For over a decade, telecom and cable TV providers including AT&T, Comcast, Cox, Charter, Time Warner, Verizon, and others have made forays into the home security and home automation markets. Likewise, energy providers continue to offer smart home solutions, some designed to monitor and manage energy consumption, and some to provide home security solutions. Many of these ventures have been on again, off again, as few service providers have had the patience to wait for consumers to embrace smart home solutions.

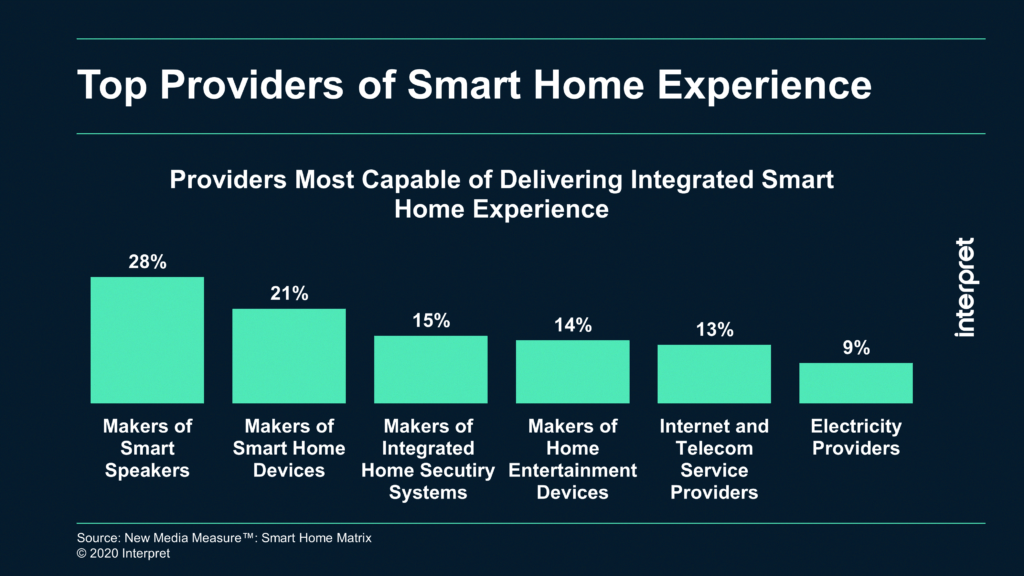

Interpret’s Smart Home Matrix® asks consumers who believe that device interoperability is important to identify the providers they believe are most capable of providing an integrated smart home experience. At the top of consumers’ expectations for integrated experiences are makers of smart speakers – Amazon, Google and, presumably, Apple. Just behind smart speaker vendors are the makers of smart home devices, which, again, include Amazon and Google. In third place are makers of integrated smart home security systems, and entertainment device makers are just behind security systems providers.

“Consumers are responding to the positive experiences they are having with DIY speakers and smart devices,” said Stuart Sikes, Interpret’s SVP. “Security providers, energy providers, and telcos have not been as capable of creating the all-important cool factor that smart device companies have mastered, combining low prices with functionalities never before attainable without an expensive installation or long-term contract.”

Many security and energy providers are taking advantage of consumer enthusiasm for popular smart home devices, incorporating smart speakers and other popular smart home devices, including smart doorbell cameras, into their integrated systems solutions. This hybrid approach of mixing branded components with Amazon Echos, Google Nest Cams, and Ring doorbells enables integrated smart home security systems vendors to ride the wave of consumer fascination, leveraging the rising popularity of smart devices to sell long-term contracts for systems and monitoring services. Smart home device makers and integrated smart home security systems providers will continue to work together more closely as device makers want a piece of the nearly $50 billion U.S. home security systems market, and home security systems providers want to follow in the wake of rising smart home device popularity.