Since before Google’s acquisition of Nest in 2014, the smart home and home security industry has often wondered if Big Tech would displace the incumbents. Speculation has ranged from Google and Amazon completely supplanting the incumbents, to the tech behemoths having no impact on the industries that heavily rely on in-home installer/dealers. Eight years later, the answer lies somewhere in the middle. The product of Google’s $450 million investment in ADT in 2020 is yet to be released but promises to combine leading-edge AI with old-school home services.

Many industry analysts expected the rise of do-it-yourself (DIY) home security products, including doorbell cameras, outdoor cameras, and contact sensors to eat the lunch of professionally installed security systems. Instead, the professional security channel has enjoyed robust growth over the past few years. Both the professional systems channel and the DIY device makers have prospered – fueled, in large part, by the global pandemic.

Big Tech players, including Amazon and Google, but not ruling out Apple, Meta or even Microsoft, could easily acquire the leading home security systems providers and their customer bases and networks of dealer/installers. One might speculate the reasons that these acquisitions have not occurred include potential anti-trust actions or misalignments of company cultures. To imagine how Big Tech will increase its hold on the connected home, it is important to consider what we know to be true about these companies and the industry:

- While DIY offerings are growing, many customers are not interested in DIY. Professional installation inside the home remains important. Amazon’s Home Services provides in-home tasks for hire and Google’s investment in ADT gives it access to the largest home security installer/dealer network in the US.

- Big Tech has sold millions of smart speakers, cameras, thermostats, and doorbell cameras into the home, but has mostly followed a business model of selling products one time. These companies are yet to move to a model that is primarily based on monthly subscriptions.

- Differentiating smart home features are provided mostly by cloud-based AI. Big Tech, for the most part, controls the cloud and is adept at cloud-based AI.

- Edge computing is on the rise in smart home products, reducing reliance on the cloud and making transactions more secure while requiring more powerful processors in devices.

- The home network can easily become a service platform for many other services, including the neighborhood (Amazon Sidewalk), cross-device advertising, voice interfaces, home shopping engines, entertainment engines, and connected health applications.

The end game for providers of smart home and security networks, of course, is likely not about device control but is about data collection and aggregation. Owning the data generated inside the home unlocks strategic advantage for companies selling food, beverages, clothing, household supplies, entertainment, healthcare, pet products and consumer electronics, to name a few.

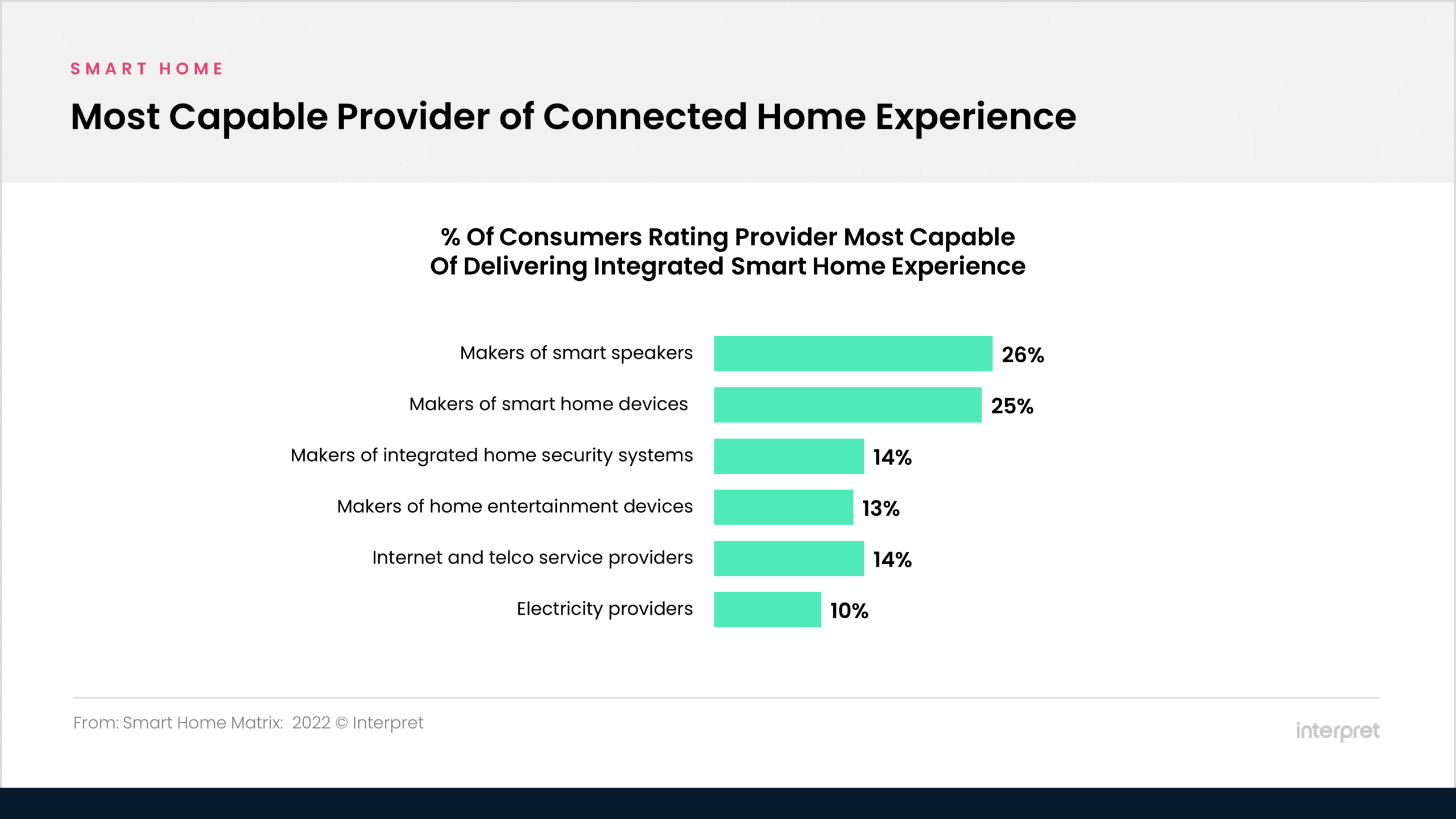

Consumers already expect Big Tech to deliver on the connected home experience. Interpret’s Smart Home Matrix research shows that consumers believe makers of smart speakers and smart home devices are the most capable of providing a connected home experience. This vote of confidence suggests that Big Tech has done a good job of making smart home products more accessible, easier to use, and more affordable for most households.