5G is accelerating

Subscriber growth and global investment in 5G network infrastructure both accelerated in 2021. More spectrums were auctioned off to give wireless service providers the needed capacity to build 5G networks, and more providers are building standalone networks (SA) and starting to market fixed wireless home internet service aggressively in territories where such service can compete with fixed broadband internet services on speed and price.

The number of 5G-capable mobile devices—smartphones, tablets, and others—have topped 1,000 for the first time during 2021. Expanding network service availability and a wide selection of 5G devices have fueled 5G subscriber growth. Interpret expects 5G subscriptions to top 800 million by end of 2021, with China alone contributing more than 700 million. 2022 could be a banner year for other markets, especially the US, to catch up on 5G subscriptions.

Broadband from satellite is coming

As 5G expands its footprint worldwide, ambitious investors have already cast their sights on the sky as the next battleground for broadband internet. 2021 marked the year for many space explorations. While Blue Origin and SpaceX captivated the world with their respective successful human-carrying space tour trips, a less known but potentially more impactful long-term project is the race to launch satellites to build a global internet network without territory restrictions. Elon Musk’s SpaceX carried out 27 launch missions and sent hundreds of satellites to Low Earth Orbit (LEO) in 2021. During its December 2nd trip alone, it sent up 48 satellites to its Starlink satellite network, which now consists of almost 1,800 satellites.

With FCC approved SpaceX’s antenna, true broadband from space is striding closer to reality. Not only do these new-gen satellite-based broadband networks provide an alternative to what consumers are currently using, they are also likely to be a key part of future 6G networks. Yes, the race to 6G is already on.

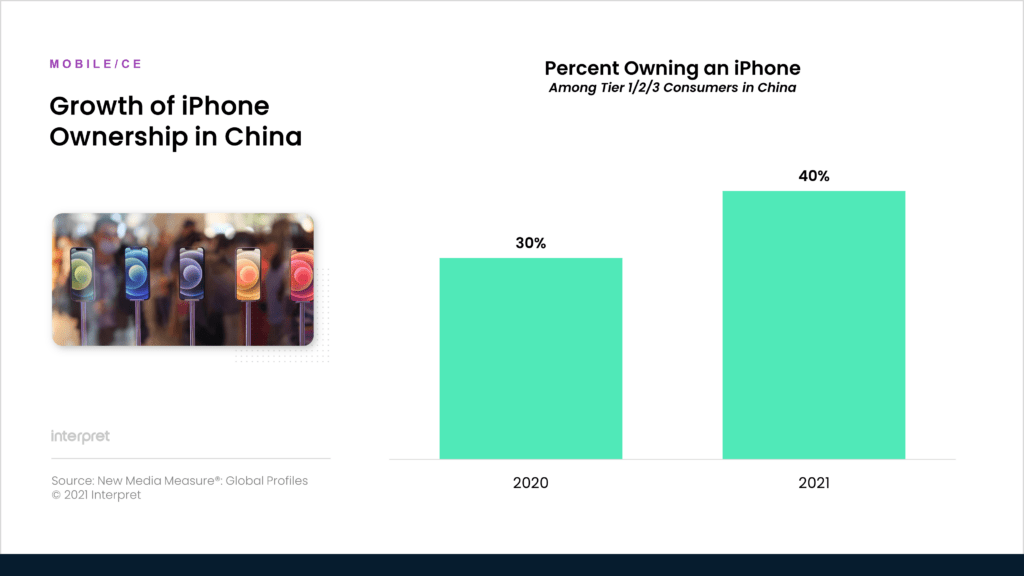

Apple is gaining market share against Google’s Android OS ecosystem

With iPhone 13’s launch in 2021, Apple has solidified its leadership role in the global smartphone market. Huawei’s smartphone business has been withering, and Samsung has been scaling back on its premium smartphone lineup—it discontinued the Galaxy Note line in 2021—giving Apple an opportunity to advance where its major competitors are retreating. Apple’s market share continues to rise in two of the largest smartphone markets—China and the US. Although Samsung has replaced its Note line with its Foldable smartphones, the latter has yet to fill the void.

iPhone’s strength radiates throughout the Apple ecosystem—loyal iPhone users translate into more purchases of other Apple products and more consumption of Apple offered services or app downloads/in-app purchases. The only potential crack is Apple’s grip on App store. The initial rulings on the Epic vs. Apple case—which Apple is appealing in court—would let app developers choose payment options rather than having to use the App Store’s. Even so, the financial impact on Apple would likely be limited.

AR/VR’s hype is over and real growth is ahead

For several years, AR/VR hardware and experiences have been far from excellent. Bulky design, being tethered to a PC, and a lack of AR/VR content are three critical shortcomings that depressed consumer demand. While AR/VR hardware sales were lagging even the lowest forecasts, signals now show that the hyperbole about AR/VR may be over, and that a positive growth reality is here to stay. Rumor has it that Apple’s next major hardware innovation is going to be in the AR space. Facebook, the leading VR vendor, not only had some success with its Oculus Quest 2 sales in 2021, but also restructured its business by separating hardware and services from its mainstay advertising-driven business. The new division called Reality Labs shows Facebook’s growing confidence in this category.

Snapchat also acquired several AR software companies and revealed its ambition in the hardware business with new AR glasses in the making. These moves by large tech are a confidence booster for the AR/VR world, for which we expect a busy 2022, with new product launches and growing supply of AR/VR content.

Chip shortage-constrained mobile hardware supply

Looking back on 2021, the biggest disruption to the mobile industry, aside from the ongoing COVID-19 pandemic, was the chip shortage. It is a widespread shortage affecting many industry sectors, but the mobile industry fortunately suffered from it less severely than others. Still, supply issues began to undermine smartphone manufacturers’ ability to build up inventory for the 2021 holiday season. It will be interesting to watch how long this persists in 2022, and whether other mobile device categories, such as tablets and wearables, will be pressured to give priority to smartphone production.