New smart TVs from top brands like LG and Samsung garnered plenty of attention at the recently concluded CES in Las Vegas, particularly since the latest QD OLED technology will be entering its second year of production and will introduce brighter panels and more refined features. While that’s great for videophiles and tech nerds, one of the more interesting storylines from the show is that streaming device leader Roku is now officially becoming a manufacturer of its own TV sets. It’s a move that’s likely to have a bigger impact on mainstream consumers who value price and ease of use.

Roku will offer two different lines this spring, a more affordable “Roku Select” and a premium series called “Roku Plus.” Even so, the most expensive model is a 75-inch set for $999, which is considered affordable for that screen size.

Roku has already worked with some TV manufacturers (Hisense, TCL) to incorporate its popular OS, but going forward with its own line of TVs not only leverages its well-established brand but also gives the company more control. The company noted that making its own models will “enable further innovation around the TV experience,” but what that will entail isn’t clear yet. If the TV push succeeds, it’ll enable Roku to further expand its audience, which in turn should boost its ad-based content business. The company has strong momentum as it recently reached 70 million global accounts.

In the battle for streaming OS dominance, Roku sees fierce competition from Amazon’s Fire TV. Amazon began selling its own TVs to complement its Fire TV sticks last year. Roku also has to contend with strong sales from Samsung and Vizio smart TVs, but if Roku can undercut those brands on price with its own TV models, it could gain some market share.

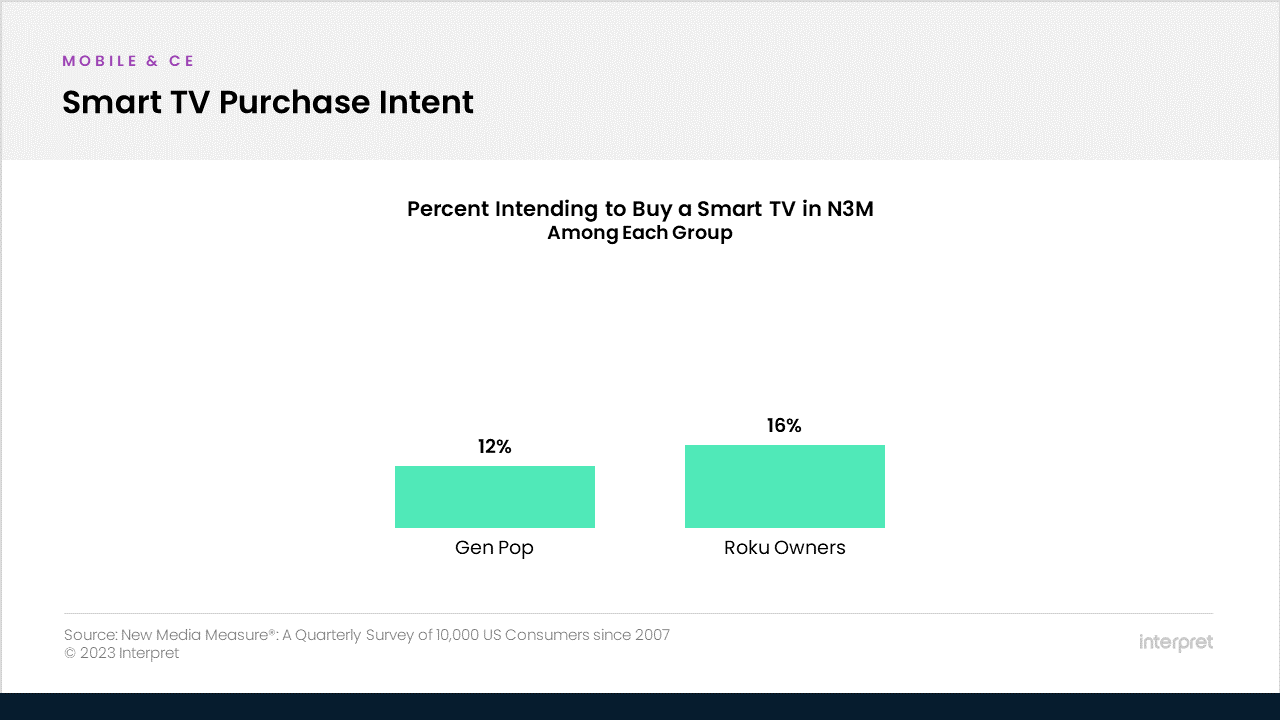

In the months ahead, Roku may have an opportunity to convert some of its existing base into buyers of one of its new smart TVs. Interpret’s New Media Measure® shows that existing Roku users are more likely to spend on a new TV than the general US population. About 16% of Roku owners intend to purchase a new smart TV in the next three months, whereas the general population stands at 12%. Roku is unlikely to provide the same fidelity as an LG or Sony, but many consumers simply don’t care if they can snag a new TV for a good price that quickly and seamlessly gets them into the Roku ecosystem.