently introduced Sky Glass, a streaming-focused TV, in the UK, and the company is teaming with Chinese manufacturer Hisense to launch a line of XClass TV models in the US.

The XClass TV models start at just shy of $300, with 4K Ultra HD, HDR10 and Dolby Vision HDR, and a one-year subscription to Comcast-owned Peacock Premium. Initially to be sold via Walmart, the new smart TVs will be powered by Comcast’s X1 operating system, which also powers Comcast’s Xfinity Flex streaming box and the XiOne global streaming box, which the company announced in September.

XClass TVs will put a spotlight on streaming services like Pluto, Tubi, IMDB TV, and, of course, Comcast’s own platforms, including Xumo. The company intends to add streaming pay-TV apps from Xfinity and Charter in the future. Baking its own services into consumer electronics is a marked transition in strategy for the telecom giant, but it’s one that’s been hinted at for some time. Last November, CEO Brian Roberts commented, “We’re wondering, can we bring our same tech stack or certain capabilities in aggregation to consumers who are relying more and more on smart TVs?”

“Comcast’s expansion into streaming devices and connected TV operating systems builds upon its vertical integration strategy,” said Brett Sappington, Vice President at Interpret. “The smart TV is an aggregation platform as well as a viewing screen. Not only does it allow Comcast to best position its own video services, but it also gives the company control over ad inventory and unique, valuable data on video consumption across streaming services. Controlling a share of the pathway between the consumer and their content has become increasingly important today, with several companies eager to stake their claim.”

Interpret’s report, The Future of OTT Aggregation 2021, mentions data control as a key driver of OTT video aggregation initiatives, along with control over advertising and other factors.

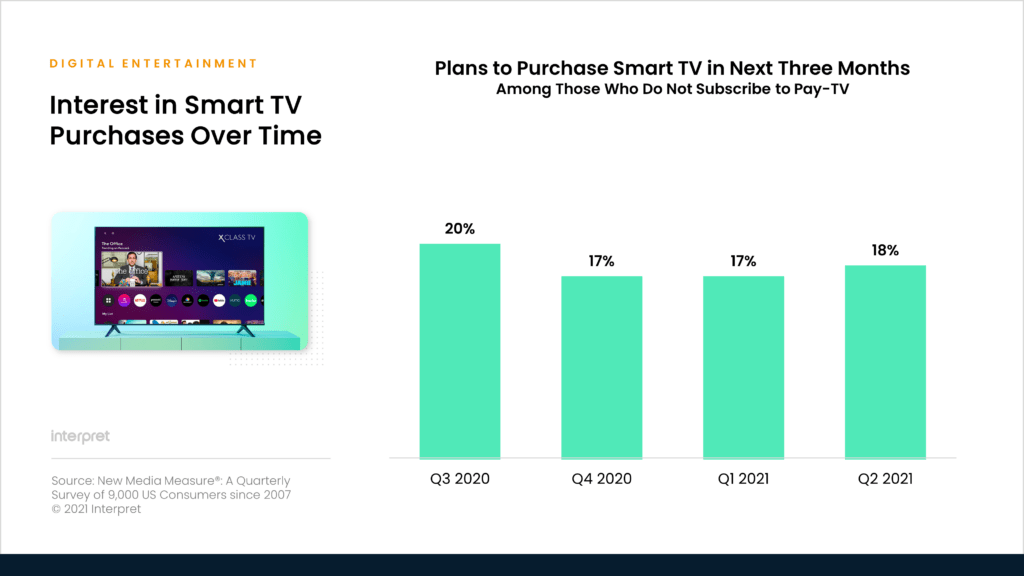

As Comcast steers itself towards streaming, the company will be able to expand its footprint beyond its cable business and diversify its ad revenue generation from other app stores and streaming services on its smart TVs and connected devices. It’ll be interesting to see how much traction Comcast can get in the smart TV world, as Interpret’s VideoWatch™ shows that intent to purchase a smart TV among those who no longer subscribe to Pay-TV remains strong in 2021 following a small dip in late 2020, likely due to early buying during the COVID pandemic.