At the height of the COVID-19 pandemic, as gyms closed and people looked to exercise at home, Peloton soared. Much like gaming, video streaming, and other home-based activities, exercising with smart fitness equipment and/or fitness program subscriptions became a focal point for the health-conscious consumer. Peloton’s revenue more than doubled from $714 million in 2019 to $1.82 billion in 2020. That momentum carried into 2021, as the firm generated over $4 billion in sales.

2022 has been a different story, however, as more consumers are returning to gyms and exercising outdoors. Peloton’s fiscal year ended in June brought in $3.58 billion in revenue and marked six consecutive quarterly losses. Consequently, Peloton made the tough decision in early October to lay off 12% of its workforce, which came primarily from the marketing department. The move coincided with Peloton’s global marketing chief leaving to take a role with Autodesk.

But marketing experts are concerned that Peloton’s cuts are coming at precisely the wrong time. Like many entertainment companies, Peloton has been increasingly shifting its business to focus on software and services. And with inflationary pressures, many consumers are going to be less inclined to shell out hard-earned money for an expensive piece of fitness equipment.

In a market where big brands like Lululemon and Tonal are stressing the services they offer, and tech giants like Apple are diving in with subscriptions like Apple Fitness+, Peloton needs to leverage marketing to communicate its value proposition. In the world of cycling or spinning, where Peloton has previously excelled, the company is also facing new competition from Zwift, which just recently entered the hardware game with an affordable smart bike trainer tied to its popular Zwift service that’s even held esports competitions.

“Peloton needs to tell its story. They have to sell a concept, especially given the recent pivot to ‘experiences’ versus selling equipment. To do that well, it needs a focused marketing team,” Allen Adamson, co-founder and managing partner of marketing agency Metaforce, explained to Adweek.

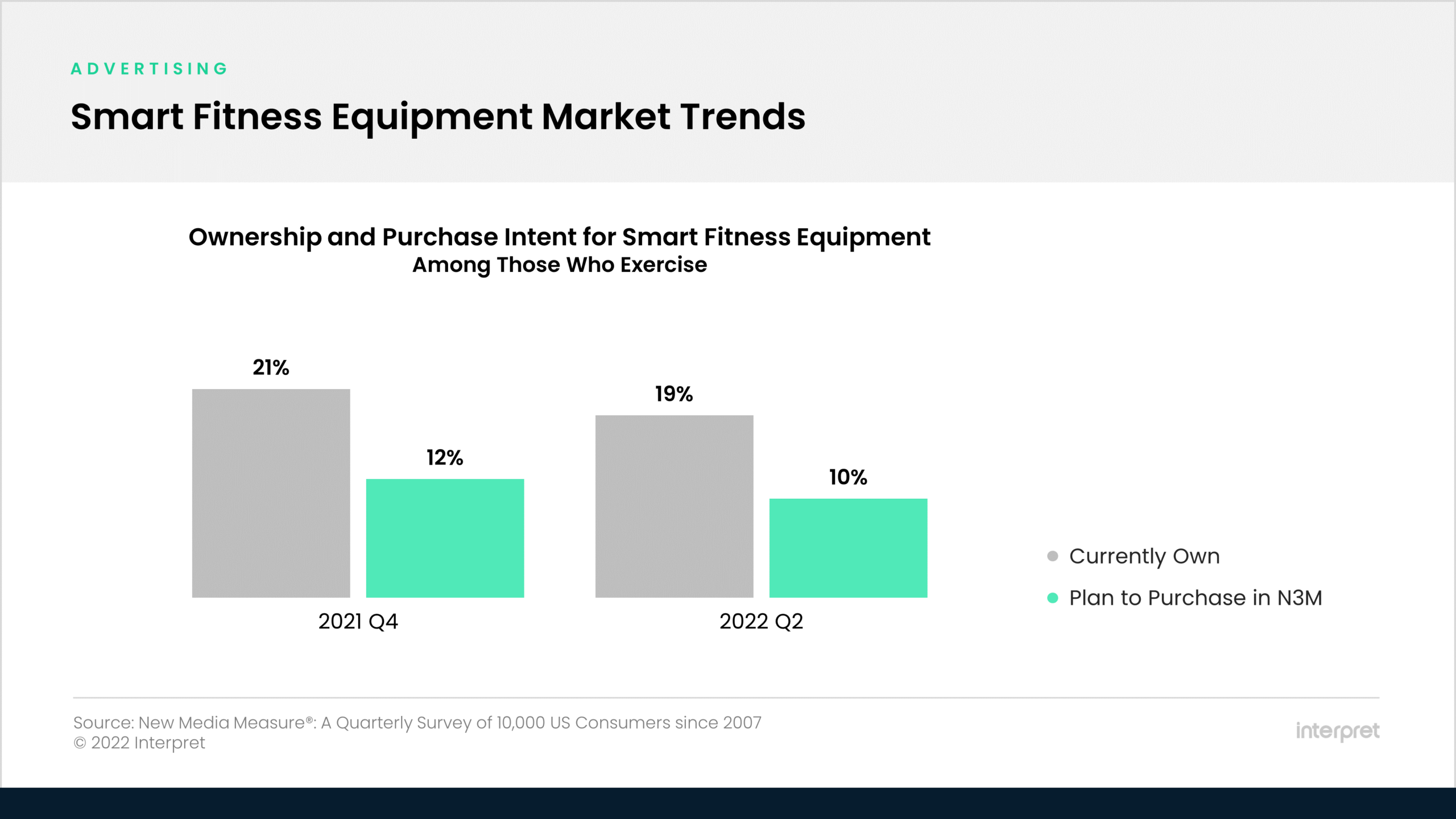

The good news for Peloton is that its efforts to transition to services have been working. The fourth quarter was the first in which higher-margin subscription revenue accounted for the majority of the company’s sales. And according to Interpret’s New Media Measure®, the market trends appear to signal that Peloton is taking the right approach, as during the past six months in the US, smart home fitness equipment ownership and intent to purchase have both been declining among those who regularly exercise.