While Spectrum and Comcast combined control around half the US broadband market, there’s a growing portion of the population looking to their wireless provider for home internet service. T-Mobile has pushed hardest in this sector of the market, and the company claims to be available to 40 million households in America compared to Verizon’s 5G home internet being available to about 30 million homes.

Verizon and AT&T both have far more widespread fiber-based home internet offerings, but the former clearly sees an opportunity to compete in the 5G home market with T-Mobile. At the recent Mobile World Congress event, Verizon unveiled its new home receiver, which automatically switches between mmWave and C-band 5G or 4G LTE to ensure its home internet users get the fastest signal.

The new Verizon Receiver was designed in partnership with Qualcomm, and the companies claim that upload speeds have been doubled – an especially important component for use cases like online gaming and video conferencing. Additionally, the new receiver is completely waterproof, enabling Verizon customers to have the device installed outdoors if they wish.

Verizon Home 5G costs $50 per month (when using auto pay) and is half that for Verizon’s 5G Unlimited mobile subscribers. The company is also incentivizing new customers with streaming perks like free Disney Plus and AMC Plus for a year. For its part, T-Mobile also offers a streaming bonus, providing one year of Paramount+ service to its home internet customers.

The acquisition of bands and deployment of 5G infrastructure has cost billions of dollars for the three leading wireless providers. In addition to gaining 5G unlimited plan customers, if Verizon and T-Mobile can generate further revenues through home internet access, that could help these telecoms offset the enormous 5G investment costs more quickly.

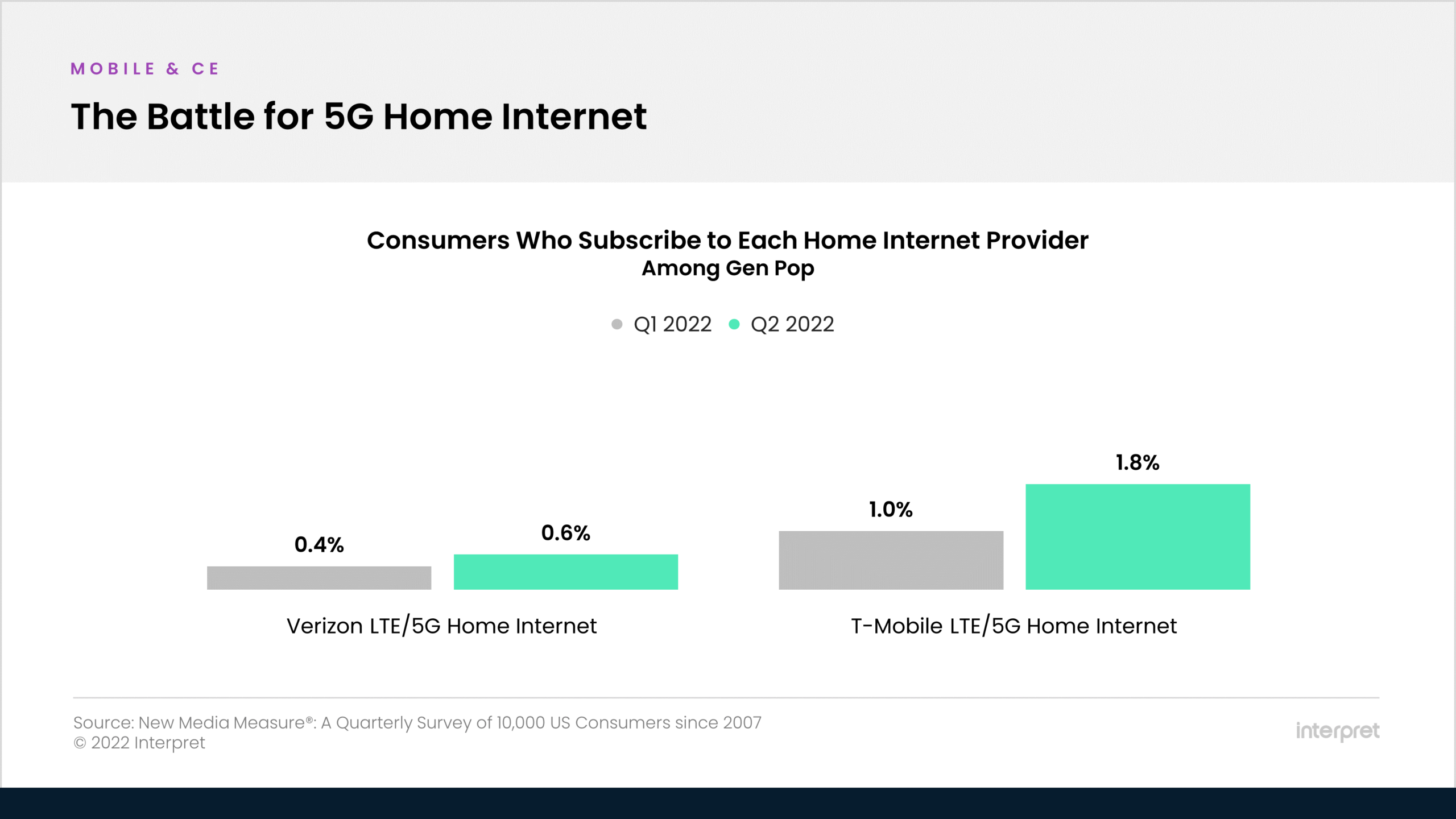

At the moment, Interpret’s New Media Measure® shows that both Verizon and T-Mobile home internet offerings comprise only a sliver of the overall US home broadband market, with Verizon just shy of 1% of consumers. T-Mobile has been pushing harder in this area to date and has grown quarter-over-quarter, further extending its lead over Verizon. It’d be easy to dismiss Verizon’s share as small potatoes, but over the course of a year, a few million customers paying $50 per month is still a multi-billion annual revenue opportunity – nothing to sneeze at.

“The next battleground for home Internet will be in the 5G space,” said Harry Wang, SVP at Interpret. “If 5G-based broadband wireless home internet services can match fixed broadband technologies (Fiber/DOCSIS 4.0) on throughput, latency, symmetrical speed, and QoS, the fixed broadband market will become much more competitive than it is today, which should be a boon for consumers who want high speed access at more affordable prices.”