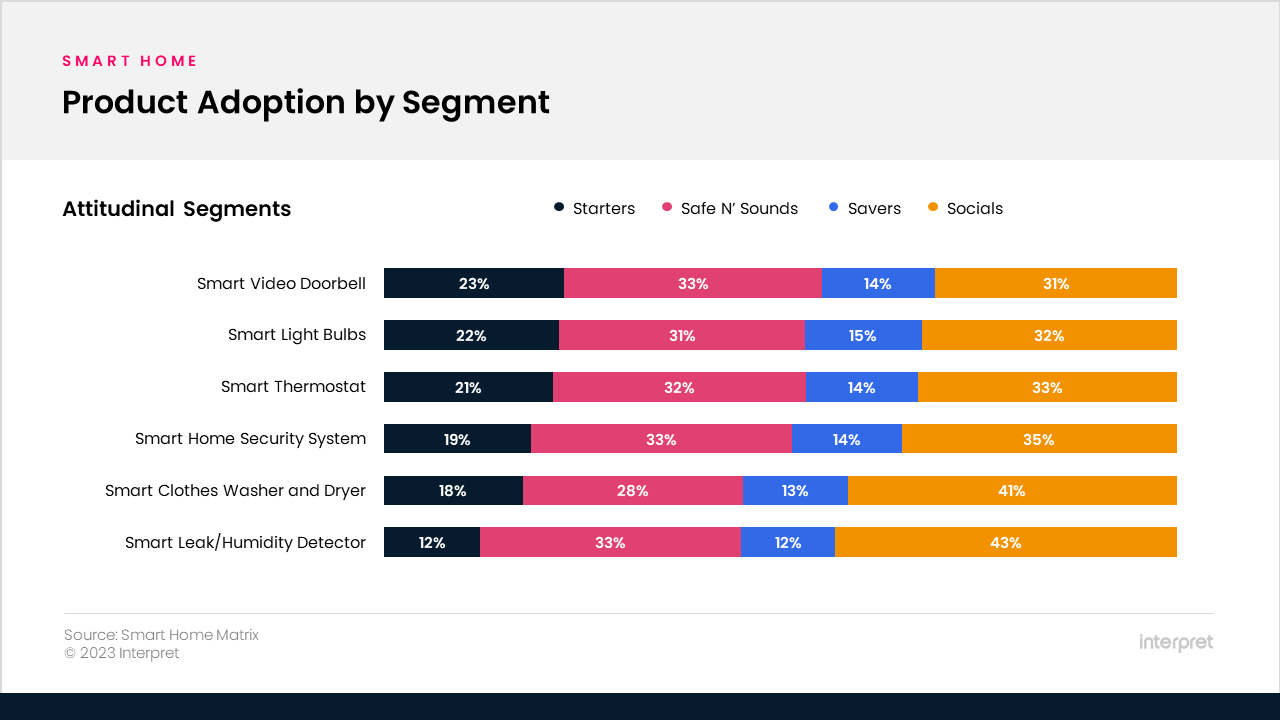

The past several years have seen unprecedented growth for smart home products, driven in large part by strong enthusiasm for doorbell cameras, Wi-Fi networked cameras, smart home security systems and smart lighting. Many of these products are now owned by nearly 20% of US consumers, according to Interpret data. For the blockbuster device makers and the makers of less often adopted products, what is the next step in product promotion? Identifying and addressing important consumer needs is the path to wider adoption.

Interpret’s consumer segmentation of US adults draws on over 50 attributes, including lifestyles, values, benefits sought, and concerns. The segmentation identifies groups of potential buyers of smart home products with common attitudinal traits so that vendors can optimize their sales and marketing strategies and craft engaging messages that address inherent interests and attitudes. By applying the segmentation, vendors can engage potential buyers on their most important value propositions and optimize marketing messages.

- “Starters” are younger adults who are tech friendly and less price sensitive; they are interested in securing their homes and likely to purchase doorbell cameras and smart door locks.

- “Safe N’ Sounds” are the largest segment, mostly married and own a home, have the most fear of intrusion and are likely to purchase security systems.

- “Savers” are the oldest segment and have the lowest income; they often live alone, are tech averse, price sensitive, and are likely to purchase smart thermostats and smart light bulbs.

- “Socials” are the youngest group with the largest households and seek convenience and healthy living; they are likely to own smart appliances and smart lighting.

As smart home device manufacturers increase their presence in US homes, aligning product messages with key attitudes is critical to selecting the proper channels, bundles, and pricing. Interpret’s Brand Segmentation Audit enables companies to better understand their buyers and compare their brand’s engagement to competitors. For more information, contact Interpret.