With more than a quarter of the global population engaging in gambling activities, and hundreds of billions of dollars in revenues literally and figuratively on the table, the betting world represents a huge growth opportunity for the still nascent esports industry. Over the last year, we’ve seen online betting firms ramping up investment into esports, and more and more states in the US have come around to legalizing esports gambling, including Nevada, New Jersey, Colorado, West Virginia, Virginia, Washington, and Tennessee.

Momentum around esports gambling has been building, and over the last month we’ve seen two new developments that could have a domino effect on the marketplace. For one, the Philadelphia Eagles recently became a shareholder in Esports Entertainment Group (EEG), which is especially notable give the NFL’s historically strict clampdown on gambling.

EEG will serve as the Eagles’ official esports provider, managing Madden tournaments, but more to the point, this means that the Eagles directly profit on gambling activities – even if they aren’t related to their games or other NFL matchups. The Eagles’ investment is an interesting litmus test for the NFL and could pave the way for other teams to get more actively involved in esports gambling as well.

Secondly, another milestone was reached in December when the first-ever esports-dedicated sportsbook in the US was launched by Las Vegas gambling firm GameCo in partnership with US Bookmaking and Sky Ute Casino Resort. Visitors to Sky Ute Casino Resort in Colorado and residents of the state will be able to access the esports betting platform online through desktop, mobile and interactive devices at the casino; GameCo partnered with esports data platform GRID in March 2020 to bring esports betting to North American casinos. With Sky Ute Casino now offering a sportsbook for esports, there’s a greater chance that other casinos in states that have legalized esports gambling will follow suit.

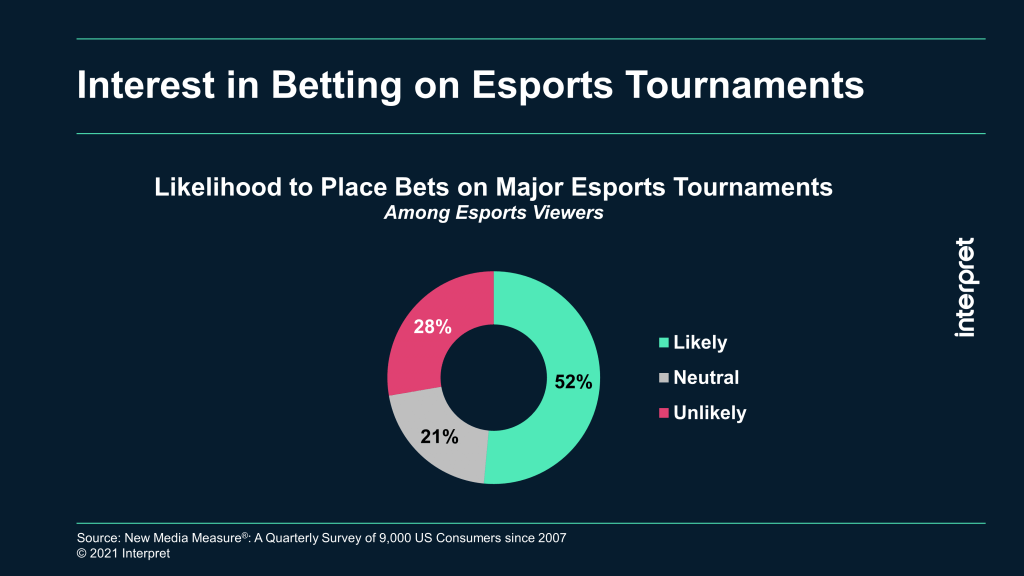

While a surge in esports gambling puts increasing pressure on teams and leagues to prevent match-fixing scandals, the rise in interest should lead to spikes in viewership, more sponsors, and greater opportunities for tournament organizers. Even without a full gambling infrastructure in place, according to Interpret’s New Media Measure®, 52% of esports followers are likely to bet on esports in the US.