In its Christmas 2019 marketing push, Peloton ran an infamous commercial that was criticized as sexist and dystopian. Over the last year, however, Peloton has turned its brand around with a new campaign and a focus on a wide range of fitness classes. With many Americans vowing to get in better shape during the pandemic or as part of a New Year’s resolution, Peloton is looking to capitalize on the fitness trend with a 60-day free trial offer for its streaming classes, which cost $13 per month when the trial ends.

Free trials are one of the oldest strategies in the marketing playbook, and they’re often employed as a low-risk way of enhancing customer acquisition. This special New Year’s promotion is twice the length of Peloton’s typical 30-day free trial and it’s being offered through January 31st. Complementing the new offer, Peloton has launched new exclusive remixes of three of Elvis Presley songs, as well as remixes from other music artists, and the Peloton app will feature classes that play these songs.

Peloton is better known for its at-home cycling equipment – and this free trial does not apply to purchases of new Peloton Bikes, which require subscriptions to Peloton’s $40 per month service. But, with its streaming exercise classes which provide more than 10 different workout types, the company is pushing to be more competitive with the likes of Google-owned Fitbit, Apple Health, and others.

“Free trials are frequently employed by companies who want to better communicate the value proposition of their services. Enabling prospective customers to try out your product is not only easier, but it’s often more effective than attempting to convey value through traditional advertising,” noted Janine Cannella, Interpret’s VP of Marketing.

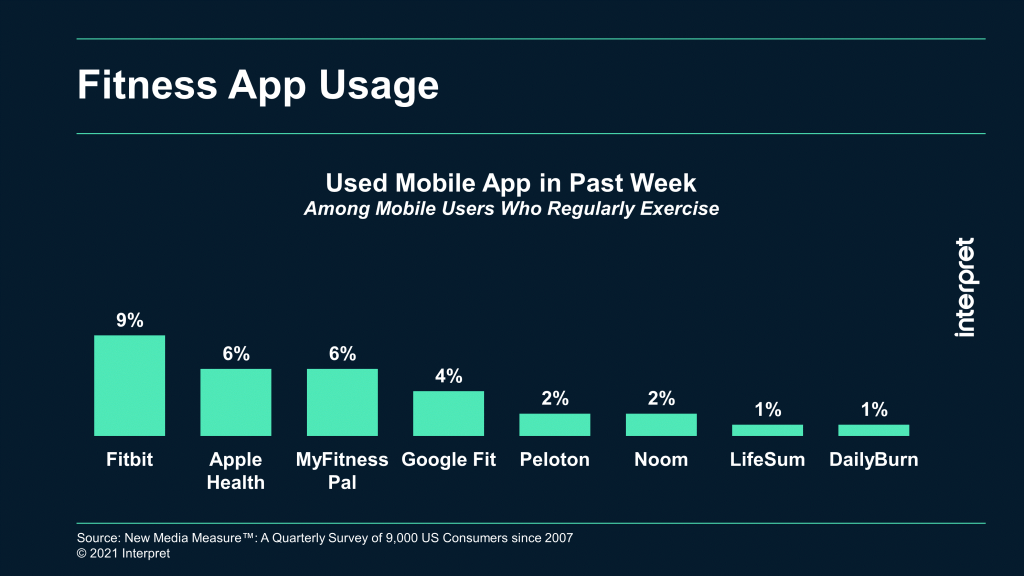

Peloton has an uphill battle when it comes to challenging heavyweights like Apple, which in December launched its own Apple Fitness+ program. Interpret’s New Media Measure® shows that mobile users who regularly exercise tend to favor either Fitbit or Apple Health as their exercise app of choice (9% and 6%, respectively), while Peloton’s app trailed the leaders in the space with just 2% of mobile users.