Following a year in which esports was thrust into the spotlight while traditional sports were on hiatus amidst a pandemic, 2021 was supposed to represent a return to normalcy, but the coronavirus put paid to those plans. Esports had its ups and downs in the last year, but here are five of the key takeaways we observed.

The most successful esports orgs have evolved into lifestyle brands

The irony of the esports business is that, so far, no organization is making a lot of money through competitive gaming. Even Riot’s League of Legends Esports circuit, the most popular in the world, remains an unprofitable venture. And while that may be acceptable for big name publishers who leverage esports for marketing, it’s a source of consternation for esports teams worldwide.

The answer for the teams who have found success has been in content creation and a larger entertainment/lifestyle culture push. TSM FTX, 100 Thieves, NRG Esports, Cloud9, Team Liquid, FaZe Clan, and others have excelled at drawing sufficient eyeballs to garner major non-endemic sponsorship. FaZe Clan, which is going public next year in a massive $1 billion SPAC deal, makes roughly 80% of its revenues through sponsored content creation and merchandising, not competitive gaming.

As FaZe CEO Lee Trink acknowledged to Forbes, his org is exploring “the outer reaches of what gaming can be.” NRG CEO Andy Miller thinks similarly, noting that focusing on a team’s performance as a metric of success is “a long way off,” adding, “There’s not going to be one thing in gaming making you money.”

Sports-esports relationships got deeper for clubs and athletes

If there’s one upside to the pandemic’s impact on the traditional sports world, it’s that it led many leagues and teams to reassess their relationship with their fanbase and how esports can be a part of their ongoing strategy to connect with a younger audience. Traditional leagues have been contending with an ageing audience for years; even in 2016, the average ages of NHL, NFL, and MLB fans were 49, 50 and 57 years old, respectively, according to Sports Business Journal. By contrast, Interpret data shows that a typical esports fan is in his/her late 20s and is relatively affluent, with 30% of esports fans reporting an annual income greater than $100,000.

We’ve seen numerous traditional sports clubs suddenly show tremendous interest in esports. Esports Entertainment Group (EEG) has been a leader in this category, becoming a shareholder in the Philadelphia Eagles and further expanding its roster of NFL teams to include the Tampa Bay Buccaneers, Baltimore Ravens, LA Chargers, Denver Broncos, New England Patriots, and more. Beyond the NFL, EEG has also secured deals with teams from the NHL (New York Rangers), Major League Soccer (Los Angeles Football Club), NBA (Cleveland Cavaliers), and the Premier League (Arsenal).

Celebrity athletes have also looked to esports to grow their personal brands. Miami Heat’s Meyers Leonard, New Orleans Pelicans’ Josh Hart, Sacramento Kings’ De’Aaron Fox, Minnesota Twins’ Trevor May, NASCAR’s Dale Earnhardt Jr., and many others have enjoyed a livestreaming presence; Leonard enjoys livestreaming so much that he spends most of his offseason doing so and he made an investment last year into FaZe Clan. The sports-esports crossover shows no signs of slowing down.

Mobile esports is expanding around the globe

The mobile esports scene has been growing rapidly, especially across Asia, Southeast Asia (SEA), India, and Brazil, driven by titles like Arena of Valor, Mobile Legends: Bang Bang, Free Fire, PUBG Mobile, and more recently, LoL: Wild Rift. Mobile esports are so popular in Asia that they will be included in the 2022 Asian Games alongside PC/console esports.

The vibrant mobile esports market in Asia has played a part in the sports-esports crossover discussed above, attracting clubs like UK football team Wolverhampton Wanderers, who have entered their Wolves Esports org into the King Pro League, and French football club PSG, who launched a roster for Mobile Legends: Bang Bang back in 2019.

In the Western hemisphere, Brazil has emerged as a mobile esports hotspot, driven largely by Garena’s Free Fire, while Mobile Legends and Wild Rift are gaining steam as well; Western esports orgs like TSM FTX and Team Liquid have begun competing in the LBFF (Liga Brasileira de Free Fire). Additionally, tournament organizer ESL recently launched a dedicated mobile esports ecosystem and sees the prevalence of smartphones opening esports “to a diverse audience, irrespective of skill level, where anyone can go from zero to hero.”

Ultimately, publishers are increasingly allocating resources to mobile games that could become popular esports; aside from the aforementioned Wild Rift from Riot, Electronic Arts has been looking to leverage esports around Apex Mobile and FIFA, Psyonix has released a mobile Rocket League, Activision Blizzard has said that mobile remains its “biggest opportunity,” and Ubisoft is reportedly considering mobile versions for many of its titles, including Rainbow Six Siege.

Students and colleges are recognizing opportunity in esports

With esports continuing to gain momentum worldwide, the number of schools, colleges, and universities offering esports activities and curriculum has been accelerating as more students are seeking entry into the esports industry, or simply to have esports as an extracurricular activity with peers; as a consequence, there have been a number of organizations popping up to help connect students with scholarship programs or to help esports clubs find up-and-coming talent.

In the Philippines, for example, AcadArena was formed to operate campus esports for schools and to help students gain access to industry professionals while developing the necessary skills to eventually gain a career in the industry. In the US, North Carolina-based Stay Plugged IN (SPIN) launched a recruiting platform for esports college scholarships, designed to connect students and collegiate esports programs while boasting “millions of dollars in college esports scholarships annually.” Meanwhile, the nonprofit National Association of Collegiate Esports (NACE), founded in 2016, now has more than 170 member schools along with $16 million in esports scholarships/aid.

BeRecruited, which claims to be the “largest college recruiting network, serving more than 2 million high school athletes,” also recruits for collegiate esports programs and offers guidance for athletes, parents, and coaches in the esports space. And earlier this year, EFuse raised $6 million, positioning itself as the “LinkedIn for Gamers,” which not only helps esports amateurs network with other gamers, but is purpose-built to help its users build a profile, show off their highlight reel, and potentially connect them with over 24,000 scholarships, internships, and job postings across gaming and esports.

Colleges and universities are increasingly onboard with esports because they recognize that competitive gaming has the ability to be transformational to their bottom line just as traditional sports have been for decades – esports can be leveraged as a recruiting tool, a marketing tool, and over the long-term as a way to generate a new steady stream of revenues.

Women and older gamers are helping drive esports viewership growth

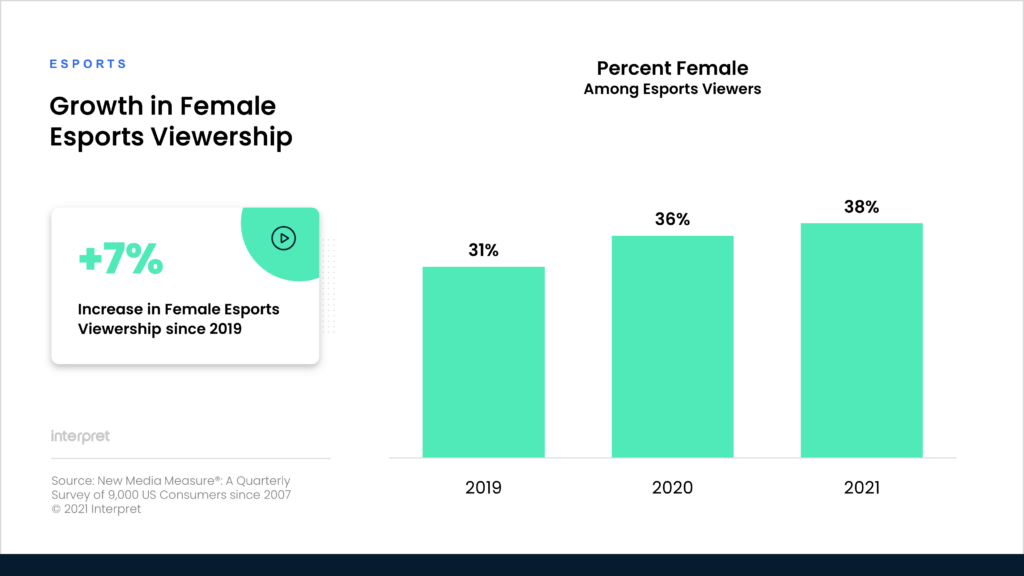

As the gaming and esports industries push for greater diversity and inclusion, it’s encouraging to see that market growth – from a viewership perspective – has been fueled by women and older players as opposed to the more stereotypical “gamer” in the 18-35 male demographic. In fact, looking at League of Legends Esports, Interpret data shows that women under 35 saw the biggest viewership gains year-over-year (17% to 22%) whereas men under 35 actually decreased seven percentage points to 30%.

With nearly one in five Americans now watching esports content, women account for nearly two-fifths (38%) of esports viewers, up from 31% in 2019. Esports leagues and orgs increasingly are recognizing that representation matters, and it’s going to be critical to the esports business in the long-term. Riot Games’ Valorant has been front-and-center in this D&I movement. At the end of February, Riot launched the VCT Game Changers program to generate new opportunities for women and other less-represented groups in the esports space. Throughout the year, numerous orgs launched women-led teams, including G2 Esports, TSM, Cloud9, Team Liquid, and others. As Team Liquid observed on Twitter in March, “There are more women in esports today than ever before.” That’s great news for the esports industry as a whole. For esports orgs to survive, they must attract a wider variety of brands, and the only way to achieve that is through broadening the audience.