One-third of broadband users own a wearable – either a fitness tracker or smartwatch. 25% of that population owns a fitness tracker, while 18% own a smartwatch as of 3Q2019. Wearables, as a category, enjoyed a 6% increase in adoption from 2018 to 2019 and are poised to continue at that pace. Within the category, however, the growth of smartwatches and fitness trackers (also called fitness bands), is expected to diverge, with smartwatches continuing to enjoy steady growth and fitness tracker sales flattening. Google will shortly consummate its $2.1 billion acquisition of Fitbit, the leader in fitness bands, potentially uniting it with its Wear OS platform, emulating the open Android versus proprietary iOS smartphone battle on the wrist.

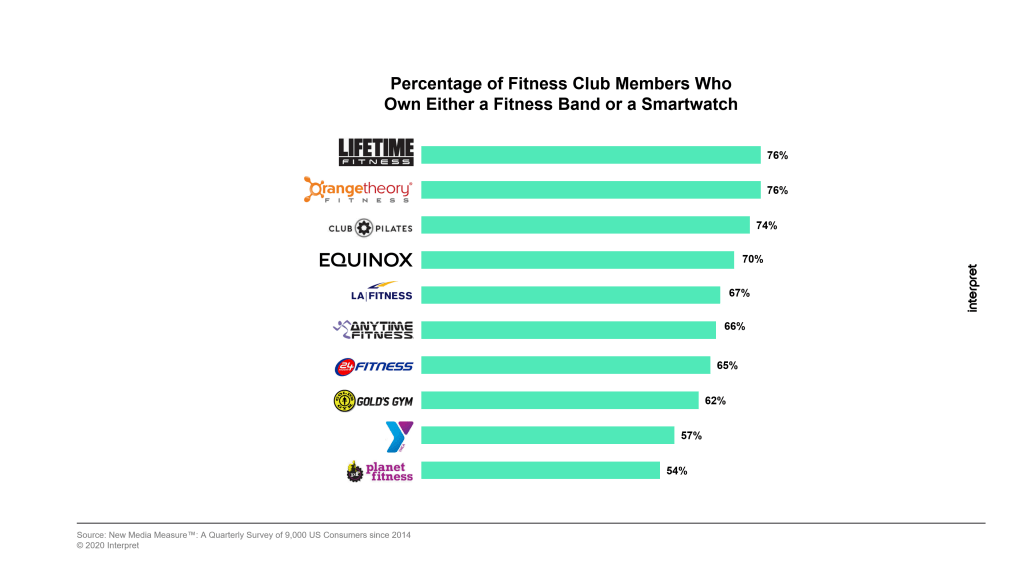

How should smartwatch makers carve out their slice of the growing wearables pie, with heavyweights Apple, Google, and China’s Xiaomi vying for leadership? Apple is going after Fitbit’s base of fitness-minded consumers, and forging relationships with national gym chains, including the YMCA, Basecamp, Crunch Fitness, and Orange Theory. This aggressive campaign actually subsidizes gym membership fees for Apple Watch owners who meet certain workout requirements. Interpret’s data confirms the correlation between fitness-minded people and owners of smartwatches and fitness trackers – 43% of physically active people own a device compared to only 27% of non-active people. Over 70% of members of national gyms Equinox, Life Time Fitness, Orange Theory, and Club Pilates own a fitness tracker or smartwatch, creating a strong base on which to build a connected fitness club experience.

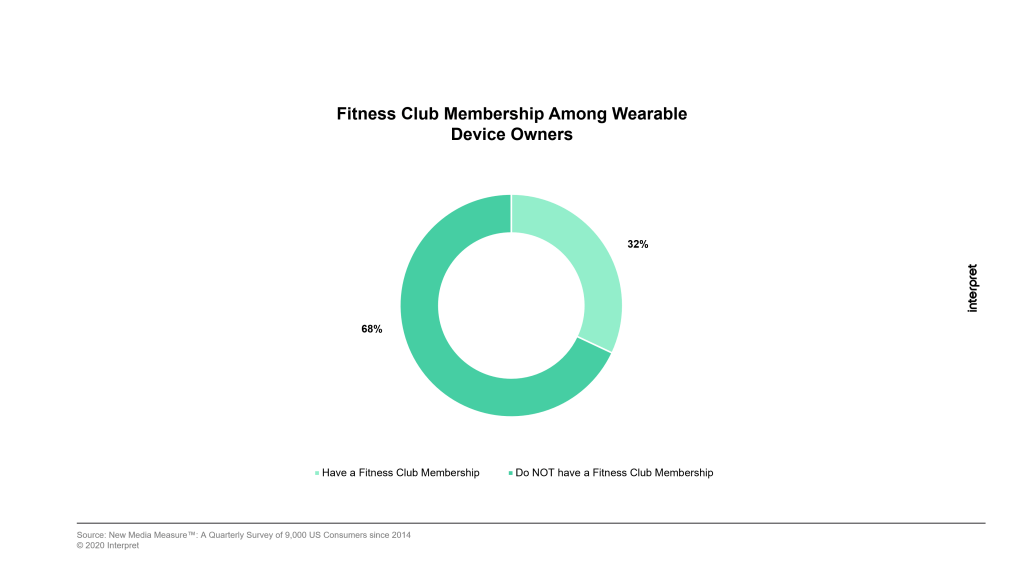

Fitness clubs have much to gain with a connected workout experience as more than two-thirds of wearables owners have not joined a fitness club.

Clubs can actively attract smartwatch owners with discounts, and with apps that notify watch-owning members of class schedules, workout progress, and special offers for accessories, snacks, and apparel.

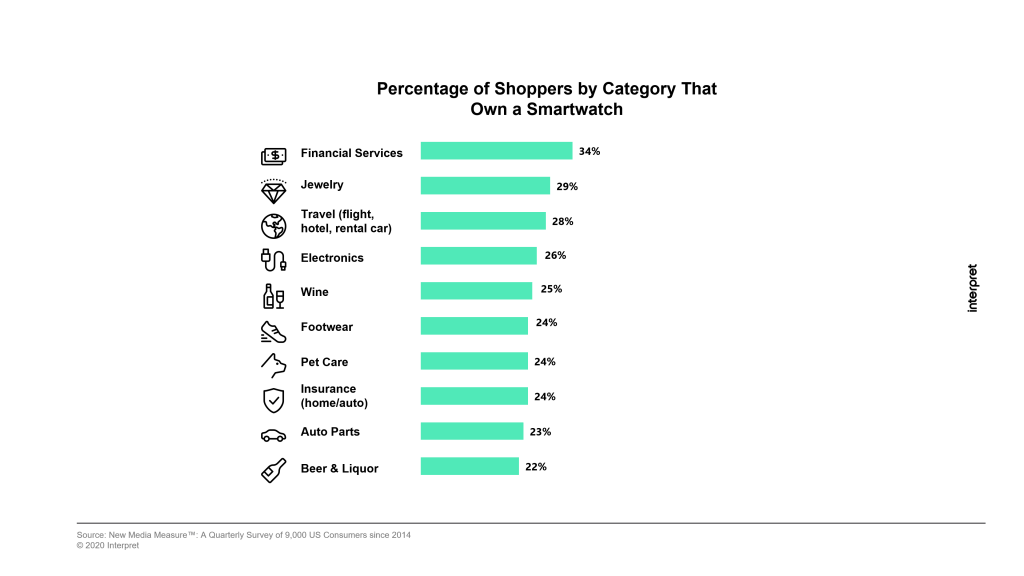

Aside from the fitness enthusiasts, how will smartwatch makers grow the segment? Smartwatches, unlike fitness trackers, are technology platforms for hundreds of apps, business partnerships, and complementary devices. Focusing on particular segments holds the key to building rich and profitable smartwatch-centered ecosystems that form deep ties with consumer lifestyles.

Looking beyond exercise enthusiasts, Interpret’s surveys identify other buyer targets. People over the age of 55 who are concerned about their health are twice as likely to own fitness trackers than smartwatches, despite the growing number of vital signs being tracked by smartwatches. Deeper partnerships with health insurance companies/self-insured payers, resulting in smartwatch subsidies, will increase interest and uptake of the smartwatch device category.

Another segment that shows strong enthusiasm for smartwatches is adults with one or more children (under 18) at home. Parents are 63% more likely than average to own a smartwatch, looking to the device for convenience and time saving for frequent tasks such as ordering food, making payments, and keeping up with finances. Patrons of takeout pizza chains (Pizza Hut, Domino’s, Little Caesars, and Papa John’s) are nearly 38% more likely to own wearables than average. A high correlation with shopping for financial services, travel services, wine, and jewelry suggests a number of consumer services that smartwatch makers can include to attract more buyers into a connected lifestyle.

Survey Methodology

Interpret surveys 9,000 Americans between the ages of 13 to 65 every quarter as part of its New Media Measure™ syndicated research. The survey covers a wide variety of topics including: demographics, behaviors, device ownership, shopping, entertainment, movies, television, music, and video games. Responses are then weighted to the American population. This survey was conducted from June through September 2019.