With the advent of 5G home internet, mobile service providers like Verizon and T-Mobile are poised to put some competitive pressure on fixed broadband ISPs who have enjoyed near monopolies in many areas. The carriers are already reporting strong demand that is exceeding their expectations. Verizon is currently offering an attractive subscription price of $50/month and a sign-on bonus of $200 bill credit for its service touting “typical speeds of 300 Mbps.” If you don’t already have a Verizon mobile plan, the subscription is $70/month. With self-installable hardware, no monthly equipment fees or data overage fees, and credits for switchers facing early termination fees, mobile carriers are striving to make switching as easy as possible.

Smart home is often touted as a use case for 5G home internet, leaving many to wonder where, or if, it will figure into the product and service offerings of these carriers. Verizon is the most aggressive in its smart home product business, acting as a reseller for over 100 smart home products in its e-store. Smart home offerings include the most popular brands of smart speakers, Wi-Fi cameras, video doorbells and DIY security systems; Verizon also resells Amazon smart speakers and Ring Alarm systems through its special partnership with the tech giant. While T-Mobile’s e-commerce offerings do not include smart home devices, the company is reportedly testing a partnership with Vivint in some of its retail stores in California.

Device sales enable these telecom giants to pursue a fledgling smart home business until, or instead of, developing a more comprehensive smart home service offering.So far, neither carrier has demonstrated an appetite for developing a hardware and service offering such as Comcast and Cox have done on the fixed broadband side of the business. Perhaps AT&T’s final phase out announcement of its long-neglected Digital Life service provides a cautionary tale.

Still, mobile carriers enjoy many of the same business assets that have enabled some MSOs to succeed with smart home services: the convenience of unified billing, a common provider for bundled services, and sales, installation, and support teams. “The large customer base and combined sales efforts of ecommerce, telephone, and retail stores offer communication service providers of all kinds a potentially formidable role in the connected home,” said Brad Russell, Vice President at Interpret. “Services create a stickiness that can help reduce the churn of mobile deal chasers.”

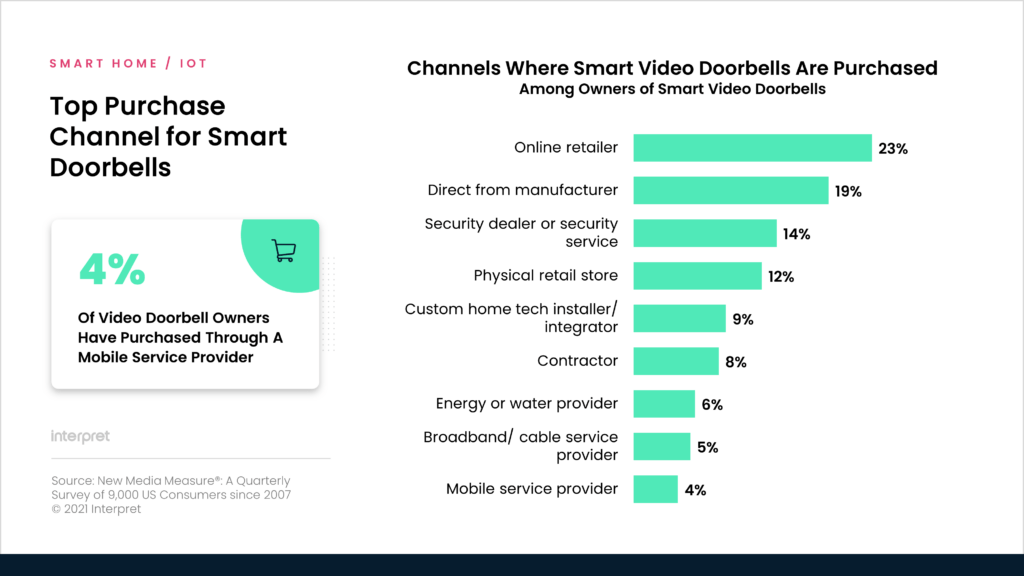

While Interpret’s Smart Home Matrix™ research data finds that mobile carriers only account for about 5% of smart home sales by product category, the majority of smart home consumers purchase from a wide variety of channels and are willing to switch channels.