Amazon recently announced Alexa Guard Plus, a new subscription service for Echo users which provides a few premium security-minded services in exchange for a $5 per month fee or $49 annually. Subscribers who seek greater peace of mind will benefit from their Echo listening for sounds such as footsteps or glass breaking, and the device will send the user alerts on their smartphone about these sounds or any smoke alerts detected. Alexa Guard Plus can also respond to suspicious noises by playing deterrent sounds such as a dog barking or a siren, and it can connect a user with a 24-hour helpline that has the capability of calling for emergency services.

Last August, Amazon rival Google entered the professionally installed home security industry through an alliance with security giant, ADT. Google acquired a 6.6% ownership interest in the security dealer leader, and as part of the agreement, Google’s tech will drive ADT’s future security hardware, while likely offering many cloud features similar to Amazon’s barking dogs, sound detection, and access to monitoring centers.

A segment of consumers who desire security but don’t want to spend $30 to $40 each month, or who believe that stand-alone smart home products such as cameras and connected doorbells offer adequate security, are driving sales of security-minded smart home products. Yet professionally installed systems providers such as ADT, Alarm.com, and Vivint showed strong growth over the past year, suggesting that new smart home products are not taking a bite out of security systems buyers.

“It appears that security-related smart home products have found an untapped market in tech savvy consumers who have an appetite for ‘security lite’,” observed Stuart Sikes, Senior Vice President at Interpret. “ADT, with its Blue line of self-installed smart home camera products and optional monitoring, is determined to play in this space as well, while Amazon’s Ring division offers a self-installed home security system, or stand-alone cameras.”

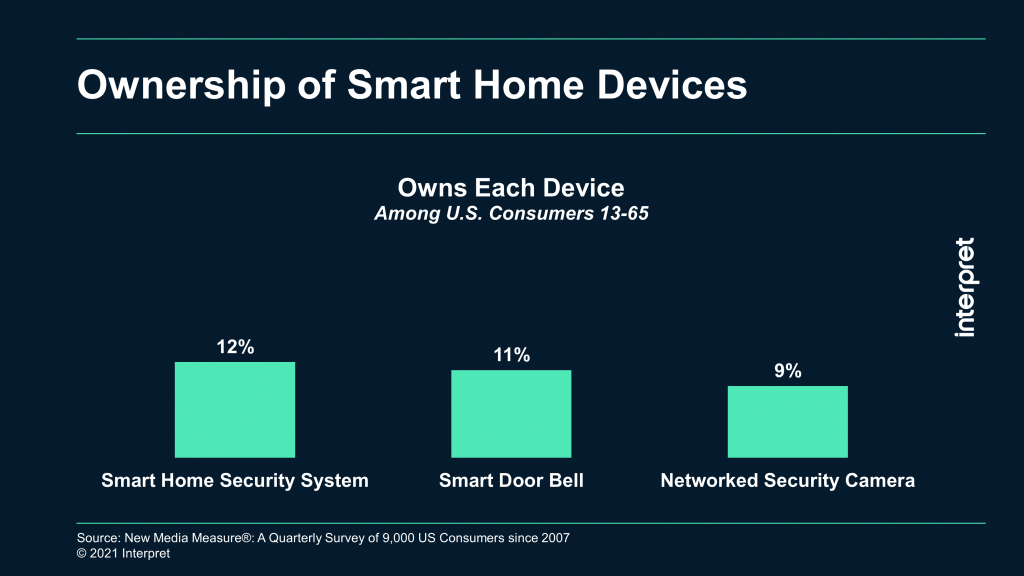

According to Interpret’s Smart Home Matrix™ research, ownership of standalone video products, including connected cameras and smart doorbells is only a few percentage points less than ownership of smart (interactive or web-connected) security systems. The growth rate of connected devices is nearly double that of smart home security systems, and ownership is likely to be at equal levels very shortly.