Amid a continued crackdown on gaming in the country, China’s video game market experienced a decline in the first half of 2022, the nation’s first gaming market contraction in 14 years. As reported by the South China Morning Post, total games revenue in China fell 1.8% while domestic revenue from Chinese gaming companies fell year-over-year by 4.25%. At the same time, overseas revenues from Chinese-developed games sold worldwide grew 6.2% to $9 billion in the first half of the year – that said, this growth rate has slowed in recent years as well.

A strict licensing system in China combined with an ageing population and a recently implemented censorship program that limits playtime for gamers under 18 has made the domestic Chinese gaming market very challenging for publishers in the country. The Game Publishing Committee of the China Audio-Video and Digital Publishing Association also notes that the gaming audience has dwindled slightly, falling from 666.6 million players at the end of December 2021 to 665.7 million at the end of June 2022.

A report in The Paper (translated by Interpret) points to several key factors in the market’s recent decline. While Chinese gaming companies were granted licenses for their new games this April, only 172 licenses have been handed out in the past three months and some of the gaming companies were already bankrupt or had disappeared. The ongoing global pandemic has also continued to impact consumer spending – a recent report shows that the Chinese economy shrank 2.6% during the first quarter of 2022.

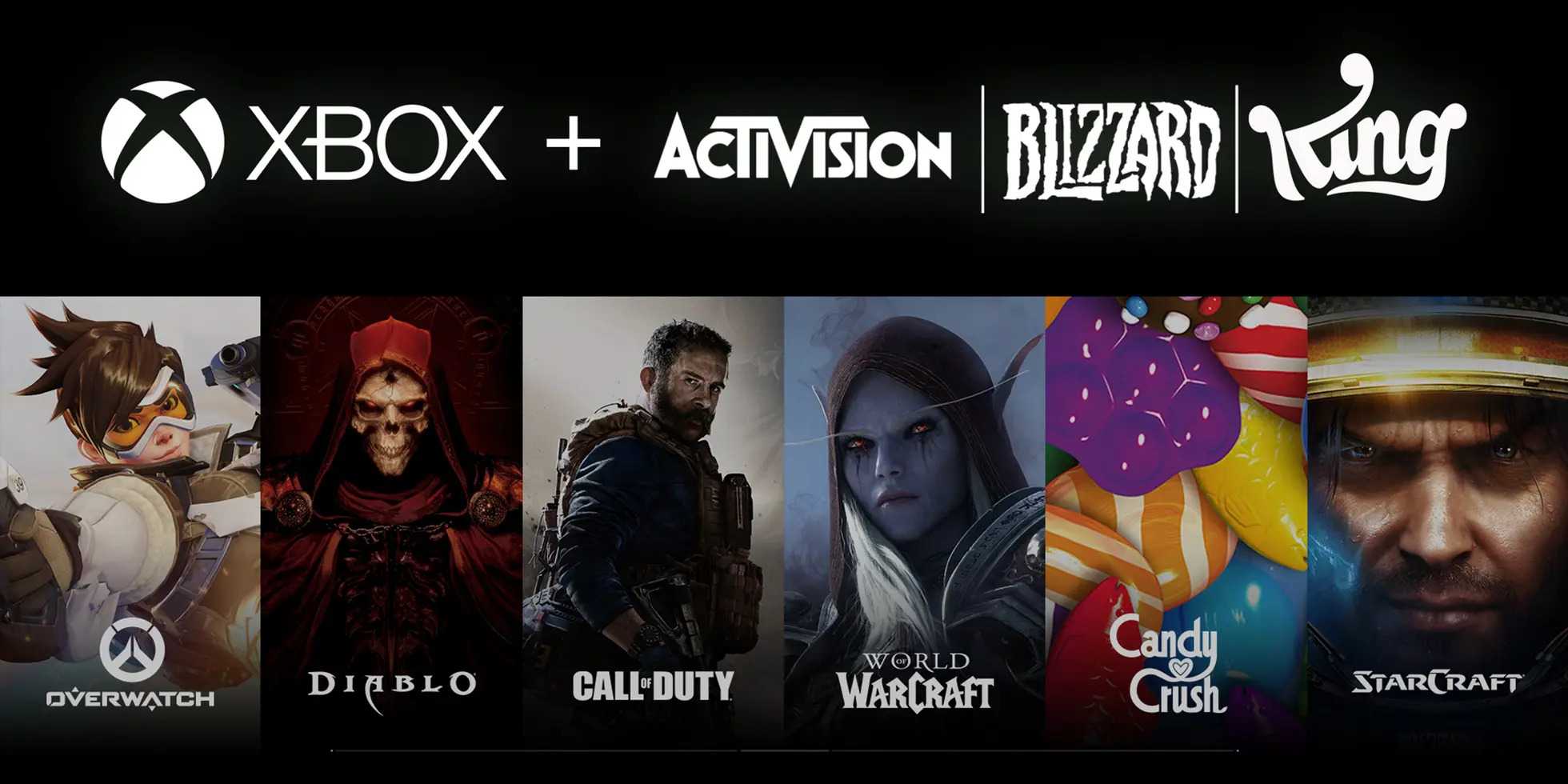

With so many hurdles to overcome within China as compared to overseas markets, it’s not surprising to see China’s gaming giants like Tencent Holdings, NetEase, and miHoYo pushing harder to expand their international footprint. Western markets in particular have become increasingly attractive. For example, Tencent opened an office in LA last year and its subsidiary Timi Studios (Call of Duty: Mobile, Honor of Kings) entered into a “strategic partnership” with Xbox Game Studios. Tencent-owned esports juggernaut Riot Games is bringing its games to Xbox Game Pass, as is NetEase.

Despite China’s domestic problems, the market remains one of the most vibrant for companies that can tap into its player base. According to Interpret’s New Media Measure: Global Profiles™, adult console/PC gamers in China play about 18 hours weekly while mobile gamers play for 16 hours each week. This puts China just ahead of other major markets like Germany, Brazil, and the US.