2020 put a damper on the global economy as many consumers were on lockdown during the pandemic. With so many individuals staying home, however, a portion decided to invest in making their domiciles “smart.” According to CEPro, which tracked 52 publicly traded smart home product companies, their average growth in 2020 was around 35% — 38 companies saw an increase in business while 14 saw their businesses sag. The top performers included Summit Wireless (WiSA), VOXX (Klipsch), Alarm.com, Logitech, LG and Vivint. Some of the companies losing ground included AT&T, Canon, Viomi and Belden.

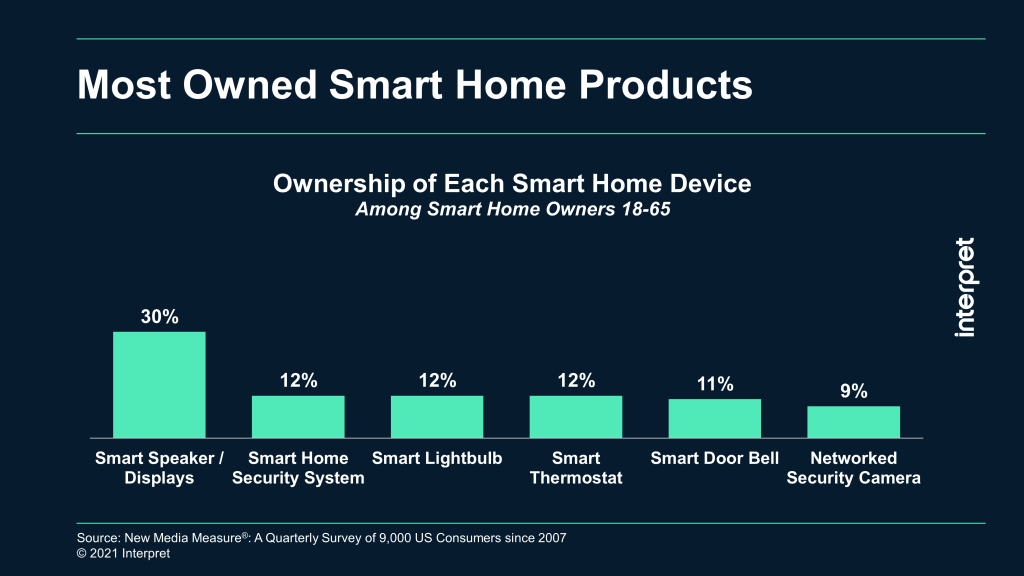

A comparison to the 2020 Dow Jones Industrial Average at 7.25% puts the smart home industry in a flattering light, although it did fall short of NASDAQ’s one-year performance of 43% in 2020. The two biggest drivers of industry growth in the smart home marketplace are smart speakers and smart displays, according to Interpret’s Smart Home Matrix™. Smart security systems, light bulbs, and thermostats have also been popular, but all three categories see less than half the ownership of smart speakers and displays in the US.

As consumers invest more in their homes – making them more comfortable, secure, connected, and high-tech – they have established a possible foundation for long-term growth for smart device manufacturers like Google and Amazon. Alexa and Nest, after all, enable further consumer spending in their respective ecosystems (or outside those ecosystems) with just a few spoken words.

“As the world seeks to find a new normal post-COVID, will the industry maintain its strength? While growth may not be as strong, upgrading the home seems to be a Pandora’s Box – the more connected and comfortable, the more one can justify the next upgrade,” noted Stuart Sikes, Senior VP at Interpret. “It has been said by many that the pandemic accelerated new technology adoption by 10 years or so, and in the case of smart home technology, this acceleration is strongly evident.”