A recent poll by Android Authority finds that 87% of its readers own one or more smart home products. Only 5% own one product, and a whopping 71% indicate owning five or more products. Among the website’s tech enthusiast readers, some report that once you start owning smart home devices, you can never go back, leading to devices in every room. One reader cites owning so many products that when he says, “Hey Google, turn off everything,” the smart voice assistant proceeds to shut down 107 devices.

Unsurprisingly, these readers own devices from a large, diverse list of brands, controlled through common hubs including Samsung’s SmartThings and Logitech Harmony remotes. But even enthusiasts encounter frustrations. One owner of half a dozen devices reports having to reset smart speakers and smart lighting regularly and having to be in the room when his robo vacuum is working for it not to get stuck.

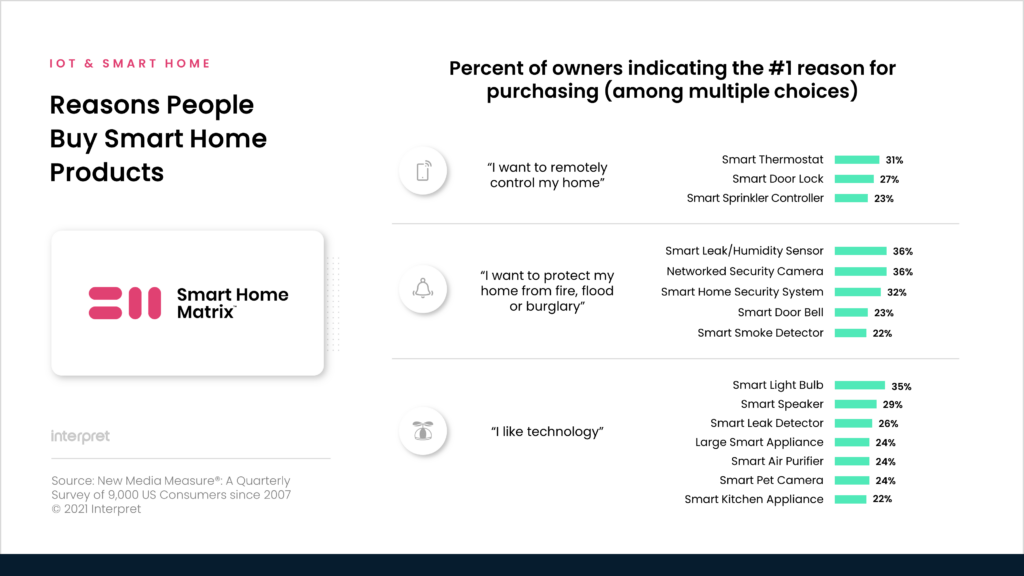

Interpret’s Smart Home Matrix™: Consumer study reveals that over half of all US consumers, ages 18 to 65, report owning one or more smart home products. When examining the primary driver for owning specific products, consumers’ answers range from a desire to secure their home and protect their loved ones, to remotely controlling home systems, or simply because a buyer likes technology.

“Despite the large percentage of people owning smart home products, the market remains extremely fragmented,” says Stuart Sikes, Senior Vice President at Interpret. “This is one of the few spaces in consumer technology in which one dominant player does not own a majority of customers. Google, Apple, Amazon, and Samsung are all megabrands that dominate consumer electronics, yet no one has carved out a large share of the smart home market. While the lack of a dominant player may be seen as good for innovation, it has led to lower growth of the category.”

Currently, Amazon’s Ring and Echo and Google’s Nest have taken a large share of specific products, but there’s still plenty of room for growth. As manufacturers continue to conform to new standards such as Matter, Interpret expects the category growth rate to increase.