Throughout this holiday season, all eyes have been on the next-gen consoles from Sony and Microsoft. The new gaming systems will provide plenty of entertainment to a few hundred million gamers during their lifecycles, but it can be easy to lose the forest for the trees in this industry. The number of smartphone users across the globe is approaching 4 billion, and gaming remains one of the most popular uses of mobile devices. Between consoles and mobile, for game publishers the difference in potential addressable audiences is vast.

Tencent’s mobile phenomenon, Honor of Kings, is recording 100 million daily active users. PUBG Mobile publisher Krafton is looking to go public next year and could be valued at a staggering $26 billion. Over 300 million players have downloaded Call of Duty: Mobile, and Activision Blizzard has been stressing to investors that mobile gaming now represents its “biggest opportunity by far” – it’s planning on bringing all its major franchises to mobile in the coming years. Mobile publisher Scopely, which operates popular games like Marvel Strike Force and Star Trek: Fleet Command, also just raised $340 million (in a pandemic, no less) at a $3.3 billion valuation.

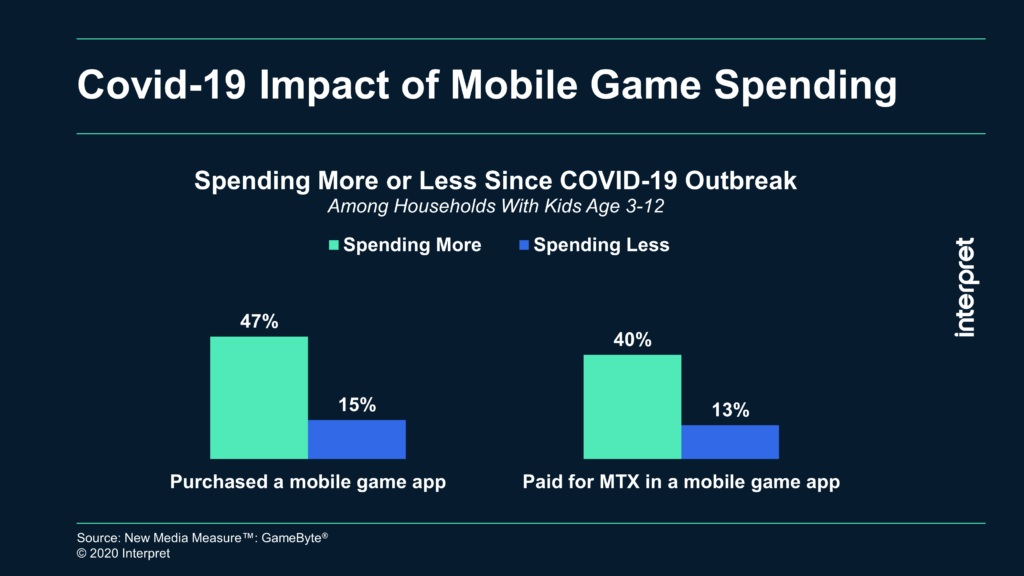

There are no signs of mobile gaming’s ascension slowing down. We may see a blurring of platform lines in part due to cross-platform franchises like Fortnite and PUBG, as well as technological advances like cloud gaming, but the biggest share of gaming revenues will continue to come from mobile devices. This has been especially true during the pandemic, as Interpret’s GameByte® reveals that households with children ages 3-12 are spending more on mobile gaming. Among those who purchased a mobile game app, 47% spent more during the pandemic, and among those who purchased mobile in-game microtransactions, 40% spent more on that content as well.