Despite many smart home offerings from energy utilities, telcos, cablecos, retailers, and others, until recently, the companies that have made serious in-roads into the mass market have been security providers. That is beginning to change thanks to smart speakers and a few hot smart home products. Connected security cameras, smart lighting and smart speakers are now in more than 5% of households in many countries around the globe.

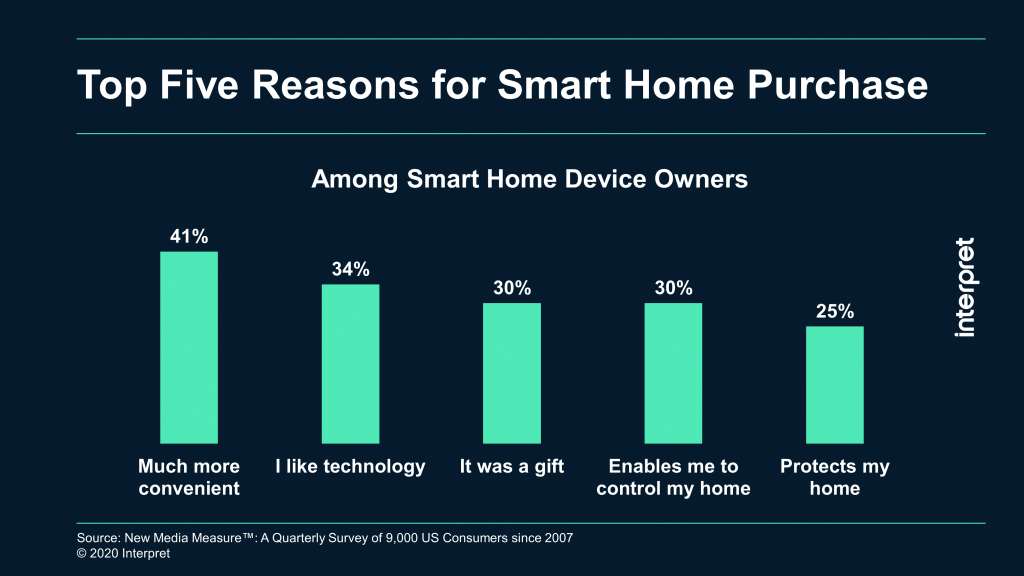

In the U.S., according to Interpret’s New Media Measure®, 41% of consumers stated that the primary reason they own smart home products is convenience, not security. For years, most consumer surveys have shown that protecting their home was the primary reason driving product adoption. Interpret’s data paints a different picture, however, as only 25% state “protects my home” as the most important reason for a smart home purchase.

These data suggest changes that are important to marketers of consumer electronics and smart home products. First, consumers are successfully adopting smart home products into their lives in such a way that they are providing value and proving beneficial, even when they are not part of a home security solution. Much of the credit for this change can be attributed to smart speakers – the most popular smart home product, and one that is frequently purchased for entertainment and information, over control or security. Second, home security providers need to quickly become smart home product and systems providers, with the option for monitored security, in order to maintain their position. Most households are yet to be automated, and home security providers must move quickly before the race is won by big tech companies and their device maker subsidiaries.