When tech billionaire Elon Musk purchased Twitter last October for $44 billion, there was plenty of skepticism about the brand and Musk’s vision for the platform. Musk’s own actions and series of changes to the social platform – including rolling back moderation rules (which some feel has fostered more hate speech), reinstating the previous US president’s account, instituting a monthly subscription fee for blue verification checks, and putting limits on the number of tweets users could scroll through in a day – didn’t do Twitter any favors.

And now, with plans to transform Twitter into an “everything app” similar to China’s WeChat, Musk has rebranded Twitter to X, following a merger in April with Musk’s own firm, X Corp. It may be seen as giving the platform a “fresh start,” but it’s also highly risky to throw out the immense brand equity that Twitter has generated over the past decade-plus.

In the midst of cost-cutting, significant layoffs, and a feeling of general chaos at Twitter, advertisers scaled back their support considerably. Musk confirmed that the platform’s ad revenues had been halved, and the company’s value had also dropped to $20 billion back in March. Advertising has long accounted for the vast share of Twitter’s annual revenue, but it’s not clear if the world’s biggest brands will ever invest the way they did prior to Musk’s buyout, if they come back at all. In April, Unilever, Coca-Cola, Merck, Chevrolet, and Chipotle, all stopped advertising on Twitter due to brand safety concerns.

Moreover, the shift towards becoming an “everything app” may also be the antithesis of what advertisers desire. WeChat, for example, does not rely heavily on advertising and instead makes much of its money from e-commerce and payment processing fees. “If Musk’s new gambit is to fully pivot the company to become an ‘everything app’ for consumers as opposed to an ad-driven social media platform, then that’s probably for the best because it would eliminate the charade that the company is trying to woo advertisers back,” Andrew Graham, founder and head of strategy at PR firm Bread & Law, commented to The Drum.

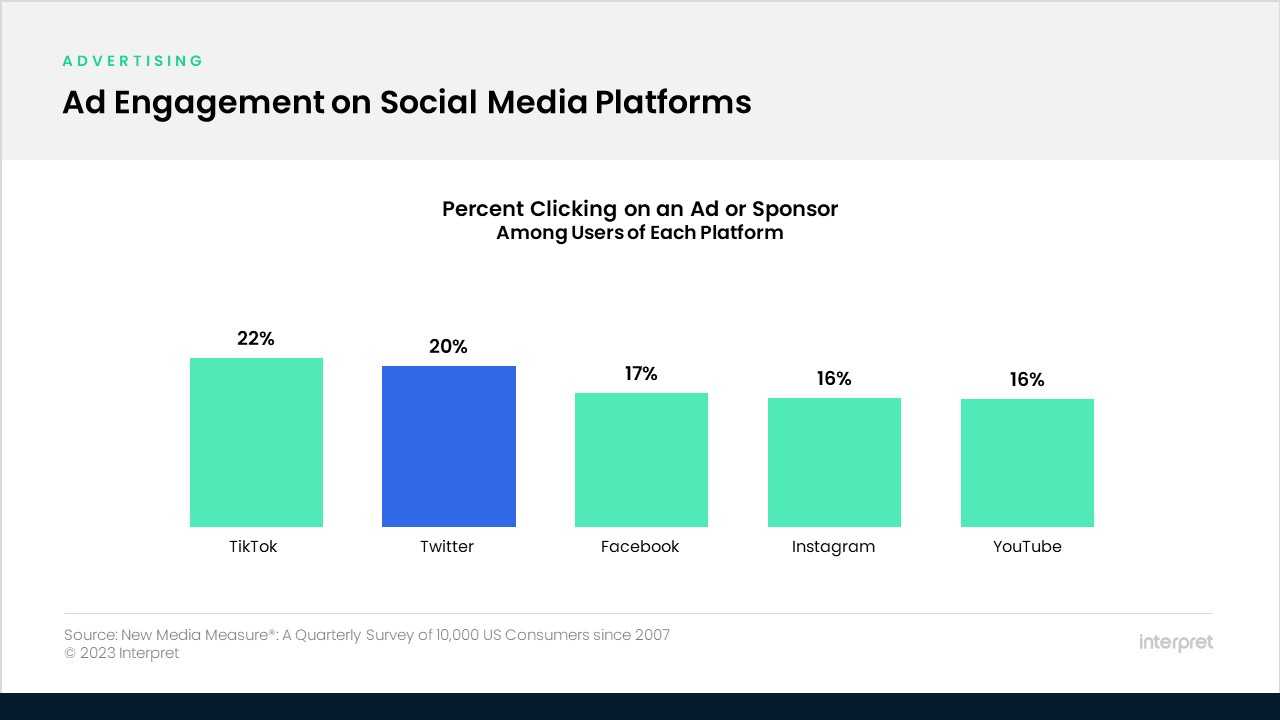

Meanwhile, Meta’s brand-new Twitter competitor, Threads, quickly skyrocketed to 100 million users but has since leveled off down to less than half that. Clearly, Twitter’s users have been open to trying out alternatives. What the future ultimately holds for the X platform remains unclear, but if Musk actually does want to lure back more advertisers, there’s a bit of good news to lean on, based on data from Interpret’s New Media Measure®, which shows that even after the Musk takeover, Twitter’s users remained almost as receptive to advertising as TikTok users.

According to the data fielded in February/March of this year, one-fifth of the US Twitter base reported clicking on an ad while using the platform, just behind TikTok at 22% of its users. This puts Twitter ahead of Instagram, Facebook, and YouTube and is certainly something that major brands will want to keep in mind. Twitter and TikTok were similarly neck-and-neck and ahead of other platforms when it comes to users agreeing that they “have allowed you to interact with brands and companies on a more personal level.”