Lockdowns and social distancing have presented marketing executives with new challenges – but as the saying goes, when there’s a crisis, there’s opportunity. For music streaming service Spotify, even though ad spending has seen a downturn, the platform has witnessed an evolution in usage patterns while people stay at home.

Streaming music has long been popular during commutes to work, but now with most people working remotely, Spotify is often playing in the background during work, chores, or general relaxation periods. As of Q1 2020, the company’s paid subscribers have jumped 31% year-over-year to 130 million while monthly active users have also risen 31% to 286 million. This puts Spotify ahead of Apple, Amazon, Google, and Pandora in the $11 billion global music industry (almost half of which is driven by streaming).

A key differentiator for Spotify has been an increasing focus on podcasts, and exclusive deals with Joe Rogan, Kim Kardashian, and DC Comics. Earlier this year, Spotify revealed its targeted ad solution for podcasts, Streaming Ad Insertion, bringing it a step closer to becoming a podcast ad network. Nonetheless, it’s worth noting that Spotify users are generally resistant to ads; according to Interpret’s New Media Measure®, 69% of users skip ads whenever possible and 56% seek ad-free content, suggesting the onus will be on Spotify to ensure highly relevant ad content so as to not upset their listening base.

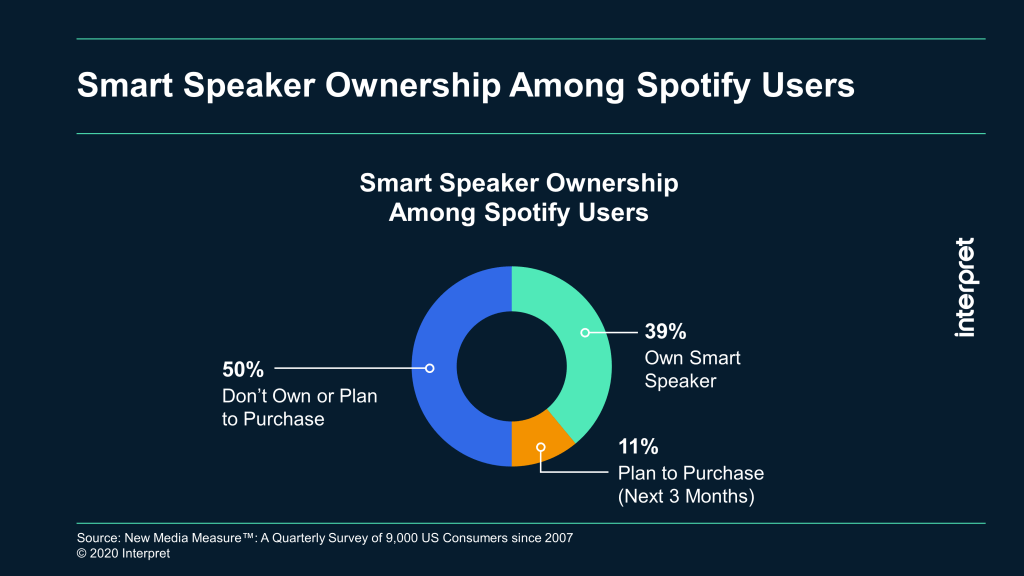

As part of their ad strategy, Spotify has wisely latched onto the smart home trend. The company unveiled its first voice-activated ad in June, for Nars makeup, which enables voice-activated delivery of makeup samples to listeners’ homes. New Media Measure shows that half of Spotify users either own or soon plan to purchase a smart speaker.