Esports has been steadily on the rise, and that’s good news for consumer tech companies. Even before the impact of COVID-19, Interpret’s quarterly survey of 9,000 consumers revealed that a typical esports fan is in his late 20s, more likely to be married than his peers, well educated, and relatively affluent. In fact, 30% of esports fans have an annual income greater than $100,000, and they are willing to spend on subscriptions they care about and regularly purchase electronics. Similarly, 25% of more casual esports viewers also reported incomes of more than $100,000.

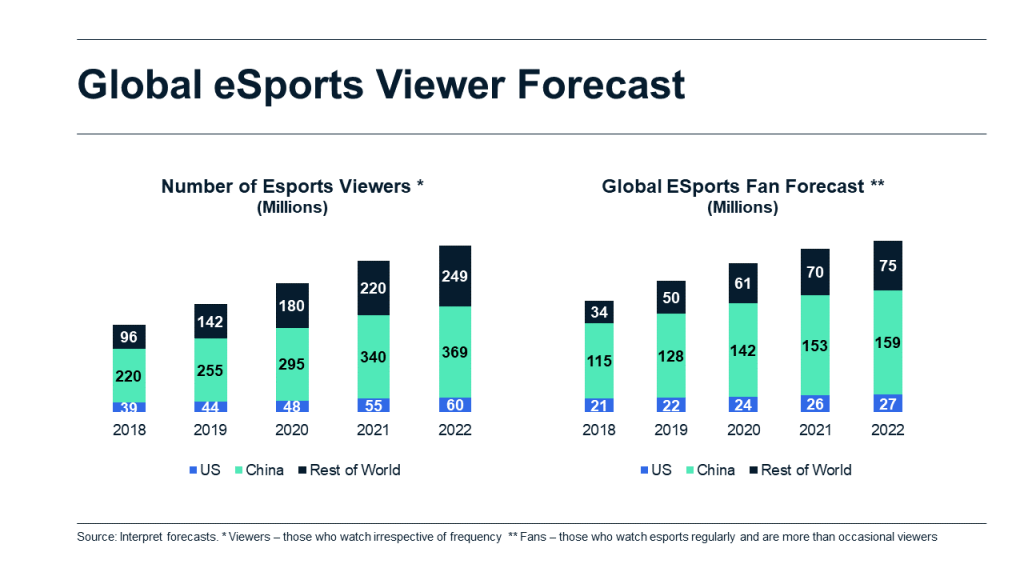

For tech companies, this valuable esports demographic represents a good opportunity for recurring revenues, and esports fans consistently spent more on electronics at both big box retailers like Walmart, and specialty retailers like Best Buy and GameStop. By comparison, only 19% of core gamers – who are at the heart of the PC and console games business – reported annual incomes higher than $100,000. The core gamer group also spent much less on subscriptions and on devices at retailers than esports fans. As the esports market continues to grow, its cash-rich audience is going to be highly sought after. Interpret estimates that esports fans will grow from 169 million in 2018 to 265 million globally in 2022.