As more and more nations move away from fossil fuels and gasoline-based vehicles, the electric vehicle (EV) market is poised for a boom. Across the globe, leading automotive firms are already overhauling their factories to accommodate the production of more EVs. In fact, at the end of 2021, six major automakers agreed to completely phase out the sale of vehicles with combustion engines by 2035 in leading markets. As the roar of engines continues to be supplanted by the softer whirring of electric motors, batteries, connected services, and other electronics tech have become critically important.

This hasn’t gone unnoticed by major consumer electronics (CE) companies. Apple iPhone maker Foxconn, for example, has expressed a strong desire to make cars for Tesla, claiming it can help Tesla (or any manufacturer) reduce development costs by a third. Panasonic, meanwhile, is about to begin construction on a Li-ion battery factory based in Kansas, offering mass production for EV makers by March 2025. CE giant Sony Group is also throwing its hat into the ring, having recently announced a partnership with Honda on a new 50:50 joint venture to produce EVs in the US.

LG Electronics, known for its leading smart TV business, has also invested in the EV market, having acquired AppleMango, a South Korean electric vehicle battery charger developer, back in June. And Xiaomi, one of China’s top electronics brands, has its eyes on becoming a “top five” global player in the EV industry too.

Then there’s Apple, which has been rumored for some time to be working on its own autonomous EV design. With incredible brand awareness and trust, Apple’s presence in the EV market – should its backdoor plans come to fruition – could completely transform the industry and how consumers perceive interactions with their vehicles.

At the moment, there are still significant hurdles for EV makers to overcome, as the vehicles are often more expensive than their gas counterparts, consumers often need to install superchargers in their garage, batteries don’t last as long as full tanks of gas, and the charging station infrastructure isn’t widespread enough yet to give consumers confidence in making long trips. Despite these challenges, auto makers seem energized by the potential of EVs. Ford Motor CMO Suzy Deering went so far as to say that EVs “will be one of the biggest revolutions since Henry Ford put vehicles out on the road.”

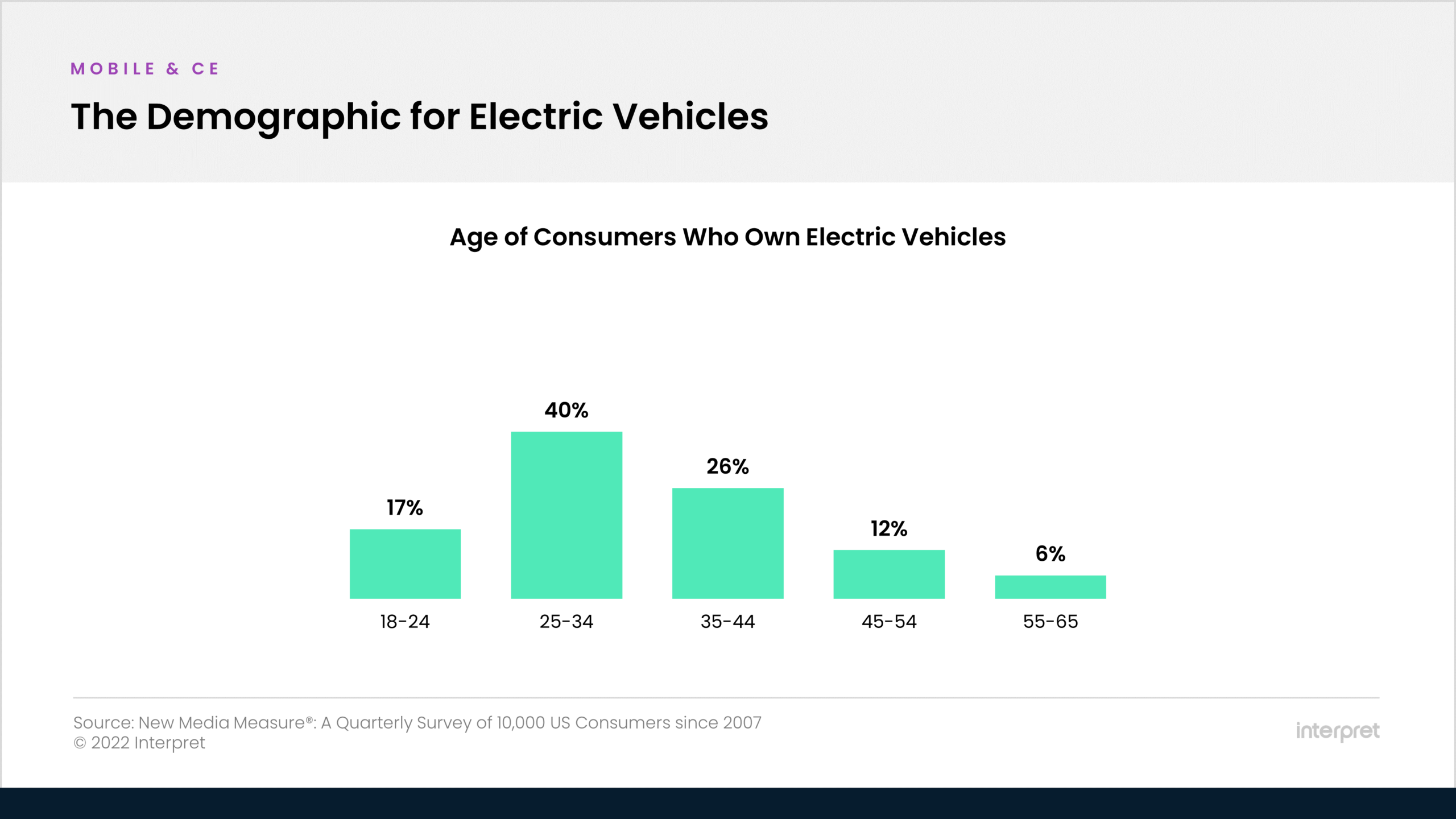

For consumers, many are waiting for a better value proposition. That said, one key demographic is already getting on board, as Interpret’s New Media Measure® shows Millennials as the top purchaser of EVs, considerably ahead of other generations. Consumer sentiment is also likely to shift as the technology improves and becomes more widespread.