It may sound like a broken record, but it’s worth repeating: there’s no bigger opportunity in the global games industry than mobile. With billions of smartphones owned worldwide, the built-in audience for a mobile game that catches fire dwarfs that of PC or console. It’s a tantalizing prospect for the world’s biggest gaming companies, and it’s why AAA publishers like Electronic Arts, Take-Two Interactive, Activision Blizzard, Ubisoft and more have invested heavily in the space. For Microsoft’s Xbox team, the pending deal to acquire Activision Blizzard could be the key to unlocking this sizable market and vastly expanding the Xbox customer base.

Xbox chief executive Phil Spencer acknowledged that fact at The Wall Street Journal’s recent Tech Live conference. “This deal for us really centered around our opportunity to get more mobile engagement,” he noted, adding that Microsoft has ambition to loosen the Apple-Google grip on the market. “We have to break that duopoly of only two storefronts available on the largest platforms,” he said. “We have to find a way to create more engagement and monetization across mobile. It’s imperative for our business.”

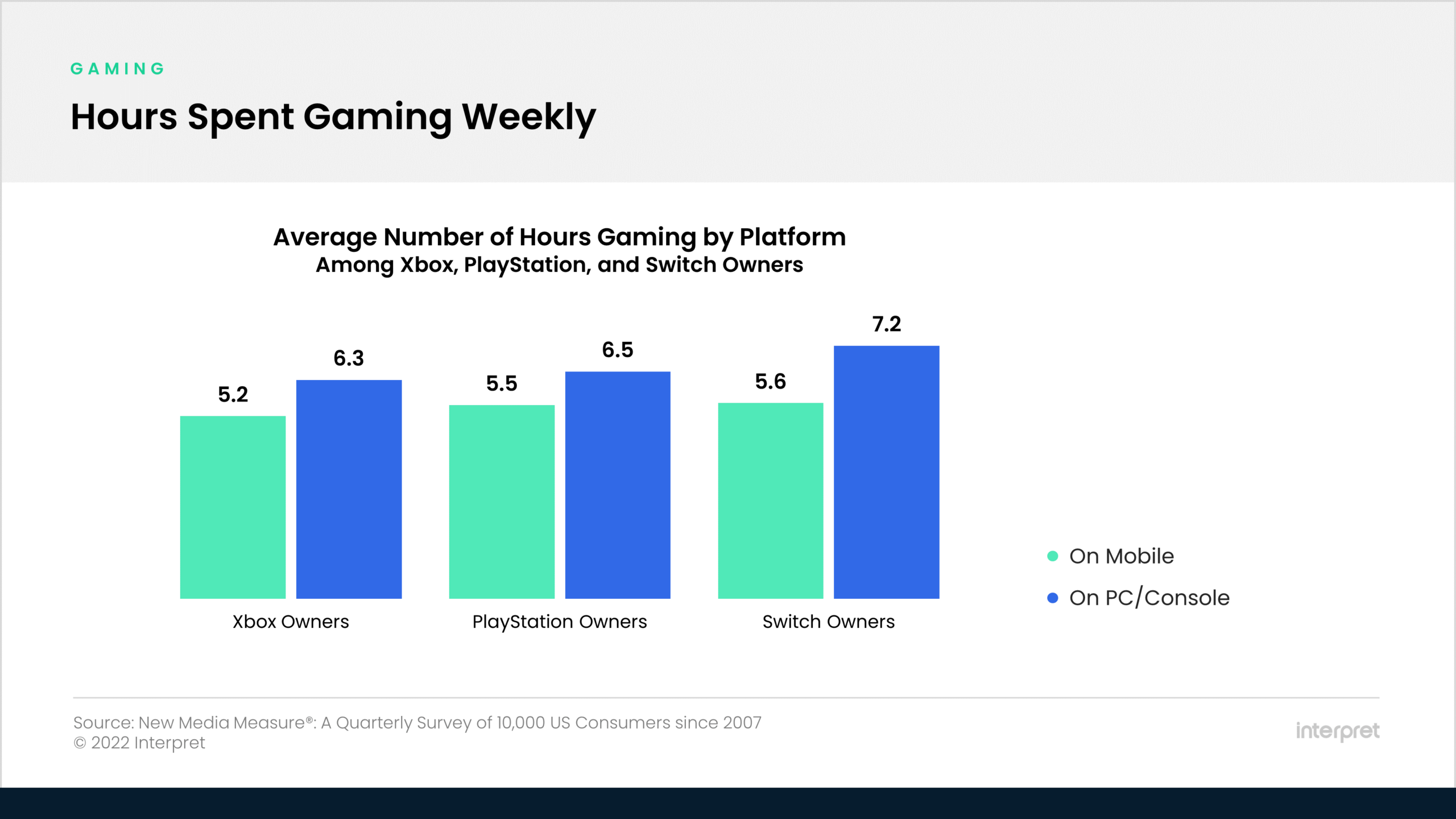

Interpret’s New Media Measure® shows that engagement with mobile gaming is lower among Xbox owners in the US than it is among either PlayStation or Nintendo Switch owners. That said, it’s a small difference and it’s likely that offering more Xbox branded content across mobile (aside from the ability to play Xbox games in the cloud on smartphones) would quickly lead to an increase in engagement that Spencer seeks.

Activision Blizzard’s portfolio – which includes King’s Candy Crush, Blizzard’s Diablo Immortal, Call of Duty: Mobile, and the upcoming Call of Duty: Warzone Mobile – would instantly make Xbox a mobile juggernaut. Call of Duty games alone have already generated $1.5 billion in revenues across mobile platforms. Moreover, mobile accounted for three-quarters of Activision Blizzard’s MAUs and a majority of the company’s revenues in the first half of 2022.

In fact, in its fight to justify the acquisition with the UK’s Competitive Markets Authority (CMA), Microsoft remarked that the “transaction will bring much needed expertise in mobile game development, marketing and advertising,” and “Xbox will seek to scale the Xbox Store to mobile, attracting gamers to a new Xbox Mobile Platform.”

And beyond the traditional free-to-play business model on mobile, it’s likely that Xbox would be able to grow its profitable Xbox Game Pass subscription business, which is already getting a strong push on both Xbox and PC. It’s such a focal point for the business that Game Pass growth is the only gaming-related performance target in the top Microsoft executives’ pay package. With games industry consolidation continuing, and fierce competition from global leaders like Tencent, Microsoft understands just how vital the mobile battle is becoming.

Ready to level up your career? Check out Interpret’s Careers page for current openings and join our squad of Fun Scientists!