With the holidays and a new year rapidly approaching, it’s a good time to examine the big trends that have impacted the games industry and key market participants. Below, in no specific order, we have outlined what we believe are five of the most impactful developments that have shaped the games business in 2021.

Publishers are increasingly shifting towards a live-service business model

As development costs for triple-A games continue to soar, game publishers are seeking to mitigate risk and increase revenue generation. The solution for many game companies has been to adopt a live-service model. GTA Online, which has been operating for seven years, has seen its player base grow 72% since 2019, and Red Dead Online grew 18% in Q1 as well.

The season-driven approach epitomized by Epic’s Fortnite has become a business strategy that most publishers now aspire too. Traditional game purchases now account for just 26% of Electronic Arts’ business, as content updates and microtransactions across franchises like FIFA and Apex Legends are generating the bulk of revenues.

Similarly, Ubisoft recently acknowledged that the upcoming Assassin’s Creed: Infinity would take the franchise completely into live-service territory. Ubisoft also said earlier this year that the company intends to put slightly less emphasis on publishing several triple-A games every year and will expand its business with “high-end free-to-play” titles; The Division: Heartland will be the first of these F2P games. Hugely popular F2P title Genshin Impact, which has generated over $1 billion, no doubt influenced the French publisher’s mindset.

The metaverse and UGC are driving the future of entertainment

Gaming experiences like Roblox, Fortnite, Minecraft, and others have become platforms unto themselves, leveraging user generated content (UGC) from aspiring developers and talented amateurs along with professionally created content. Entire studios, such as Israel-based Toya and Ohio-based Supersocial, have been built from the ground-up to take advantage of the nascent metaverse-like games currently on the market. Supersocial recently raised $5.2 million to pursue its content creation goals for emerging metaverses and called Roblox “transformative in democratizing the creation of games for a whole new generation.”

While game developers will always have a key role in creating immersive experiences, notable designers are coming to realize that part of offering a compelling game universe means handing the reins to fans at times. Jade Raymond of Assassin’s Creed fame announced that her new studio, Haven, would focus on social elements and UGC as key parts of the studio’s first project. “How do we create an IP that has that depth, but it is designed to be owned by the fans from the start?” Raymond asked.

Publishers and startups alike are looking at how they can leverage the UGC trend. Overwolf, a startup that looks to help creators building games for platforms like Roblox and Minecraft, recently launched a $50 million “Creator Fund” to help in-game content creators monetize their hobby. In September, leading publisher Electronic Arts announced its own Creator Network, a platform that EA is planning to utilize as it seeks to support and create opportunities for UGC creators within EA titles.

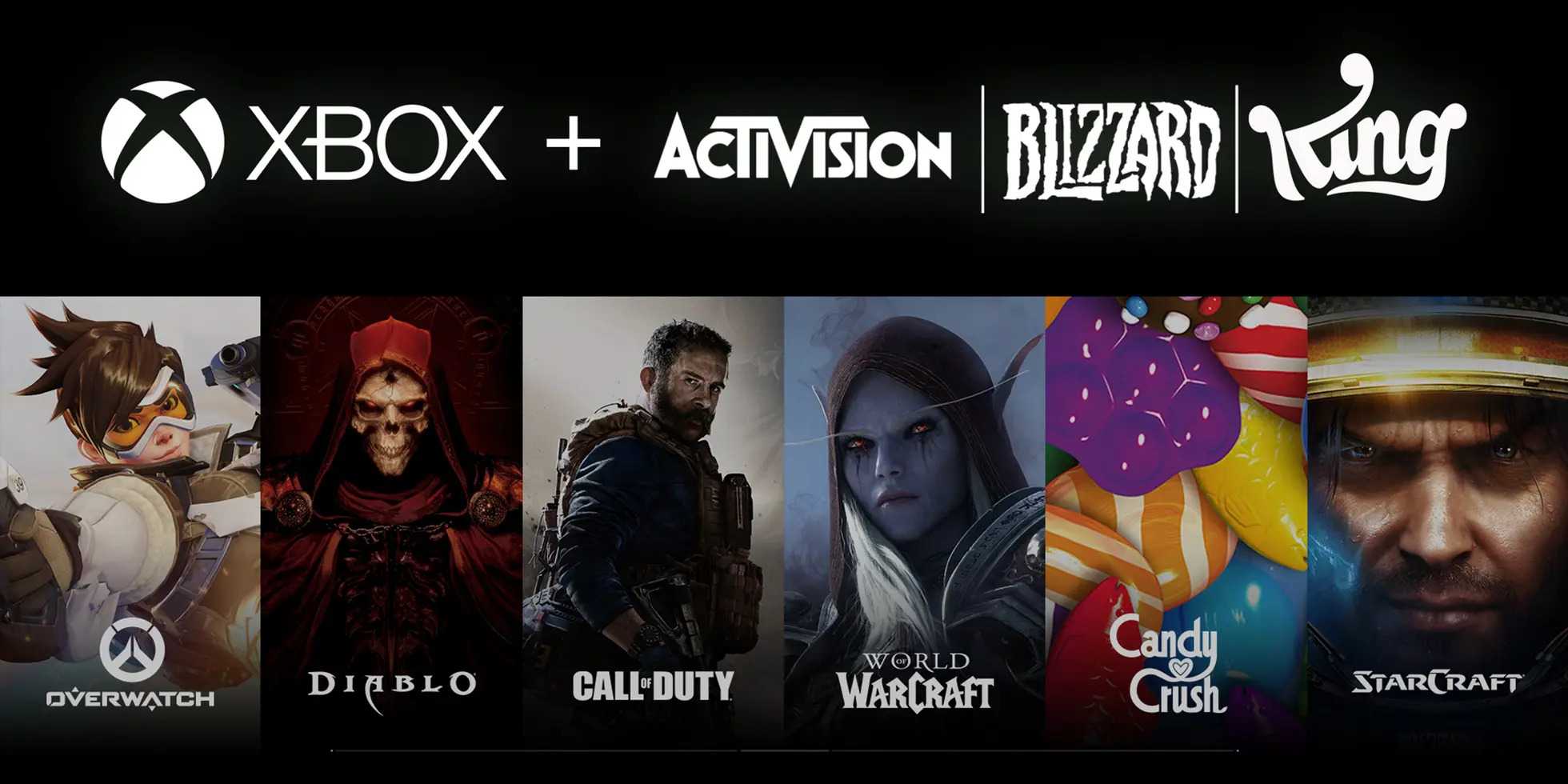

A wave of consolidation is sweeping the industry as big companies flex their muscles

2021 has been awash in major M&A activity among leading game firms, who are acquiring studios or other publishers to improve their capabilities and meet ever-growing demands from the gaming audience. Here are just a few of these mega deals:

- Electronic Arts acquired racing game experts Codemasters for $1.2 billion, mobile publisher Glu Mobile for $2.4 billion, and Playdemic for $1.4 billion.

- Epic Games purchased Fall Guys outfit Tonic Games Group and Rock Band creator Harmonix.

- Zynga picked up Echtra Games, ByteTyper, and monetization firm Chartboost.

- THQ Nordic parent company Embracer Group bought Gearbox Software for $1.3 billion in addition to numerous other studios.

- Chinese tech giant Tencent bought Sumo Group for $1.3 billion and a majority stake in Swedish developer Stunlock Studios.

Ultimately, what we’re seeing is that game companies are identifying any strategic gaps in their portfolio and fixing them with cash. That said, some firms may be better served by patiently waiting to strike since the red-hot market drives up valuation and lowers ROI.

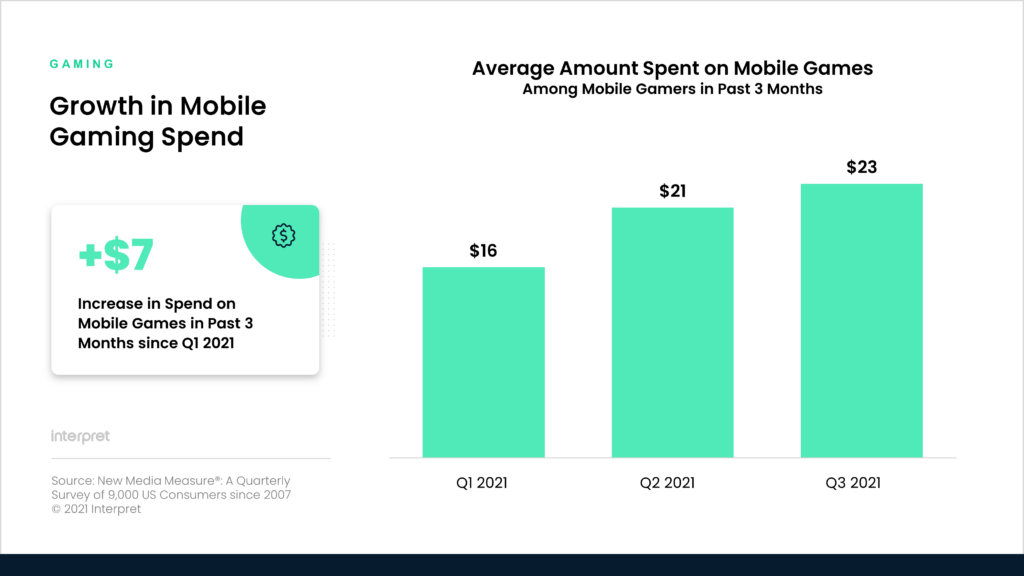

Mobile gaming is surging, but consoles remain incredibly important in Western markets

Mobile has long been a vital gaming platform across Asia, but the rise of Fortnite, PUBG Mobile, Call of Duty: Mobile, Wild Rift, and others has attracted more core and mid-core players to mobile in the West. With CoD: Mobile generating over $1 billion in revenues by May, Activision quickly recognized mobile as its “biggest opportunity,” and it intends to bring all its IP to mobile over time.

EA, too, sees mobile as its fastest growing segment, which is why the publisher made sure to invest in companies with mobile expertise, purchasing both Glu Mobile and Playdemic. EA Mobile’s net bookings in Q1 FY22 were $272 million, up 20% year-on-year, and there’s no sign of the mobile games industry slowing down.

It’s worth considering that mobile gaming also benefitted from the pandemic, as mobile is typically an entry point for young players – Interpret data shows that among parents of children ages 3-12 in the US who purchased a mobile game, 47% spent more in 2020. And in 2021, the amount spent during a three-month period among mobile gamers has steadily increased each quarter.

At the same time, demand for new consoles and the Nintendo Switch continues to be exceedingly strong in the US, as the market is not a zero-sum game. Sony says its PS5 release was its “biggest console launch ever” and as of October, nearly 14 million units had been sold, while Microsoft notes that the response to its Xbox Series X/S has been “overwhelming.” Meanwhile, Nintendo has sold over 92 million Switch units and demand this holiday is being driven by the new OLED model.

The rise of NFTs has led to the emergence of the “play-to-earn” model

Blockchain tech and cryptocurrencies have been around for years, but in 2021, crypto was finally normalized thanks to support from giants like Tesla, Apple, Google, and others. As crypto surged, non-fungible tokens (NFTs) took off as well, revolutionizing digital sales and fueling venture capital interest. Stakeholders in games have taken notice, but the segment remains polarizing. Valve/Steam bans games using blockchain technology or allowing gamers to exchange NFTs with cryptocurrency, the Chinese government announced a ban on cryptocurrency use in the country, which has caused huge volatility in cryptocurrency’s value, but Epic Games and EA have both been supportive of NFTs and blockchain in general.

One key impact of the NFT boom on games has been the emergence of a “play-to-earn” model, which financially rewards every user who adds value by playing and spending time in the gaming ecosystem. Games supporting NFTs and a play-to-earn model operate their store more like a marketplace. Gamers can not only purchase but also trade virtual items as NFTs. They can earn cryptocurrencies with values determined by trading prices on crypto exchanges rather than game developers’ own rules.

Indie studios have been more aggressive with NFT gaming than big publishers beholden to shareholders. A good example is the Pokémon-inspired game Axie Infinity, developed by Vietnam-based studio Sky Marvis, which reportedly has attracted more than one million active players. Andreessen Horowitz partner Arianna Simpson sees NFT-based Axie as “just the beginning” as making money through games will be “baked into coming generations.”