In the smart home category, not all consumers are created equal. A purchaser of Google Nest might also decide to buy a Ring Doorbell, but how do manufacturers know which people have greater intent? That’s where Interpret’s Smart Home Matrix comes in.

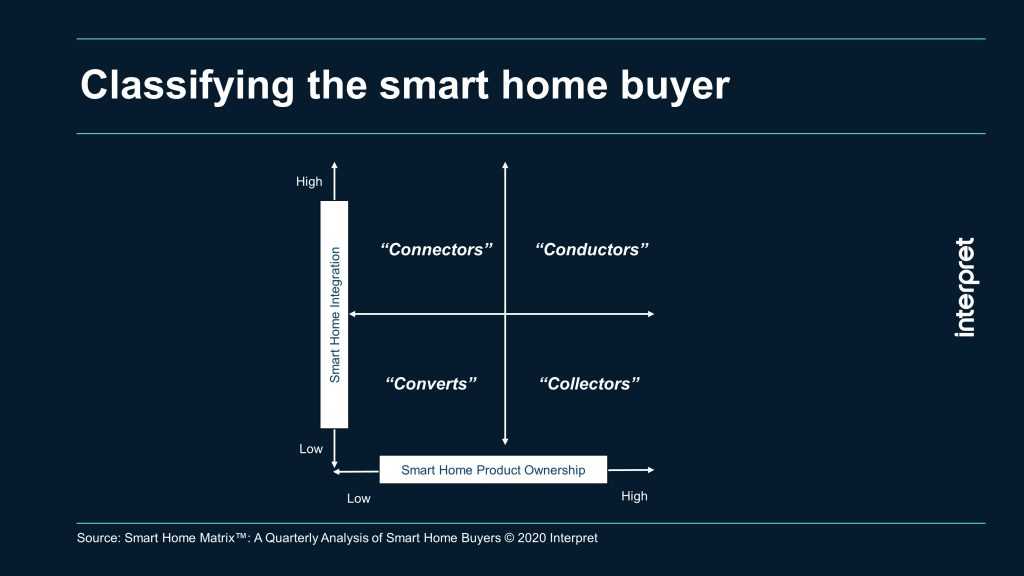

Interpret has identified four key segments in the smart home category based on number of products owned and interest in connectivity.

-

- Low product ownership and low integration: these households are only beginning their smart home buyer journey and have committed only to the first step(s). They are the “Converts.” Typical Converts are female, not parents, equally likely to rent, with lower income.

- High product ownership and low integration: these households enjoy a number of products that may not work together and require separate apps to control. These are the “Collectors.” Typical Collectors are male, own eight smart home products, are aged 25 to 44, with a partner and own a home.

- Low product ownership and high integration: these households don’t own many smart products, but their products are well connected, and more likely installed by a professional home systems integrator. They are the “Connectors.” Typical Collectors are male, 25 to 44, lower incomes, own homes but have no children.

- High product ownership and high integration: these are advanced smart households that have paid significantly for their integrated systems or are expert with technology. These are the “Conductors.” Typical Conductors are married male homeowners with higher incomes and children at home.

Applying this matrix, we observe that the Nest thermostat has high appeal among smart home starters (Converts), but the same is not true for Nest camera and doorbell products. Interpret’s Smart Home Matrix is guiding marketing strategies for savvy brands looking to gain market share in a competitive growth market.