Profitability in esports has been elusive for quite some time, with even Riot Games’ massively popular LoL Esports business not quite achieving profitable status. It’s one thing for a behemoth publisher to list esports as a loss on a quarterly P&L statement, but for individual esports orgs, failing to generate net income can sink an entire business. That’s why teams like FaZe Clan, TSM, Team Liquid, NRG, and 100 Thieves, among others, have focused on content creation and elevating their brands to encompass entertainment and lifestyle.

Esports competition represents a small fraction of annual revenues for these orgs, but that doesn’t mean that competition is meaningless or that winning tournaments can’t have a tangible impact. In fact, UK-based Fnatic was victorious at the recent Valorant Champions Tour LOCK//IN, and the org enjoyed a significant boost to its social media metrics and overall engagement.

According to Fnatic head of marketing Joshua Brill and analytics platform GEEIQ, during Q1 2023, the team attracted 120,000 new social followers and over 57 million video views, in large part driven by the recent tournament win. As Brill explained to Digiday, the key is not just to win a tournament but to leverage the accolades and tie them into visibility for existing sponsors – as Fnatic did with Jack Link’s and other partners. “It’s more that we can report on the metrics that they’re looking to succeed on, the media value from a sponsorship perspective,” he explained.

At a time when individual content creators and influencers are drawing more attention from major commercial partners, esports teams must be strategic to make sure they can reinforce the value of their brand – especially in the wake of a big tournament victory. The LOCK//IN competition was the biggest event in the history of Valorant to date, garnering a peak viewership of 1.43 million fans. For Fnatic, capitalizing on that level of exposure with the gaming and esports community was a no brainer.

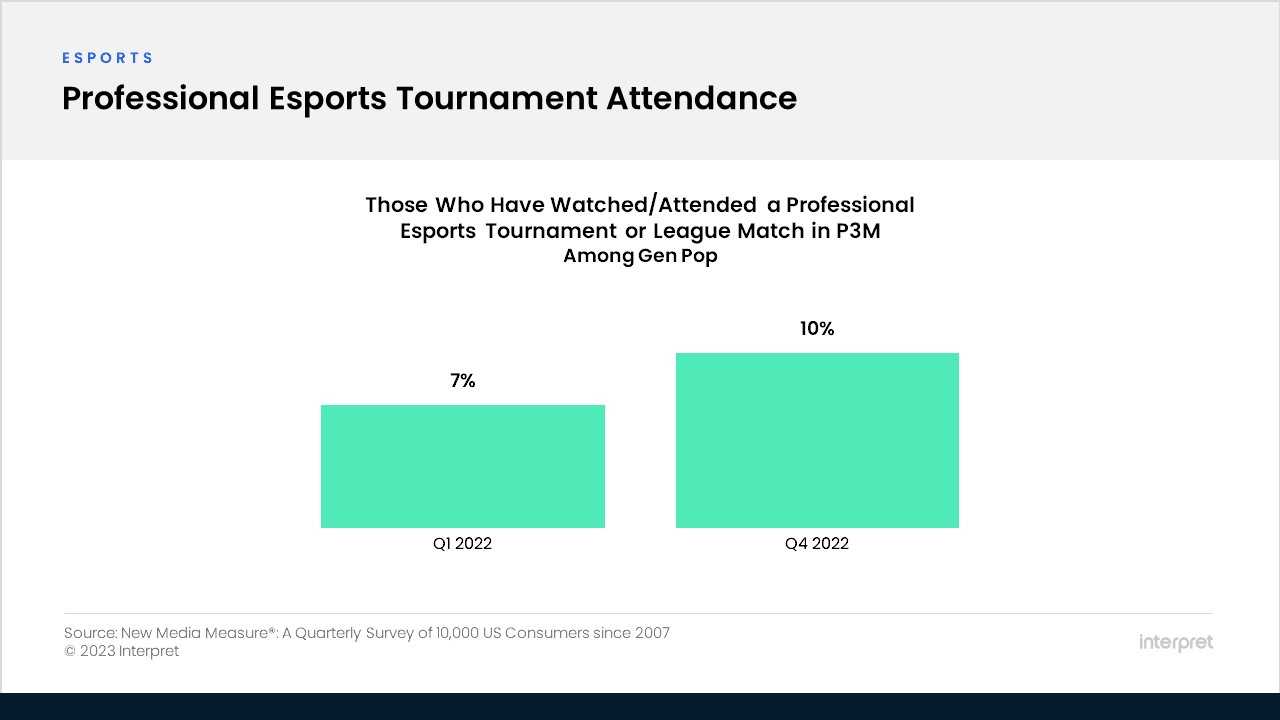

Over the long-term, esports teams will have to carefully balance their investment into content creation vs. fielding the most skilled roster of players. The past several years of pain in the esports industry have led to some lessons learned for the orgs weathering the storm, and the same lifestyle branding approach won’t work for every org, but teams would be wise to still take tournaments seriously. Interpret’s New Media Measure® data shows that 2022 represented a growth year for interest in professional esports tournaments, rising from 7% to 10% of US consumers who watched or attended a tournament over a three-month period.