In the span of just three years, India’s grown from a small esports market into one that’s gaining traction quickly. At the end of 2017, Dreamhack Mumbai became the first international tournament hosted in the nation, and in 2018 that was quickly followed by ESL One Mumbai, Dreamhack Delhi, and COBX Masters. By 2019, prize pools paid by Indian tournaments had jumped 180% to $1.5 million.

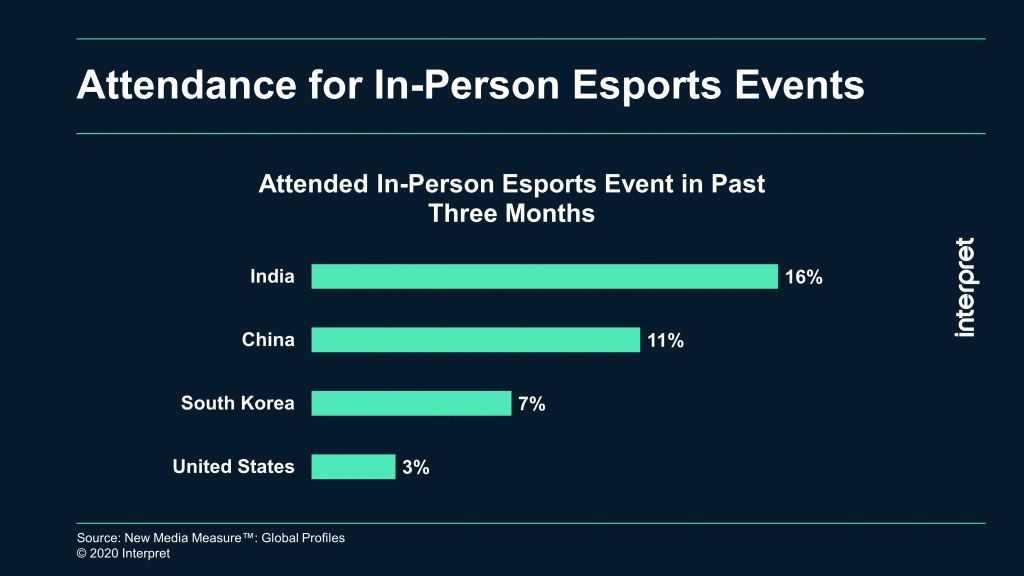

While other parts of Asia – most notably, China and South Korea – have long been leaders in esports, India’s ascension should not be ignored. In fact, according to Interpret’s NMM: Global Profiles®, the esports audience in India appears to be more engaged than in other parts of the world, with 16% of respondents indicating that they participated in tournaments in-person (pre-COVID), compared to 11% of people in China, 7% in South Korea, and 3% of respondents in the U.S.

India’s increasing focus on esports is due in no small part to Tencent’s PUBG Mobile, which is hugely successful in the country, and esports organizations like Nodwin Gaming, which claims to be thriving during the pandemic. As the market has grown, it’s also managed to attract big name esports teams like Fnatic and Team SoloMid.

Unlike the western hemisphere, which has an affinity for game consoles, the primary gaming platform for most people in India is the smartphone. India is the second largest smartphone market in the world, and mobile is expected to generate 85% of all gaming revenues in India this year. Combining the prevalence of smartphones with the rise in mobile esports – driven by the likes of Free Fire, Call of Duty: Mobile, Clash Royale, and of course, PUBG – makes India an esports market ripe for explosion.