In August 2020, Amazon launched its first Halo Band fitness tracker. The $100 device did not come with a screen and required a $4 monthly subscription to take advantage of its advanced features. The wearable utilized a built-in mic to track the tone of a user’s voice to discern emotional health, which some critics immediately flagged due to privacy concerns. Over a year later, Amazon has updated the product by doing away with the mic and incorporating a screen to make the tracker more like an Apple Watch or Fitbit product.

Amazon is clearly trying to carve out a piece of the crowded fitness market, as the new Halo View is cheaper than its predecessor at just $80, and the tech behemoth is including a one-year subscription to both Halo Fitness and Halo Nutrition. It’s not yet known how much these subscriptions will cost users once the free trial expires. Amazon is looking to ship Halo View by the holidays and Halo Fitness content will start rolling out to members around the same time, whereas Halo Nutrition will become available in January 2022.

Considering that Fitbit devices that offer similar functionality to Halo are at least $150, and Apple Watches start at $199 for the older Series 3 models, Amazon will have a price advantage and could be an impulse purchase for many holiday shoppers who will already be utilizing Amazon to complete their holiday lists.

That said, Amazon will have to convince consumers that the Halo View and associated subscriptions are worth it in the face of more popular options. Apple so far has dominated the wearables category; in Q4 2020, Apple accounted for more than 40% of smartwatches sold and controls more than a third of the global smartwatch business, with Samsung at 8% and Google’s Fitbit at just over 4%, according to a Forbes report.

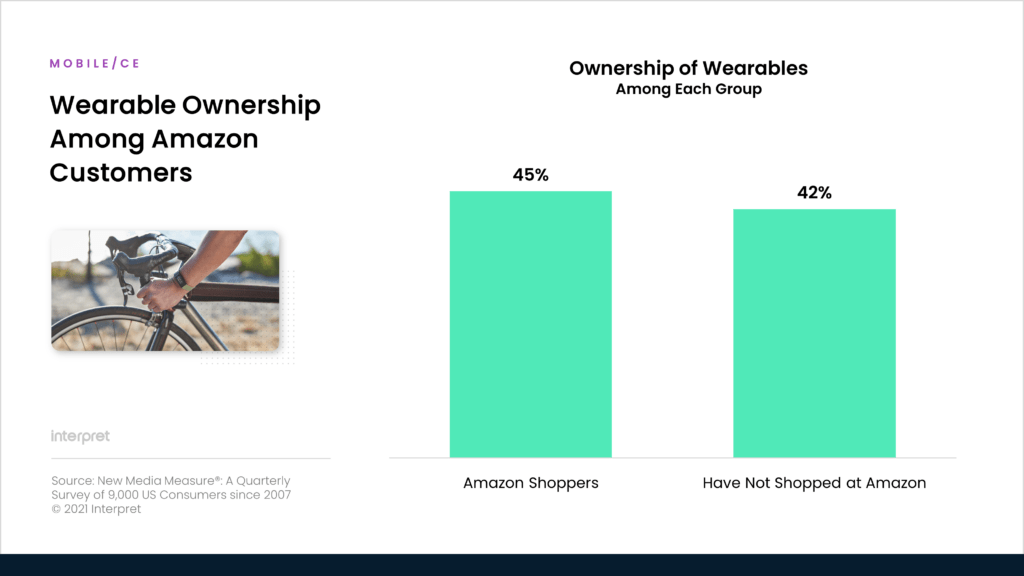

The fitness category is fast becoming a fitness-as-service business. The leading firms all have subscriptions (Apple Fitness+, Samsung Health, Fitbit Premium, etc.) that generate the bottom line-boosting recurring revenues big corporations so greatly desire. The device is merely a trojan horse intended to get consumers hooked to a subscription. As a cash-rich company, Amazon is likely unafraid to take a hit on Halo View profits to build up subscription numbers over the long-term. The good news for Amazon is that nearly a third of its US customers report trying to improve their health and fitness. Additionally, Amazon shoppers in the US are more likely than non-Amazon shoppers to own a fitness tracker or smartwatch, according to Interpret’s New Media Measure®. If Amazon can convert a portion of those wearables owners into Halo users, it’ll be off to a good start.