US homebuilders have become increasingly optimistic as mortgage rates inch downward and sales traffic increases, according to the National Association of Home Builders/Wells Fargo Housing Market Index released in Q1 2023. While housing supply shortages still plague many markets, builders are ramping up production and strategizing over the right mix of amenities that will drive ROI.

Smart home products and systems play an ever-growing role in winning homebuyers with the most to spend at every price point. While builders have varied in their business models for capitalizing on this opportunity, the traditional idea of simply selling smart home upgrade options serviced by an integrator is now one of many variations where devices may be installed as standard by the builder, offered as a customization allowance, or offered as upgrades.

A builder’s smart home strategy must fit hand in glove with their pricing strategy. Here are some key questions a builder should consider:

- Can they ask a higher sales price to recoup their smart technology investments, or must they compete at the same average price per square foot of competitors in the marketplace?

- Which devices might homebuyers be willing to pay more for?

- Where does buyer selection fit in?

- How can builders leverage the buyer desire to roll tech costs into their mortgage, rather than paying out of pocket after the home purchase?

- How large are these preference segments?

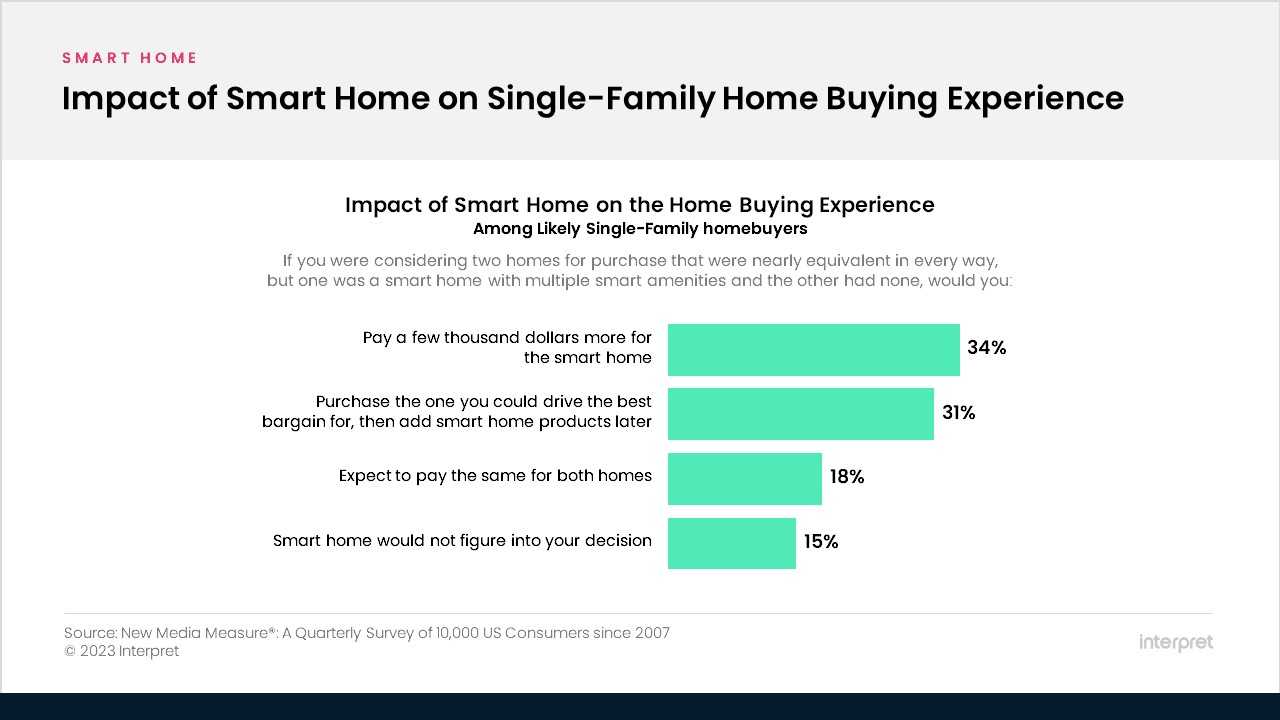

Interpret’s latest Smart Home MatrixTM research among likely homebuyers identifies and sizes four patterns of smart home preferences. When hypothetically comparing a smart home to a non-smart home for purchase, 34% would pay a few thousand dollars more for the smart home. 31% would purchase the home they could drive the best bargain for, then add smart home products later. 18% would expect to pay the same for both houses while 15% report smart home would not figure into their decision.

“The slightly largest group of homebuyers will pay a bit more for a home with pre-installed smart home products,” says Interpret Vice President Brad Russell. “Smart home makes a difference in one way or another for 85% of buyers and about 40% expect to pay nothing more for smart home products. This insight requires builders have a strategy that either accommodates these different types of buyers or focuses in on the ones they think they can capture most profitably.”

Learn more from Interpret’s latest Smart Home Matrix report coming soon, Smart Home and Single-Family Homebuyers and Renters. Also, join Brad Russell and Diahann Young from Pulte Group on an upcoming podcast from John Burns Real Estate Consulting on May 9 at 1pm ET. Join the New Home Trends Institute for podcast access.