As climate change has become a chief concern for many, especially as floods and wildfires have devastated lives, brands are doing their part to cut their carbon footprint and operate more sustainably. Leading fast-food chain McDonald’s recently announced that by 2025 it would aim to source 100 percent of its guest packaging from renewable, recycled, or certified sources and to recycle all packaging used by customers in its restaurants.

Additionally, the company said that the plastics used in its popular Happy Meals toys would be replaced largely by cardboard or plant-based plastics. The goal is to reduce its reliance on virgin fossil-fuel-based plastic for its toys by 90 percent.

For the last 40-plus years, McDonald’s has been selling Happy Meals with small toys in the box. It was a smart marketing move to get children excited about coming to the restaurant while providing parents with a distraction for their kids when sitting down in a public place.

What many didn’t consider back in 1979 when McDonald’s first introduced the concept was just how much plastic would be produced in the process. McDonald’s sells around one billion toys through its Happy Meals annually, which amounts to an enormous volume of plastic each year, contributing to an ever-growing stockpile on the Earth – only 9% of plastic waste ever used has been recycled.

As the generation that will be facing an environmental crisis head-on, today’s kids are becoming acutely aware of the situation. According to Ann Murray, VP of Global Marketing at McDonald’s, the fast-food chain heard the message not just from parents but directly from kids. “They’re worried about the planet, they’re worried about animals, they’re worried about climate change,” she told Adweek.

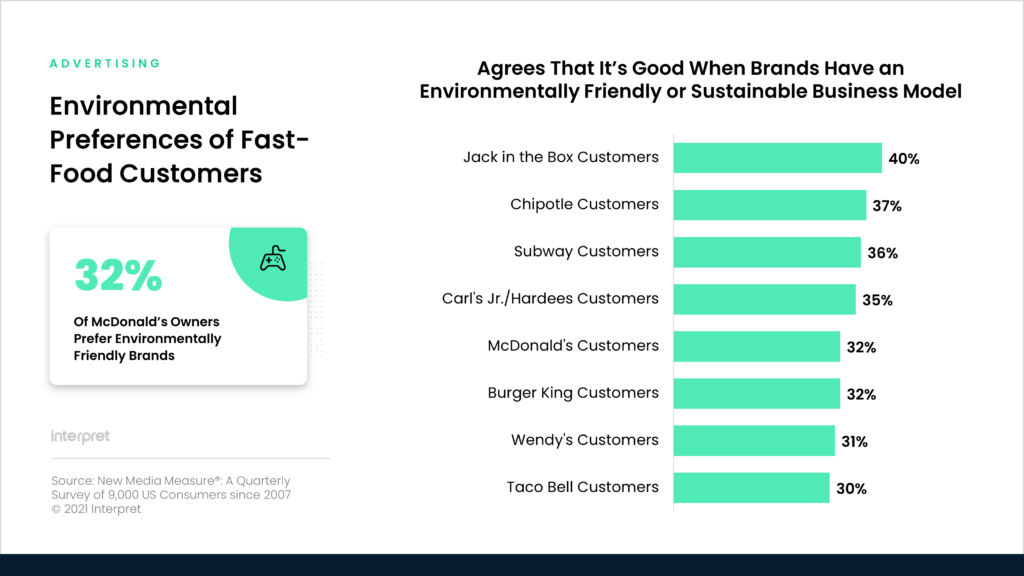

Interpret’s New Media Measure® shows that nearly a third (32%) of McDonald’s patrons in the US agree that it’s good when brands have an environmentally friendly or sustainable business model. That puts McDonald’s ahead of Taco Bell (30%) and Wendy’s (31%), and ties it with rival Burger King, but the chain remains behind Carl’s Jr./Hardees (35%), Subway (36%), Chipotle (37%), and Jack in the Box (40%). These numbers are likely to increase across the board as more young people gain discretionary income; marketers would be wise to plan their messaging accordingly.