In 2021, building a new home means building a smart home – the top 10 single-family homebuilders in the US are establishing a new standard that puts smart home products, ranging from energy management to home security, front and center in their designs. US single-family housing starts for 2021 are expected to reach over 1.16 million homes, despite significant supply chain constraints. The top 10 production home builders supplied over 30% of new homes in 2019, and their share is increasing.

With all top builders offering smart home amenities – either directly or through partnerships with home systems integrators or third-party providers such as Best Buy’s Geek Squad – hundreds of thousands of new homes will feature some combination of smart thermostats, lighting, locks, water shut off valves, doorbells, and cameras on move-in day, according to Interpret’s Evolution and Expansion of Smart Home Channels report.

Interpret VP Brad Russell explains that smart home use case priorities typically lead with smart access control and energy management, followed by security and smart home automation to boost value for consumers, and then asset protection solutions, such as smart water sensors with shut-off valves, and HVAC remote maintenance monitoring. Russell states that one result of the COVID-19 pandemic is an increasing interest in healthy homes, resulting in consumer interest in air quality and water quality products such as air purifiers, water filtration systems, touchless controls, and antimicrobial surfaces.

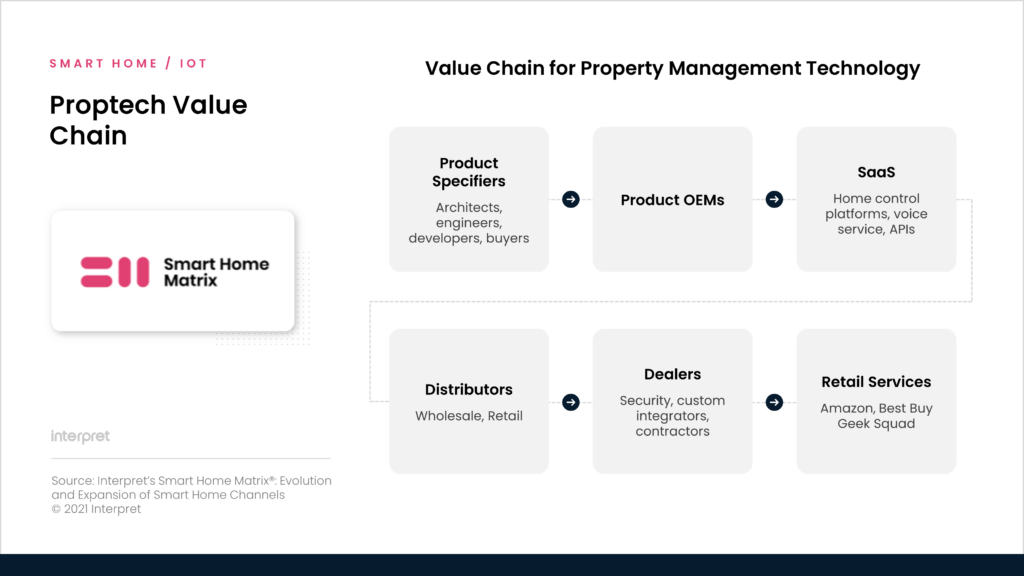

Interest in smart home products is driving the entry of a number of well-known, and a few new SaaS providers, who are seeking to deploy a combination of smart home devices and cloud-based services. Leading providers include Alarm.com, Resideo/Honeywell Home, Vivint and Alula from the security channel, and Control4, Savant, Crestron, and Elan from the custom integrator channel. Amazon/Ring and Google Nest have aggressively sought builder partnerships. Delivering solutions to end users requires a number of players in the value chain, starting with architects and planners, device makers, SaaS cloud providers, distributors, dealers, and installers.

The opportunities for smart home integrators, with demand for new homes outstripping supply, appears to only be increasing, especially as existing homeowners see and desire smart home technologies that are quickly becoming table stakes for new homes.