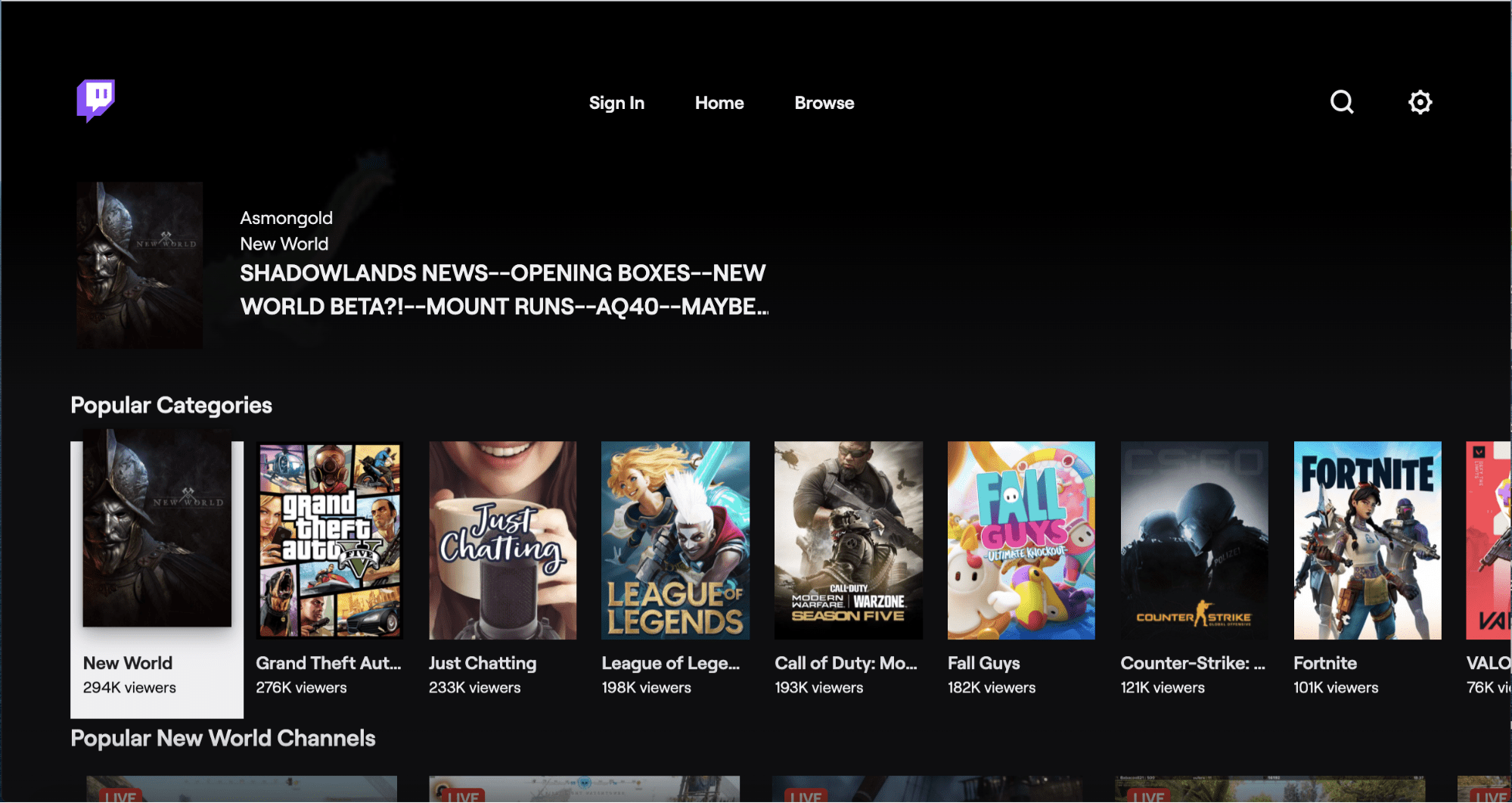

Twitch and YouTube account for the lion’s share of esports streaming coverage in the West, but with the growing penetration of connected TVs and the continued momentum of the esports market, there’s an opportunity for greater coverage directly on leading streaming devices. According to Interpret’s VideoWatch™, 55% of US consumers have a streaming media player and 63% own a smart TV. Of course, Twitch and YouTube are already widely used on connected TVs, but there has been some movement to complement those platforms with other esports channels.

Roku offers multiple esports apps/channels, including LEGS Esports TV, Signature Esports TV, Gamer Esports Network and a Fnatic esports app. The company recently teamed with ESR 24/7 Esports Network to bring the network to the Roku Channel, Roku’s free, ad-supported streaming service available online via browser and on Roku devices. ESR’s content includes documentaries, tournaments, recorded gameplay, game shows, interviews, and other esports-related media content.

Apple TV, meanwhile, only added Twitch to its Apple TV app store in 2019. Apple TV also features Arena Esports, added in 2017, which provides weekly content updates, tournament highlights, player interviews, recorded gameplays, and tutorials. Other esports apps were previously available but have been removed from the app store.

Amazon-owned Twitch is the major esports platform on Fire TV devices, but other apps are available via sideloading. Livestreaming services like Caffeine typically require screen mirroring, which limits availability to those who are more tech savvy.

Ultimately, dedicated esports channels can help grow the legitimacy of the scene by increasing potential viewership numbers and offering fans around-the-clock coverage of a segment that is often underserved in the traditional television market. That said, the revenue and data sharing requirements imposed by streaming device manufacturers could make it difficult for esports content services to thrive. It’s a catch-22, however, as many services need the distribution in order to achieve adequate scale to attract advertisers.

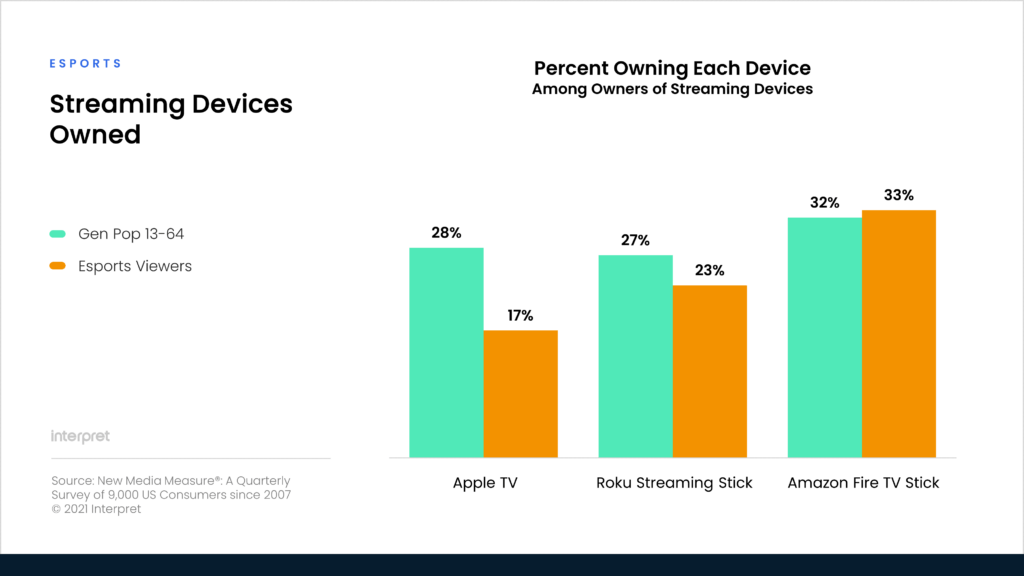

Interpret data reveals room for growth for both Roku and Apple TV, which currently lag behind Fire TV among esports viewers. Considering that Roku and Apple are both investing heavily in original content, esports programming could be an opportunity worth pursuing.